6 States Where the Average Homeowner Pays Less Than $900 in Property Taxes

6 States Where the Average Homeowner Pays Less Than $900 in Property Taxes

Look past the sticker price

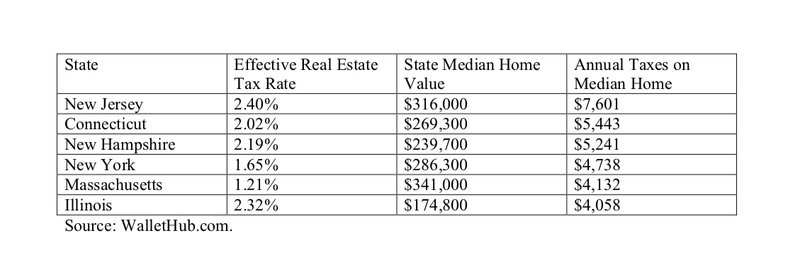

When you're buying a home, it's easy to focus on the price of the home itself and not pay too much attention to other costs you'll be incurring, such as home insurance and property taxes. That can be a major mistake -- at least in states that levy hefty taxes on homes. For example, the median home value was recently about $316,000, and the annual taxes on such a home would total $7,601, according to a recent WalletHub report.

The following states feature the highest annual property taxes on median-value homes:

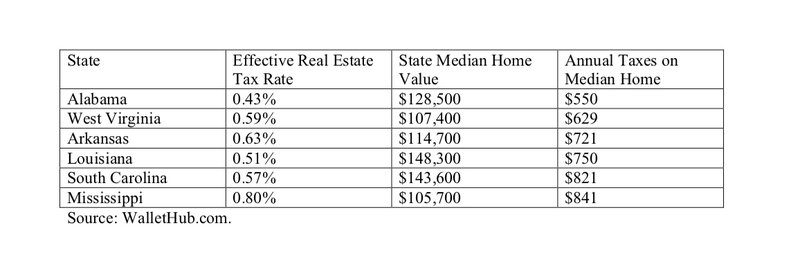

Here's a look at the six states where the average homeowner pays less than $900 in annual property taxes:

Now let's take a closer look at those low-tax

states.

Previous

Next

1. Alabama

Alabama is one of the states where you'll face very low property taxes, with a median home value of $128,500 and a property tax on that of about $550 per year. That can make it appealing to retirees -- especially those who enjoy football, warm weather and southern cooking. It also offers beaches and its own Mardi Gras celebrations, in Mobile. Before you pack up your belongings, though, know that Alabama is also a classic example of how some states can charge relatively little in property taxes: They simply make up their needed revenue elsewhere, levying other taxes, such as on sales or personal income. Alabama, for instance, ranks among the five states with the highest sales tax rates in the country, recently charging 9.01% (which reflects both the state sales tax and the average local sales tax combined). The state also boasts a relatively low cost of living, with expenses averaging about 87% of the U.S. average.

ALSO READ: Can You Lower Your Property Tax Bill Without Moving?

Previous

Next

2. West Virginia

You may be thinking of retiring in West Virginia, especially if you enjoy beautiful scenery, bluegrass music, and outdoor recreation such as fishing, golfing, biking, rafting, or hiking. You might also be drawn by the low property taxes, which amount to $629 on a home with the median value of $107,400. It, too, charges a meaningful sales tax, though unlike Alabama, it's far from the highest, with a total rate of 6.29% for state and average local sales tax. The state also boasts a low cost of living, with expenses averaging about 83% of the U.S. average. If you're evaluating various locations as possible places to retire, it's important to look at all the taxes you'd face and the cost of living in the region, too. Retirees tend to live on fixed or limited income, so you don't want to end up surprised by how costly some expense is.

Previous

Next

3. Arkansas

Arkansas, home of the Ozark mountains, also sports very low property taxes, with a median home value of $114,700 and a property tax on that of about $721 per year. Those rates may attract retirees who love nature, hunting, country music, and football. But Arkansas also ranks among the five states with the highest sales tax rates in the country, recently charging 9.30% (which reflects both the state sales tax and the average local sales tax combined). Offsetting that a bit is the fact that Arkansas's cost of living is well below average, with expenses averaging about 83% of the U.S. average.

Previous

Next

4. Louisiana

Think about Louisiana and you'll probably think of New Orleans, with its rich culture, fine cuisine, great music scene, and colorful festivals. The state also boasts beaches and barbecue and lots of natural beauty -- but nature has whacked the state with bad flooding on occasion, and there may be more to come. Still, you might be impressed with its median home value of just $148,300 that translates to an annual property tax hit of $750. Louisiana's cost of living is another plus, as it's below average, with expenses averaging about 90% of the U.S. average. That low property tax rate is offset by whopping sales taxes, though, as Louisiana ranks at the top on that score, with the state and the average local tax rate each 5%, for a combined total sales tax rate of 10%. Depending on where you live, home insurance rates can be above average, too, due to flood risks, among other things.

Previous

Next

5. South Carolina

South Carolina, with abundant southern charm, has a lot to offer. It boasts beaches, fine restaurants, warm weather, natural beauty, and plenty of history. Its property taxes are also appealing, with a median home value of $143,600 resulting in a tax hit of about $821 annually. South Carolina's cost of living is somewhat below average, too, with expenses averaging about 93% of the U.S. average. (Housing prices are well below the national average, at 75%, but groceries and utilities cost a bit more, at 105% and 107%, respectively.) On the other hand, South Carolina ranks 18th in sales tax, charging a total of about 7.22% in combined state and average local taxes.

ALSO READ: Who's Struggling the Most to Buy Homes? The Answer Might Surprise You

Previous

Next

6. Mississippi

Then there's Mississippi, with a very low median home value of $105,700 and a resulting property tax on that of about $841 annually. It offers lots of natural beauty and outdoor recreation (as long as you're okay with hot and often humid weather), along with some cities (such as Jackson, Biloxi, Hattiesburg, and Gulfport) that feature more culture and entertainment possibilities. Mississippi's cost of living is anther draw, as it's well below average, with expenses averaging about 85% of the U.S. average. (Housing prices are well below the national average, at 60%, but utilities cost about 5% more than the national average.) The state ranks 20th in sales tax, charging a total of about 7.07% in combined state and average local taxes.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.