How I Got My Credit Score to an All-Time High

It's one thing to be able to write about how to improve your credit score. It's another to actually follow through and do it. And while I didn't follow my own advice exactly to the letter, as my credit score has always been good enough for what I needed.

It's one thing to be able to write about how to improve your credit score. It's another to actually follow through and do it. And while I didn't follow my own advice exactly to the letter, as my credit score has always been good enough for what I needed.

I recently improved my Equifax FICO score 13 points in one month to 777. That's an all-time high since I started monitoring my credit score on a regular basis about two years ago.

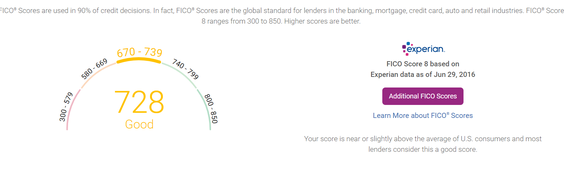

While my Experian FICO score is a couple points lower, 775, it's made the most progress since I started tracking my scores. In June of last year, my Experian FICO score was just 728.

To be fair, I've never had any major problems with credit. There are no collections, bankruptcies, or any other bad marks on my credit report. When I first started tracking my credit score a couple years ago, it was around 740 for all three bureaus.

That said, the steps I took are the same ones anyone can use to increase their credit score. Mind you, I didn't take these steps with the goal of increasing my credit score. That was just a happy side effect.

Image source: Getty Images

How your credit score gets calculated

There are a bunch of formulas for calculating your credit score, and they'll all result in slightly different numbers. No worries, though: They all use similar inputs that you can usually control to some degree.

The following table shows the five major factors that go into determining your credit score, and how heavily they're each weighted.

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| Credit Mix | 10% |

| New Credit | 10% |

Data source: FICO.

Focusing on the top categories -- payment history and credit utilization -- will have the biggest impact on improving your credit score. While the other three are also important, their impact isn't nearly as great.

In fact, I completely ignored my average age of accounts (a key part of the length of credit history factor), my credit mix, and applications for new credit while improving my score. Some of the steps I took actively hurt those factors.

How my score went from 728 to 775

The short version of the story is I applied for a few new credit cards, used them, and then paid them off.

I started applying for new credit cards a couple of years ago to take advantage of the big sign-up bonuses available for spending a certain amount in the first few months of being a cardmember. One of those cards came with a 0% intro APR for the first 18 months. I used that card to pay for a new roof on my house.

After applying for all of those new credit cards, my available credit rocketed to $60,300. The balance on the card I used to pay for the roof, combined with my regular spending, left me utilizing about 10% of that available credit. That's a pretty good number for anyone aiming to earn a high credit score, but lower is usually better. Once the charge for the roof hit my credit report, my Experian score fell to 728.

The 0% intro APR promotional period just ended on the credit card I used to pay for the roof, and I was sure to pay off the full balance before it expired. If you don't pay off the full balance before the promotional period ends on some cards, you'll get charged interest dating back to the original purchase.

After paying off the large balance and a couple of other card balances while I was at it, I was using just $213 out of $60,300 available credit on my latest credit check. That's 0.35% credit utilization, and the FICO gods like that a lot more than 10%. Considering credit utilization is such a huge part of any FICO score, I saw a significant boost in my scores.

It was really quite simple, and as I mentioned, I didn't do anything with the sole intent of raising my credit score. I just increased my available credit, I paid my bills on time every time, and then I stopped using most of my credit line.

What would I do if I wanted to increase my score even more?

There are a few steps I would take if my goal were to continue increasing my credit score.

Step 1: Apply for a credit-builder loan -- a special type of loan designed to help people build credit. It works by putting a deposit in a savings account that backs a loan from the bank. The bank doesn't have to do a credit pull -- although it might -- because the loan is guaranteed by the cash in the savings account.

I don't have any installment loans on my credit report. Credit mix accounts for 10% of a credit score, so showing I can handle both credit cards and an installment loan will help boost the magic number higher.

To avoid unnecessary interest payments on the loan, I'd pay nearly the entire balance off at the start of the loan and then make minimum payments until the loan expires.

Note that if you already have a mortgage, auto payment, or loan, this step won't help.

Step 2: Stop applying for new credit cards and keep spending on existing credit cards extremely low.

Applying for and adding new credit to your report makes you look desperate for credit. Every time a bank makes a hard inquiry on your credit report, there's a small penalty on your credit score. That usually goes away over time, but you'd effectively have to take a break from applying for new credit cards and loans altogether to completely remove any negative impact from new credit applications.

My Equifax score is slightly higher than those at the other two bureaus because the credit cards I've applied for recently haven't pulled that report. It has just one inquiry in the past two years, compared with six for TransUnion and two for Experian.

Step 3: Wait. There's not much else to do at this point.

While these steps will help my credit score, the idea of paying interest (even a small amount) on an unneeded credit-builder loan and forgoing future sign-up bonuses just to increase my credit score doesn't seem worth it. After all, what's the point of having a high credit score if you're not going to use it to get credit from banks?

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.