When you want to get a great deal on a hotel stay through Chase Ultimate Rewards, you can transfer Chase points to Hyatt. Although it's not the largest hotel chain in the world, Hyatt still has plenty of properties to visit. It also offers fantastic award availability and a high value for your points no matter what category of hotel you book.

Hyatt is undoubtedly one of Chase's best travel partners. In this guide, we'll cover how to transfer Chase points to Hyatt and get maximum value on your award stays.

What you need to transfer Chase points to Hyatt

To transfer Chase points to Hyatt, you need a World of Hyatt account. You can register online, and membership is free. You also need one of the following Chase credit cards and at least 1,000 Ultimate Rewards points:

|

|

|

| Chase Sapphire Reserve® | Chase Sapphire Preferred® Card | Ink Business Preferred® Credit Card |

|

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Rating image, 4.50 out of 5 stars.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

|

Apply Now for Chase Sapphire Reserve®

On Chase's Secure Website. |

Apply Now for Chase Sapphire Preferred® Card

On Chase's Secure Website. |

Apply Now for Ink Business Preferred® Credit Card

On Chase's Secure Website. |

|

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

Credit Rating Requirement:

Falling within this credit range does not guarantee approval by the issuer. An application must be submitted to the issuer for a potential approval decision. There are different types of credit scores and creditors use a variety of credit scores to make lending decisions.

Recommended Credit Score required for this offer is: Good/Excellent (670-850)

Good/Excellent (670-850) |

|

Welcome Offer: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠. 60,000 bonus points |

Welcome Offer: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠. 60,000 bonus points |

Welcome Offer: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. Earn 100,000 bonus points |

|

Rewards Program: Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases. 5x points on flights and 10x points on hotels and car rentals through Chase Travel℠. |

Rewards Program: Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more. 5x on travel purchased through Chase Travel℠, 3x on dining and 2x on all other travel purchases |

Rewards Program: Earn 3 points per $1 on the first $150,000 spent in combined purchases on travel, shipping purchases, Internet, cable and phone services, advertising purchases made with social media sites and search engines each account anniversary year. Earn 1 point per $1 on all other purchases-with no limit to the amount you can earn. Earn 3 points per $1 in select business categories |

|

Intro APR: Purchases: N/A Balance Transfers: N/A |

Intro APR: N/A Purchases: N/A Balance Transfers: N/A |

Intro APR: N/A Purchases: N/A Balance Transfers: N/A |

|

Regular APR: 22.49%-29.49% Variable |

Regular APR: 21.49%-28.49% Variable |

Regular APR: 21.24%-26.24% Variable |

|

Annual Fee: N/A $550 |

Annual Fee: N/A $95 |

Annual Fee: N/A $95 |

|

Highlights:

|

Highlights:

|

Highlights:

|

|

Apply Now for Chase Sapphire Reserve®

On Chase's Secure Website. |

Apply Now for Chase Sapphire Preferred® Card

On Chase's Secure Website. |

Apply Now for Ink Business Preferred® Credit Card

On Chase's Secure Website. |

Show More

Show Less

Show Less

|

||

How to transfer Chase points to Hyatt

On the Ultimate Rewards site, you can transfer Chase points to Hyatt quickly and easily. Here are the steps to follow:

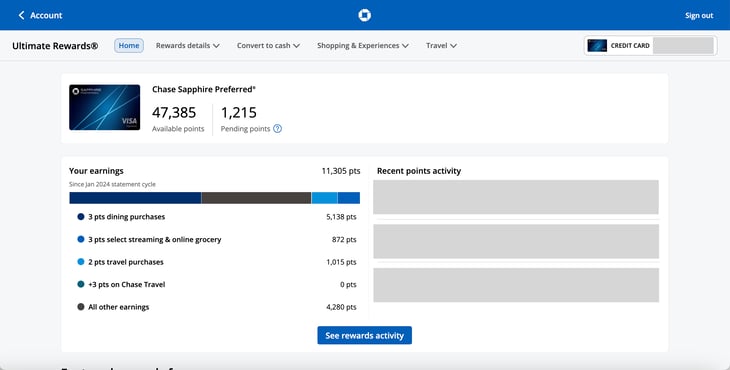

1. Log in to your Chase Ultimate Rewards account.

If you have more than one rewards card with Chase, select the Chase card with the points you wish to transfer after logging in.

Image source: Brooklyn Sprunger

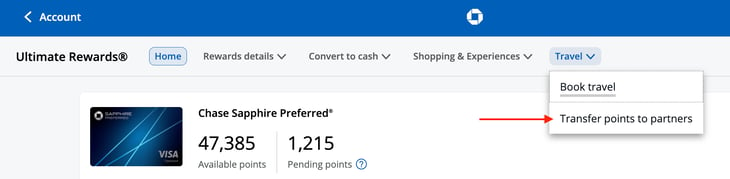

2. Select "Transfer to Travel Partners."

You can find this option by clicking "Travel" to open the dropdown menu.

Image source: Brooklyn Sprunger

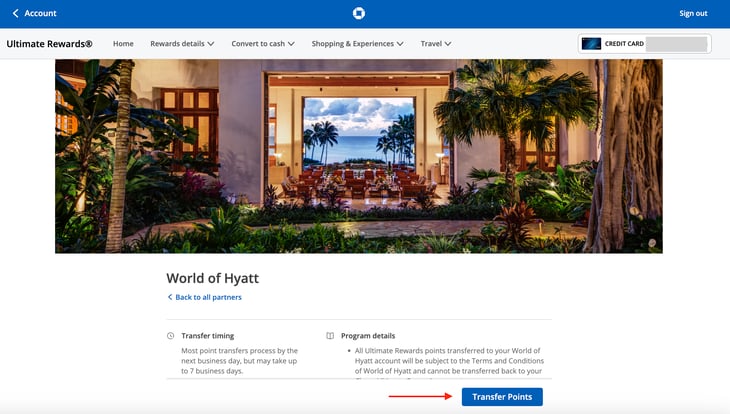

3. Go to the World of Hyatt listing and select "Transfer Points."

You'll find this listing in the Hotels section of Chase's travel partners.

Image source: Brooklyn Sprunger

4. Select a transfer recipient.

When you transfer Chase points to Hyatt, you can send them to yourself or a recipient who is both an authorized user on your account and a member of your household.

5. Enter the World of Hyatt account number.

Use the dropdown menu to pick the recipient, and then enter the corresponding World of Hyatt account number.

6. Decide how many points to transfer.

You must send your transfer in increments of 1,000 points, and the minimum amount is also 1,000 points. There's a 1:1 transfer ratio when you transfer Chase points to Hyatt, which means 1 Chase Ultimate Rewards point gets you 1 Hyatt point.

7. Submit your transfer.

Chase provides a standard review screen. If everything looks correct, you can click to confirm and finalize the points transfer.

Remember that all transfers are final.

You can't cancel or send the points back. Because of that, you should only transfer Chase points to Hyatt after you've found the award stay you want to book.

How to book a Hyatt award stay

Booking a Hyatt award stay follows the same process as booking in cash. Here's the process to set up your Hyatt stay:

- First, fill out the search form on the Hyatt homepage with where you're going, your check-in and check-out dates, the number of rooms you need, and your number of guests.

- Check the "Use Points" box on the search form, and then perform a search.

- If you didn't select a specific hotel on the search form, pick one now. This takes you to the hotel page.

- Choose the type of room you want. (You'll be at this section already if you selected a hotel on the search form.)

- On the hotel page, you can also toggle between viewing prices in points and cash. To see cash prices, click "View Rates."

- When you've found the room you want, click "Select." You'll need to log in to your World of Hyatt account if you haven't done that yet, and then you can complete the booking.

Maximizing value when you transfer Chase points to Hyatt

Hyatt bases the cost of an award stay on the category of the hotel and the type of room you choose. There are eight categories of Hyatt hotels. As you'd expect, higher category hotels cost more and also tend to be more luxurious.

The great thing about Hyatt points is that there aren't any bad redemption options. You can get $0.015 per point or more on award stays at each hotel category. Hyatt also gives you the option to pay with points plus cash. In some cases, this can get you an even better value per point.

You do tend to get more value for your points when you use them to book expensive Hyatt hotels in popular destinations. And of course, there are standout Hyatt properties where you can get a great value for your points, including:

- Park Hyatt Maldives Hadahaa: Located in an island paradise, rooms here can cost $800 or more per night. Award stays, on the other hand, can be had for 25,000 points per night.

- Park Hyatt Paris-Vendome: Centrally located and with gorgeous room designs, this hotel offers rooms that cost over 1,500 euros for 35,000 points per night.

- Hyatt All-Inclusive Resorts: If you'd like to have everything taken care of on your vacation, then any of Hyatt's all-inclusive resorts will do the trick.

Should you transfer Chase points to Hyatt or redeem through Chase's portal?

Besides transferring points, your other option is booking a stay with Hyatt through the Chase Travel portal. Chase lets you turn your points into cash that you then apply toward the purchase. Your rewards are worth:

- $0.0125 per point if you have the Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card.

- $0.015 per point if you have the Chase Sapphire Reserve®.

An advantage to booking this way is that it's the same as paying in cash to Hyatt. That means if you have a World of Hyatt account, you can earn 5 Hyatt points per $1 on the booking. If you're in one of the World of Hyatt elite status tiers, you can also get a 10% to 30% bonus on those points. You don't earn points on award stays.

Since Hyatt's site makes it so easy to compare room prices in points and cash, that's the best approach. Check whether it would cost you more of your rewards if you transfer Chase points to Hyatt or if you book through the Chase Travel portal. If it's close, you should lean toward using the Chase portal, since you'll also earn Hyatt points that way.

Chase's The World of Hyatt Credit Card

If you're a frequent Hyatt customer, you may be interested in its co-branded consumer credit card offered with Chase. Here are the key details of The World of Hyatt Credit Card:

- Earn up to 60,000 Bonus Points ( bonus points for spending $3,000 on purchases in the first 3 months and 2 points per $1 on purchases that would otherwise earn 1 point per $1 for the first six months, up to a spending cap of $15,000)

- One night free every year after your cardmember anniversary at any Category 1-4 Hyatt property, plus an extra free night at any Category 1-4 Hyatt property when you spend $15,000 during your cardmember anniversary year

- 4 points per $1 on purchases at all Hyatt hotels

- 2 points per $1 on restaurants purchases, airline tickets purchased directly from the airline, local transit and commuting, and fitness club and gym memberships

- 1 point per $1 on other purchases

- $95 annual fee

If you stay at Hyatt hotels often, this Hyatt credit card is 100% worth it. The free night alone can save you much more than the $95 annual fee. You can also collect quite a few bonus points. Considering the low cost and the value it provides, The World of Hyatt Credit Card compares favorably to the best travel rewards cards.

Chase and Hyatt also offer the World of Hyatt Business Credit Card. If you're looking for business credit cards and you're a frequent guest at Hyatt hotels, then it's worth checking out.

Don't you wish you could take a peek inside a credit card expert's wallet sometimes? Just to see the cards they carry? Well, you can't look in anybody's wallet, but you can check out our experts' favorite credit cards. Get started here:

Redeeming your Chase points to stay at Hyatt

For award bookings, Hyatt ranks near the top not just among Chase transfer partners, but among all hotels. Most other hotels charge significantly more points for their rooms across every category.

The lone drawback is that Hyatt doesn't have as much coverage as some of its competitors. Still, it can certainly be worth it to transfer Chase points to Hyatt. The more affordable properties are excellent choices for their cost, and its luxury hotels are spectacular.

Still have questions?

Here are some other questions we've answered:

FAQs

-

Yes, you can transfer Chase points to your Hyatt account. Here's how:

- Go to the Chase Ultimate Rewards site and log in to your account.

- Choose the option to transfer points to travel partners.

- Select World of Hyatt from the list of partners.

- Enter your World of Hyatt account number.

- Decide on the number of points to send over, then submit the transfer.

-

When you transfer Chase points to Hyatt, it's a 1:1 transfer ratio. If you transfer 1,000 Chase points, you'll receive 1,000 Hyatt points.

-

You're almost always better off transferring Chase points to Hyatt than to Marriott. Hyatt points tend to be worth much more than Marriott points, so you get more value this way.

Our Credit Cards Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.