Current Fed interest rate

| FED RATE DECISION DATE | FEDERAL RESERVE INTEREST RATE |

|---|---|

| Jan. 29, 2025 | 4.25% to 4.50% |

The current Fed interest rate, or federal funds rate, is 4.25% to 4.50%. This is the overnight rate that banks charge each other when they borrow or lend funds. We'll explain this in more detail below. As a consumer, the Fed interest rate matters because it impacts the interest rates you'll get on your borrowing and savings.

Why the Fed shifts its rates

The Federal Reserve is responsible for maintaining financial stability and promoting maximum employment. That means trying to keep the job market steady and inflation under control. Changing interest rates is one way it does this. It increases rates to slow the economy and reduces them to stimulate it.

In 2020, the Fed cut rates to near zero in the wake of the COVID-19 pandemic. It was one of several moves aimed at countering the economic disruption caused by the uncertainty and anti-COVID stay-at-home measures. It then aggressively raised rates to try to tackle sky-high inflation. That meant making 11 rate hikes in 16 months, starting March 2022.

January's unanimous decision to cut rates can be seen against a backdrop of easing inflation and a softening job market. The Fed hopes to achieve what's known as a "soft landing" -- getting price rises back under control without triggering a recession.

Compare savings rates

Make sure you're getting the best account for you by comparing savings rates and promotions. Here are some of our favorite high-yield savings accounts to consider.

| Account | APY | Promotion | Next Steps |

|---|---|---|---|

Open Account for American Express® High Yield Savings Account

On American Express's Secure Website.

4.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

3.60%

Rate info

3.60% annual percentage yield as of July 3, 2025. Terms apply.

Min. to earn: $0

|

N/A

|

Open Account for American Express® High Yield Savings Account

On American Express's Secure Website. |

Open Account for SoFi Checking and Savings

On SoFi's Secure Website.

4.50/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

up to 3.80%

Rate info

SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus.

Min. to earn: $0

|

N/A

|

Open Account for SoFi Checking and Savings

On SoFi's Secure Website. |

Open Account for Barclays Tiered Savings

On Barclays' Secure Website.

5.00/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

3.90%

Rate info

Balances less than $250,000 earn 3.90%, and balances greater than $250,000 earn 4.10%.

Min. to earn: $0

|

N/A

|

Open Account for Barclays Tiered Savings

On Barclays' Secure Website. |

Next Fed rate meetings

The next Federal Reserve meeting will take place on Mar. 18 and 19.

Fed rate meeting schedule in 2025

Here's the schedule for the Fed rate meetings in 2025:

- January 28-29

- March 18-19

- May 6-7

- June 17-18

- July 29-30

- September 16-17

- October 28-29

- December 9-10

How the Fed rates impact the economy

The Fed uses interest rates as a tool to slow or stimulate the economy. Here's how the economy shifts depending on whether rates are high or low.

When rates are high: Borrowing becomes more expensive. That can mean businesses are less likely to expand, hire more people, or increase wages. Consumers may cut back on their spending, particularly on big-ticket items. Not only that, but higher savings rates can encourage people to keep more money in the bank.

When rates are low: It's easier to access credit, so businesses and consumers may spend more. An expanding economy can translate into a more competitive jobs market and higher wages. Lower mortgage rates and affordable auto loans can stimulate the housing and vehicle markets. Lower savings APYs mean there's less incentive to save.

For the Fed, this can be a tricky balancing act. If it increases rates too much or for too long, there's a risk the slowdown could trigger a recession. But low rates can cause the economy to overheat, causing rapid price increases and high inflation.

How does inflation impact the federal interest rate?

Inflation is the rate at which the cost of goods and services increases. Given that part of the Federal Reserve's job is to keep prices stable, there's usually a direct correlation between inflation and the federal reserve interest rate.

When inflation is high, the Fed raises interest rates to try and slow things down. As inflation cools, the Fed decreases rates -- or holds them steady -- to stop the economy from stagnating.

The Fed has a target rate for inflation of 2%. According to its October data, we're slightly above that level at 2.3%. It uses the Personal Consumption Expenditures price index to track inflation.

As most of us have discovered in recent years, high inflation means money won't go as far. If groceries cost 10% more than they did a year ago, your food bill alone could cost hundreds of extra dollars.

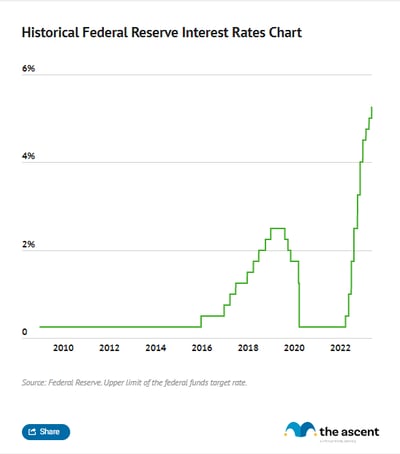

Fed interest rates chart

The Federal Reserve sets the target rate as a range, giving it the flexibility needed to achieve its goals. The chart below shows how the upper limit of the federal funds target rate has changed over time.

Historical Federal Reserve interest rates

The table below shows the Federal Reserve interest rate change history, dating back to 2015.

| DATE | FEDERAL RESERVE INTEREST RATE |

|---|---|

| January 29, 2024 | 4.25% to 4.50%. |

| December 18, 2024 | 4.25% to 4.50%. |

| November 7, 2024 | 4.50% to 4.75% |

| September 18, 2024 | 4.75% to 5% |

| July 31, 2024 | 5.25%-5.50% |

| June 12, 2024 | 5.25%-5.50% |

| May 1, 2024 | 5.25%-5.50% |

| Mar. 20, 2024 | 5.25%-5.50% |

| Jan. 31, 2024 | 5.25%-5.50% |

| Dec. 13, 2023 | 5.25%-5.50% |

| Nov. 1, 2023 | 5.25%-5.50% |

| Sept. 20, 2023 | 5.25%-5.50% |

| July 26, 2023 | 5.25%-5.50% |

| June 14, 2023 | 5.00%-5.25% |

| May 3, 2023 | 5.00%-5.25% |

| March 22, 2023 | 4.75%-5.00% |

| Feb. 2, 2023 | 4.50%-4.75% |

| Dec. 14, 2022 | 4.25%-4.50% |

| Nov. 2, 2022 | 3.75%-4.00% |

| Sept. 22, 2022 | 3.00-3.25% |

| July 28, 2022 | 2.25%-2.50% |

| June 16, 2022 | 1.50%-1.75% |

| May 5, 2022 | 0.75%-1.00% |

| March 17, 2022 | 0.25%-0.50% |

| March 16, 2020 | 0%-0.25% |

| March 3, 2020 | 1.00%-1.25% |

| Oct. 31, 2019 | 1.50%-1.75% |

| Sept.19, 2019 | 1.75%-2.00% |

| Aug. 1, 2019 | 2.00%-2.25% |

| Dec. 20, 2018 | 2.25%-2.50% |

| Sept. 27, 2018 | 2.00%-2.25% |

| June 14, 2018 | 1.75%-2.00% |

| March 22, 2018 | 1.50%-1.75% |

| Dec. 14, 2017 | 1.25%-1.50% |

| June 15, 2017 | 1.00%-1.25% |

| March 16, 2017 | 0.75%-1.00% |

| Dec.15, 2016 | 0.50%-0.75% |

| Dec. 17, 2015 | 0.25%-0.50% |

What is the federal funds rate?

We said earlier that the federal funds rate is the overnight interest rate that banks charge when they lend each other money. From a consumer perspective, it impacts the rates lenders offer on things like credit cards, loans, and mortgages. For savers, it affects how much we can earn on savings accounts, money market accounts, and CDs.

You might be wondering why banks and financial institutions have to lend each other money. Banks have to keep a percentage of their deposits in reserve -- it helps to avoid things like bank runs. But the amount of money each bank has fluctuates depending on the day's activities. Banks borrow from one another to make sure they have enough cash on hand to function and meet the reserve requirements.

How the Fed sets interest rates

The Fed sets interest rates through regular meetings of the Federal Open Market Committee (FOMC). It uses a range of indicators to take the pulse of the economy. These include jobs data, the consumer price index, GDP, stock market performance, and more.

The FOMC meets eight times a year -- more if needed -- to evaluate the latest economic data. The 12 board members vote to decide if they need to make any shifts in policy, including any changes to the federal funds rate.

Federal funds target rate

The federal funds target rate is also known as the federal funds rate or Fed interest rate. The word "target" is used because banks decide the interest rate between themselves when they lend and borrow from each other. The Fed can't tell them exactly what rate to use.

If you're wondering what the actual rate gets called, it's the "effective federal funds rate." This is the average overnight rate at which banks lend money to one another. It's usually pretty close to the target rate.

Why the Fed raises interest rates

The Fed raises interest rates when it wants to slow the economy down. It may do this because inflation is too high or because it thinks the economy is overheated.

Why the Federal Reserve lowers interest rates

The Fed lowers interest rates when it wants to stimulate the economy. It may do this because of rising unemployment or to try to avoid a recession.

How are other interest rates impacted by the Fed rate?

As a consumer, we come across many interest rates in our financial lives. The Fed rate impacts all of them to a greater or lesser extent. For example, many lenders use something called the Prime rate as a basis for their APRs. This is the rate that lenders give to their most creditworthy customers, and it's usually about 3% higher than the federal funds rate.

Credit card interest rates

Credit card APRs are loosely based on the Prime rate, so they will drop slightly if the Fed rate falls. However, the Fed is cutting rates at a fraction of a percent at a time. As such, Fed rate cuts won't make a lot of difference to your monthly payments.

The average credit card APR was 23.37% in October, per the Fed. You may get better rates on the best credit cards, but interest payments can still add up. Let's say you carry a balance of $6,000:

- If your APR is 24%, you'd owe almost $120 in monthly interest.

- If your APR is 22%, you'd owe almost $110 in monthly interest.

Not only that, the Fed rate is only one factor that goes into calculating how much credit card interest you'll pay. According to Consumer Reports, the gap between the Prime rate and average credit card APRs has increased steadily for the past decade.

Savings account interest rates

Banks use the federal funds rate as a guide when setting savings accounts interest rates. As rates fall, so will savings APYs. And, unlike CDs, which lock in a rate for the length of the CD, savings account rates are variable. That means the rate can change at any time.

To maximize the interest you earn on your savings, pick a top high-yield savings account. The rates on these -- often online-only -- accounts are significantly higher than the average. If you want to earn inflation-beating returns, shop around for accounts with high APYs, low fees, and achievable minimum deposit requirements.

Mortgage loan interest rates

The federal funds rate is one of many factors that influence mortgage rates. Rates are also impacted by inflation, the housing market, economic expectations, the bond market -- specifically the 10-year Treasury yield -- and more.

The majority of home buyers opt for 30-year fixed-rate loans. The 10-year Treasury yield is the rate the U.S. government pays on what are essentially decade-long loans. These Treasuries hold more sway over mortgage APRs than the very short-term federal funds rate.

Auto loan interest rates

The Federal Reserve rate influences auto loan APRs, but it's only part of the story and it can take time for rate cuts to filter down. Cox Automotive says, "The Fed does not directly control the rates consumers see, and auto loan rates may end up being the slowest to move."

Like mortgages, these are longer-term loans. Auto lenders have to factor in other considerations, including the delinquency rates on existing loans. To qualify for the best auto loan rate, take steps to improve your credit score and try to make a down payment of at least 20%.

Personal loan interest rates

The federal funds rate influences personal loan rates, but it's not the be-all and end-all. Lenders also take broader factors into account like inflation, loan delinquencies, Treasury yields, and more. Your situation will play a big part too -- you can get a lower rate if lenders are confident you will repay the loan.

Personal loan rates are likely to fall as the Fed cuts its rates. This will only impact new loans or adjustable-rate loans. If you have a fixed-rate personal loan, Federal Reserve rate cuts will not impact your APR unless you refinance.

If you're applying for a personal loan, you can take steps to lower your rate. Work to improve your credit score, pay down existing debt, and shop around to find the best personal loan.

-

Data research sources

- https://www.federalreserve.gov/newsevents/pressreleases/monetary20241107a.htm

- https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

- https://www.bls.gov/opub/ted/2022/consumer-prices-up-9-1-percent-over-the-year-ended-june-2022-largest-increase-in-40-years.htm

- https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20241107.pdf

- https://www.federalreserve.gov/aboutthefed/fedexplained/monetary-policy.htm

- https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

- https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/fed-likely-to-cut-rates-again-this-month-as-2025-view-grows-more-cloudy-86639995

- https://www.federalreserve.gov/economy-at-a-glance-inflation-pce.htm

- https://www.bls.gov/news.release/cesan.nr0.htm

FAQs

-

Interest rates will almost certainly fall further in 2025, though it isn't clear how quickly or by how much. The Fed considers various economic indicators, including inflation and unemployment figures, before making any rate decisions.

-

Decisions from the Federal Reserve can have a big impact on interest rates. If it cuts the federal funds rate, this has a knock-on effect on other interest rates for both savers and borrowers. Interest rates can also rise or fall because of inflation or changes in the supply and demand for credit.

-

When the Fed rate falls, it becomes cheaper to borrow money. It can take time for the Fed's rate moves to filter through to consumer loans and mortgages, but falling rates can make borrowing more affordable. When businesses and consumers have easier access to credit, it can spur economic growth.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Motley Fool Money does not cover all offers on the market. Motley Fool Money is 100% owned and operated by The Motley Fool. Our knowledgeable team of personal finance editors and analysts are employed by The Motley Fool and held to the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands. Terms may apply to offers listed on this page.