Zelle is a fast and free mobile payment application that makes it easy to send and receive money from people you know. You can make transfers directly from your bank account with just an email address or phone number. Our detailed Zelle review will discuss its features and help you decide if it's the right app for you.

Pros

- Free and fast

- Secure transactions

- Integrates with many banking apps

- You don't need the recipient's banking information

Cons

- There's no fraud protection

- You can't transfer funds from a credit card

- Only supports U.S. bank accounts

- You can't cancel most payments

- Sending and receiving limits apply

What is Zelle?

Zelle is a free payments app that is easy to use and transfers money fast. This mobile peer-to-peer payment app lets you send money directly from one savings or checking account to another. It's a good way to send money to someone you already know.

How does Zelle work?

Once you have an account, it is simple and free to move money between other Zelle users. All you need is a person's phone number or email address -- you don't need to know their bank account details.

- Start by choosing whether you want to send or receive money, or split a bill.

- Enter the mobile number, or email address of the other person. You can choose any of your cellphone contacts directly from the app.

- Set the amount and the bank account you want to use.

- Confirm the transaction.

- If you're sending money, Zelle will send a text message or email to let the recipient know there's a payment waiting.

If you don't have an account, it is super easy to get started:

- Look to see if your bank or credit union offers Zelle -- many of them do. If so, you'll be able to access the service through your mobile banking app or online banking.

- If your bank does not work with Zelle, download the app from the App Store or Google Play. You'll then need to enter your personal and bank information. At least one person (sender or receiver) must have access to Zelle through their credit union or bank.

What we like about Zelle

No fees

Zelle is free to download and use. Unlike some other payments apps, Zelle won't charge you to send or receive money. That said, it's always a good idea to check with your bank to ensure it doesn't charge any money transfer service fees.

It's secure

Zelle sells itself as a secure money transfer app because it doesn't store your personal information. Your details stay secure with your bank and are never visible to Zelle.

However, the downside to instant money transfers is that you may not be able to cancel transactions once they are made. That's why you need to know and trust the person you're sending money to.

Money transfers are fast

This payment option is a great way to send money quickly. In most cases, those who are enrolled with Zelle can receive a money transfer within minutes. According to Motley Fool Money research, speed is one of the most important features Americans want from digital payment app.

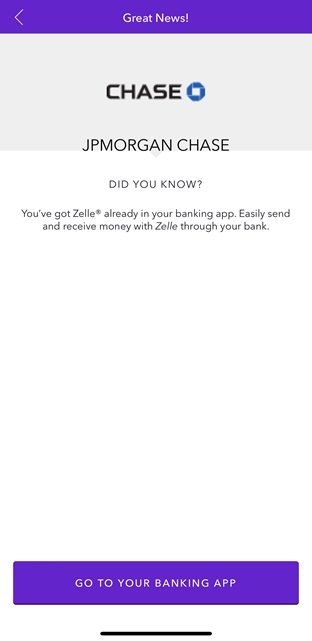

Integrated with banking apps

This mobile payment app was created by some of the big banks. As a result, Zelle is already built into many banking apps, including Bank of America, Chase, and Wells Fargo. Its website lists 2,100-plus banking partners.

It says 150 million people can access Zelle through their banks, so you may not even need to download it separately. Plus, unlike other banking apps, there's no middleman. The money will go straight to the recipient's savings or checking account.

No recipient banking info is needed

You don't need to have the recipient's banking details on hand to send money. All you need to know is their phone number or email address. Zelle will text or email the recipient and handle the rest. That makes it even easier to handle your personal finance and money transfer needs.

You can send money, request money, or split purchases

Zelle lets you send money, request money, or split purchases with other Zelle users. To split the cost of something, enter the total amount and choose who to split the expense with. Zelle will do the math for you.

Compare savings rates

Make sure you're getting the best account for you by comparing savings rates and promotions. Here are some of our favorite high-yield savings accounts to consider.

| Account | APY | Bonus | Next Steps |

|---|---|---|---|

Open Account for SoFi Checking and Savings

On SoFi's Secure Website.

4.90/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

up to 4.00%

Rate info

Earn up to 4.00% Annual Percentage Yield (APY) on SoFi Savings with a 0.70% APY Boost (added to the 3.30% APY as of 12/23/25) for up to 6 months. Open a new SoFi Checking and Savings account and pay the $10 SoFi Plus subscription every 30 days OR receive eligible direct deposits OR qualifying deposits of $5,000 every 31 days by 3/30/26. Rates variable, subject to change. Terms apply at sofi.com/banking#2. SoFi Bank, N.A. Member FDIC.

Min. to earn: $0

|

Earn $50 or $300 and +0.70% Boost on Savings APY with direct deposit. Terms apply.

Earn up to 4.00% Annual Percentage Yield (APY) on SoFi Savings with a 0.70% APY Boost (added to the 3.30% APY as of 12/23/25) for up to 6 months. Open a new SoFi Checking and Savings account and pay the $10 SoFi Plus subscription every 30 days OR receive eligible direct deposits OR qualifying deposits of $5,000 every 31 days by 3/30/26. Rates variable, subject to change. Terms apply at sofi.com/banking#2. SoFi Bank, N.A. Member FDIC. |

Open Account for SoFi Checking and Savings

On SoFi's Secure Website. |

Open Account for CIT Platinum Savings

On CIT's Secure Website.

4.60/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

3.75%

Rate info

3.75% APY for balances of $5,000 or more; otherwise, 0.25% APY

Min. to earn: $5,000

|

N/A

|

Open Account for CIT Platinum Savings

On CIT's Secure Website. |

Open Account for Western Alliance Bank High-Yield Savings Premier

On Western Alliance Bank's Secure Website.

4.40/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

3.80%

Rate info

The annual percentage yield (APY) is accurate as of January 8, 2025 and subject to change at the Bank’s discretion. Refer to product’s website for latest APY rate. Minimum deposit required to open an account is $500 and a minimum balance of $0.01 is required to earn the advertised APY.

Min. to earn: $500 to open, $0.01 for max APY

|

N/A

|

Open Account for Western Alliance Bank High-Yield Savings Premier

On Western Alliance Bank's Secure Website. |

Platinum Savings is a tiered interest rate account. Interest is paid on the entire account balance based on the interest rate and APY in effect that day for the balance tier associated with the end-of-day account balance. *APYs — Annual Percentage Yields are accurate as of January 9, 2026: 0.25% APY on balances of $0.01 to $4,999.99; 3.75% APY on balances of $5,000.00 or more. Interest Rates for the Platinum Savings account are variable and may change at any time without notice. The minimum to open a Platinum Savings account is $100.

Based on comparison to the national average Annual Percentage Yield (APY) on savings accounts as published in the FDIC National Rates and Rate Caps, accurate as of January 20, 2026.

For complete list of account details and fees, see our Personal Account disclosures.

The annual percentage yield (APY) is accurate as of January 8, 2025 and subject to change at the Bank’s discretion. Refer to product’s website for latest APY rate. Minimum deposit required to open an account is $500 and a minimum balance of $0.01 is required to earn the advertised APY.

Accurate as of the time of publication. The national average rate referenced is from the FDIC’s published National Rates and Rate Caps for Savings deposit products, accurate as of January 20, 2026. For more information, you can check the FDIC website.

What could be improved

There's no fraud protection

One of the biggest concerns about Zelle is its lack of fraud protection. Unlike PayPal, which will reimburse you if a product doesn't arrive or isn't as promised, Zelle does not protect buyers and sellers.

Be aware of potential Zelle scams, as they do exist. Zelle recommends you only use its service to send money to people you know and trust. Don't use Zelle to send money to strangers.

You can't transfer funds from a credit card

Zelle only supports bank transfers. If you usually use your credit card to send money to family and friends, this isn't the right payments app for you.

If you do use credit card transfers with other payments apps, be aware that you often have to pay. Plus, credit card issuers typically mark these kinds of transactions as cash advances, which are very expensive.

Only supports U.S.-based bank accounts

Zelle does not work for international transactions as it only supports U.S.-based banks and credit unions. Other apps, like PayPal and Xoom, also work well for international payments.

You may not be able to cancel a payment

Once you've made a transfer, the only way you can cancel a Zelle payment is if the recipient has not yet enrolled. If you transfer money to someone who already has a Zelle account, there is no way to cancel it.

There are payment limits

Zelle limits the amount of money you can send. Each bank can set its own limits, so you'll want to check with your bank. If you're using the Zelle app to send money, the weekly sending limit is $500, and the weekly receiving limit is $5,000.

How much does Zelle cost?

Zelle is free to use. You can download the app and use it to send or receive money without paying a cent. If you're using Zelle through your banking app, double-check that your bank will not charge you.

Zelle online ratings

The Zelle app scores highly for both iOS and Android, with users praising the ease of use and speed of transfer. However, some users complained of technical glitches and sign-in issues. The company does not fare well on Trustpilot and BBB where users have had problems with customer service and blocked transactions.

- iOS app rating: 4.8/5 stars

- Android app rating: 4.0/5 stars

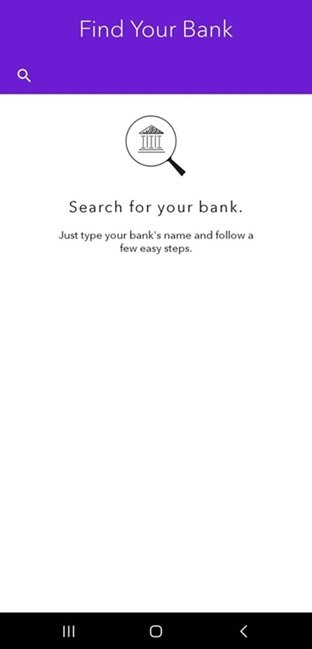

Zelle platform

Zelle is intuitive and easy to use, particularly if your bank partners with the payment app. As long as you and the person you are paying (or being paid by) have Zelle accounts, you can send or receive money in minutes. It really is as simple as choosing who you want to pay and by how much.

Zelle app home screen. Image source: Zelle, captured by author.

Zelle search for your bank screen. Image source: Zelle, captured by author.

Zelle "You've got Zelle already in your banking app" screen. Image source: Zelle, captured by author.

Is Zelle safe?

In terms of safety, the biggest risk with Zelle is fraud. Zelle says it has authentication and monitoring features to ensure your payments are secure. Importantly, you will never share your account details when you make a transaction -- only your email or mobile number.

Only use Zelle to pay people you know and trust.

- Don't send money to people you don't know through Zelle. If, say, an online seller says they only accept Zelle payments, do not follow through with the purchase.

- Double-check the phone number or email address of the person you're sending money to. If you get the contact details wrong when you send money, you may not get it back.

- Consider using your credit card to buy things from people you don't know. This will almost certainly give you more protection.

Alternatives to Zelle

If you want an app that makes international payments: PayPal is a global payments app that works in over 200 countries and also accepts credit cards. But you may want to stick with Zelle if you want an app that integrates with your online bank.

If you want an app that offers buyer protection: Venmo offers purchase protection on eligible payments, so you're covered if your online purchase arrives damaged or doesn't arrive at all. But you may want to use Zelle for everyday payments to people you know

Zelle might be right for you if:

- You want a quick money transfer service that will not charge any fees.

- You only want to send money to people you know and trust.

- It integrates with your existing bank account.

-

Review sources

- https://play.google.com/store/apps/details?id=com.zellepay.zelle&hl=en_US

- https://apps.apple.com/us/app/zelle/id1260755201

- https://www.bbb.org/us/az/scottsdale/profile/payment-processing-services/early-warning-1126-97029654/customer-reviews

- https://www.trustpilot.com/review/zellepay.com

- https://www.zellepay.com/join-zelle-network/partners

- https://www.zellepay.com/faq/who-can-i-send-money-zelle

- https://www.zellepay.com/get-started

- https://www.zellepay.com/faq/there-limit-how-much-money-i-can-send-or-receive

- https://www.zellepay.com/faq/can-i-cancel-payment

- https://www.zellepay.com/pay-it-safe/zeller-safety-101

FAQs

-

If you have a U.S.-based bank account, you'll likely be able to use Zelle. More than 2,100 participating banks and credit unions are part of the Zelle network, and most banking partners have Zelle built into their mobile banking apps.

If your bank isn't a Zelle partner, you can still use Zelle to send and receive money by downloading the Android or iOS app. But to use the standalone Zelle app, at least one person must have a bank that is part of the Zelle network.

-

Zelle was created by a group of big banks to change the way we make person-to-person transactions. It offers an easy and secure way to send money to people you know.

However, Zelle does not offer purchase protection, and criminals may try to take advantage of its instant and irreversible transactions. It is important to only use Zelle to send money to people you know.

-

The limits on how much you can send or receive vary from bank to bank. Some banks will allow you to send $1,000 or more per day and may also limit the amount you can send each month. Contact your bank to find out more. If you use the Zelle app, you won't be able to send more than $500 in a week.

Motley Fool Stock Disclosures

Bank of America is an advertising partner of Motley Fool Money. JPMorgan Chase is an advertising partner of Motley Fool Money. Wells Fargo is an advertising partner of Motley Fool Money. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Emma Newbery has positions in Apple. Natasha Gabrielle has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Apple, Bank of America, Intuit, JPMorgan Chase, PayPal, Target, and U.S. Bancorp. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short June 2025 $77.50 calls on PayPal. The Motley Fool has a disclosure policy.