Average House Price by State in 2025

KEY POINTS

- The median home sales price in the United States is $410,800 as of the second quarter of 2025. The average home sales price is $512,800.

- Hawaii is the most expensive state to buy a house, with a median home value of $977,538, according to the Zillow Home Value Index average over the second quarter of 2025.

- West Virginia is the least expensive state to buy a house, with an average home value of $170,514 over the second quarter of 2025, according to the Zillow Home Value Index.

The median house price is $410,800 as of the second quarter of 2025, according to the Federal Reserve Bank of St. Louis. That's down $12,300 from the previous quarter and $3,700 lower than the previous year.

The average house price is $512,800 for the second quarter of 2025. That's down from $514,200 from the previous quarter and up $502,200 from the second quarter of 2024.

House prices grew quickly from mid-2021 through late 2022, but the market has started to cool off. The median home sales price in the U.S. declined in three out of four quarters in 2023, but just one quarter in 2024. Still, the median home sales price fell overall in 2024 and has see-sawed in 2025.

Mortgage rates dropped significantly in 2020, driving up demand as home buyers looked to take advantage. The COVID-19 pandemic also led to consumers shifting spending to housing and pushed more millennials toward homeownership. Starting in 2022, however, mortgage rates began to rise rapidly as the Federal Reserve raised rates, and house prices have dropped from their peak. Mortgage rates declined from the fall of 2023 through the fall of 2024, but have since rebounded.

Read on for a look at what average house prices are across the country.

Average home price in the United States: $512,800

The average home sales price is $512,800 as of the second quarter of 2025. That's a 0.30% decrease from the previous quarter, but a 38% increase from the second quarter of 2020, when the average home sales price was $383,300.

The median home sales price is $410,800 as of the second quarter of 2025. That's also a 1% decrease quarter over quarter and a 27% increase from the first quarter of 2020, when the median sales price was $371,100.

The average cost of a house in the United States has increased over the past four decades. Here's a look at how the median and average home sales prices have changed over the last 40 years (prices are for the first quarter of each year listed unless otherwise specified):

| Year | Median Sales Price of Homes in the U.S. | Average Sales Price of Homes in the U.S. |

|---|---|---|

| 1980 | $63,700 | $73,600 |

| 1985 | $82,800 | $98,500 |

| 1990 | $123,900 | $149,500 |

| 1995 | $130,000 | $153,500 |

| 2000 | $165,300 | $202,900 |

| 2005 | $232,500 | $288,500 |

| 2010 | $222,900 | $275,300 |

| 2015 | $289,200 | $348,000 |

| 2020 | $329,000 | $383,000 |

| 2025 Q2 | $410,800 | $512,800 |

Between 1980 and 2020, the median home sales price increased by 416%. From 1980 to the second quarter of 2025, home sales prices rose 544%.

The gap between those percentage changes is a result of home prices rapidly rising from 2020 through late 2022. From the first quarter of 2020 to the fourth quarter of 2022, the median home sales price rose 46% from $329,000 to $479,500, among the fastest rate of median home sales price increases in U.S. history.

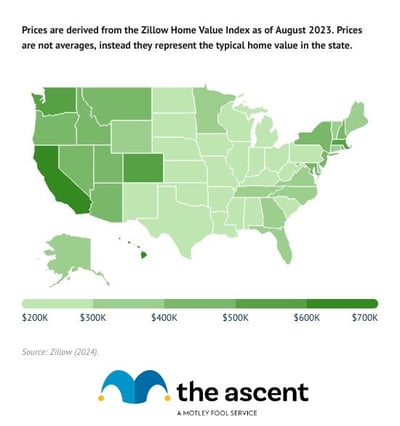

Typical home value in the United States: $371,133

The Federal Reserve only provides data on home sales prices and does not include state-level data. The Zillow Home Value Index (ZHVI), however, does provide that data. The ZHVI isn't an average, but it represents the typical home value in a given area. In the United States as a whole, typical home value as defined by the average ZHVI over the second quarter of 2025 was $371,133 .

Affordability of housing varies by state. For a look at house prices in each state, the median income by state, and housing affordability, read on.

Typical home value by state

Typical home value in Alabama: $232,205 (65% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $232,205

- Median household income as a percentage of home value: 26%

Homes in Alabama are among the most affordable in the country. The typical home value is just 65% of the national average, with household income covering over a quarter of that value.

Typical home value in Alaska: $394,781 (111% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $394,781

- Median household income as a percentage of home value: 22%

Alaska homes are priced slightly above the national average. However, strong household incomes help offset housing costs.

Typical home value in Arizona: $441,802 (124% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $441,802

- Median household income as a percentage of home value: 17%

Arizona homes are significantly pricier than the national average. Income levels, however, remain near the national median, making affordability more strained.

Typical home value in Arkansas: $220,174 (62% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $220,174

- Median household income as a percentage of home value: 25%

Housing in Arkansas is notably affordable. Despite lower incomes, homes remain accessible due to below-average values.

Typical home value in California: $813,110 (228% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $813,110

- Median household income as a percentage of home value: 11%

California has the most expensive housing market nationwide. Even with above-average incomes, the income-to-home-value ratio is the lowest in the U.S.

Typical home value in Colorado: $570,492 (160% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $570,492

- Median household income as a percentage of home value: 16%

Colorado home prices are well above the national norm. Strong incomes help, but affordability remains a challenge.

Typical home value in Connecticut: $463,968 (130% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $463,968

- Median household income as a percentage of home value: 19%

Connecticut homes are priced above average, but high household incomes help keep ownership within reach for many.

Typical home value in Delaware: $405,696 (114% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $405,696

- Median household income as a percentage of home value: 20%

Delaware homes hover just above national values. Strong regional incomes contribute to manageable housing costs.

Typical home value in District of Columbia: $770,566 (216% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $770,566

- Median household income as a percentage of home value: 13%

DC ranks among the priciest markets in the country. Despite high median incomes, home prices outpace earnings significantly.

Typical home value in Florida: $407,830 (114% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $407,830

- Median household income as a percentage of home value: 17%

Florida homes are more expensive than the national norm. Income growth hasn't kept pace, reducing overall affordability.

Typical home value in Georgia: $339,764 (95% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $339,764

- Median household income as a percentage of home value: 21%

Georgia homes are just under national value. That, paired with incomes near the median, keeps housing relatively affordable.

Typical home value in Hawaii: $977,538 (274% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $977,538

- Median household income as a percentage of home value: 9%

Hawaii is the least affordable housing market in the nation. Even with high household incomes, sky-high home prices dominate.

Typical home value in Idaho: $476,401 (134% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $476,401

- Median household income as a percentage of home value: 15%

Idaho home values are well above the U.S. average. Incomes, however, don't scale proportionally, leading to lower affordability.

Typical home value in Illinois: $291,686 (82% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $291,686

- Median household income as a percentage of home value: 26%

Illinois offers below-average home prices with above-average income. This makes for one of the more affordable housing markets.

Typical home value in Indiana: $254,805 (71% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $254,805

- Median household income as a percentage of home value: 26%

Indiana continues to rank as one of the more affordable states. Home values remain low compared to national levels.

Typical home value in Iowa: $237,298 (67% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $237,298

- Median household income as a percentage of home value: 29%

Iowa homes are some of the most affordable in the U.S. High income-to-home ratios make ownership very attainable.

Typical home value in Kansas: $243,092 (68% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $243,092

- Median household income as a percentage of home value: 28%

Kansas offers strong affordability with home prices well below national averages. Incomes stretch further here than in most states.

Typical home value in Kentucky: $224,934 (63% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $224,934

- Median household income as a percentage of home value: 26%

Kentucky continues to offer budget-friendly housing. Home prices are among the lowest nationwide.

Typical home value in Louisiana: $214,187 (60% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $214,187

- Median household income as a percentage of home value: 26%

Louisiana homes are valued significantly below the U.S. norm. Even with low incomes, affordability is solid.

Typical home value in Maine: $414,479 (116% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $414,479

- Median household income as a percentage of home value: 17%

Maine home prices exceed the national average. Income levels, however, are slightly below, reducing affordability.

Typical home value in Maryland: $451,221 (126% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $451,221

- Median household income as a percentage of home value: 21%

Maryland has one of the highest median incomes in the country. That helps counterbalance above-average home values.

Typical home value in Massachusetts: $687,004 (193% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $687,004

- Median household income as a percentage of home value: 14%

Massachusetts homes are nearly twice the national value. While incomes are high, housing remains expensive.

Typical home value in Michigan: $259,483 (73% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $259,483

- Median household income as a percentage of home value: 26%

Michigan continues to be a relatively affordable housing market. Moderate home prices and decent income ratios support accessibility.

Typical home value in Minnesota: $358,671 (101% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $358,671

- Median household income as a percentage of home value: 23%

Minnesota's home prices are just above the national average, with median incomes 10% higher than the U.S. median. This balance makes Minnesota's housing market moderately affordable.

Typical home value in Mississippi: $190,755 (53% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $190,755

- Median household income as a percentage of home value: 28%

Mississippi offers one of the most affordable housing markets in the country, with home prices less than half the national average. Median incomes are relatively low, but the income-to-home-value ratio remains high.

Typical home value in Missouri: $264,878 (74% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $264,878

- Median household income as a percentage of home value: 24%

Missouri homes are well below the national price average, and incomes cover a solid share of home values. This makes Missouri a relatively affordable market.

Typical home value in Montana: $468,222 (131% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $468,222

- Median household income as a percentage of home value: 14%

Montana's home values exceed the national average by 31%, but incomes are lower compared to home prices. This suggests affordability pressures in the state.

Typical home value in Nebraska: $277,245 (78% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $277,245

- Median household income as a percentage of home value: 25%

Nebraska offers affordable homes priced well below the national average, with a healthy income-to-home-value ratio. This supports accessibility for buyers.

Typical home value in Nevada: $473,604 (133% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $473,604

- Median household income as a percentage of home value: 15%

Nevada's home prices are significantly above average, but incomes lag behind, limiting affordability. This reflects ongoing housing cost challenges.

Typical home value in New Hampshire: $527,625 (148% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $527,625

- Median household income as a percentage of home value: 17%

New Hampshire homes are well above the national average price, while incomes, though higher than average, don't keep pace with home values. Affordability is moderate but strained.

Typical home value in New Jersey: $587,599 (165% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $587,599

- Median household income as a percentage of home value: 16%

New Jersey has one of the highest home prices nationally. High median incomes partially offset costs, but affordability remains a challenge.

Typical home value in New Mexico: $317,051 (89% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $317,051

- Median household income as a percentage of home value: 19%

New Mexico's home values are just below the national average with moderate incomes. This combination supports decent affordability.

Typical home value in New York: $486,341 (136% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $486,341

- Median household income as a percentage of home value: 16%

New York homes are priced well above average, and incomes don't fully keep up with housing costs. This points to affordability pressures.

Typical home value in North Carolina: $340,100 (95% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $340,100

- Median household income as a percentage of home value: 20%

North Carolina's home values are just under the national average, with incomes about 10% below the U.S. median. Housing remains relatively affordable.

Typical home value in North Dakota: $289,192 (81% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $289,192

- Median household income as a percentage of home value: 25%

North Dakota offers affordable housing with home values below the national average and a strong income-to-home-value ratio.

Typical home value in Ohio: $245,994 (69% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $245,994

- Median household income as a percentage of home value: 27%

Ohio homes are priced well below the national average, making it one of the more affordable markets. Incomes cover a high portion of home values.

Typical home value in Oklahoma: $219,076 (61% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $219,076

- Median household income as a percentage of home value: 27%

Oklahoma has one of the lowest home prices nationally, with incomes covering a large share of the cost. Affordability is strong.

Typical home value in Oregon: $517,134 (145% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $517,134

- Median household income as a percentage of home value: 15%

Oregon's housing prices are well above the national average, but incomes lag behind home values. Affordability is a challenge.

Typical home value in Pennsylvania: $286,033 (80% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $286,033

- Median household income as a percentage of home value: 25%

Pennsylvania offers affordable homes with median incomes covering a healthy portion of home values.

Typical home value in Rhode Island: $506,114 (142% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $506,114

- Median household income as a percentage of home value: 16%

Rhode Island's home values are well above average, with incomes not fully keeping pace. Affordability pressures exist.

Typical home value in South Carolina: $307,144 (86% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $307,144

- Median household income as a percentage of home value: 21%

South Carolina's home prices are below the national average, and incomes cover a decent portion of home values, supporting affordability.

Typical home value in South Dakota: $321,486 (90% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $321,486

- Median household income as a percentage of home value: 22%

South Dakota homes are slightly below the national price average, with moderate incomes helping maintain affordability.

Typical home value in Tennessee: $336,083 (94% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $336,083

- Median household income as a percentage of home value: 19%

Tennessee offers housing priced just below the national average, with incomes lagging somewhat but still supporting reasonable affordability.

Typical home value in Texas: $309,450 (87% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $309,450

- Median household income as a percentage of home value: 23%

Texas homes are moderately priced below the national average, with incomes close to the median supporting affordability.

Typical home value in Utah: $547,417 (153% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $547,417

- Median household income as a percentage of home value: 16%

Utah's housing market is well above the national average, with median incomes not keeping pace, creating affordability challenges.

Typical home value in Vermont: $406,269 (114% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $406,269

- Median household income as a percentage of home value: 18%

Vermont's home prices exceed the national average, but incomes are relatively modest, limiting affordability.

Typical home value in Virginia: $416,725 (117% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $416,725

- Median household income as a percentage of home value: 21%

Virginia homes are priced above average, supported by higher-than-average incomes, easing affordability concerns somewhat.

Typical home value in Washington: $629,103 (176% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $629,103

- Median household income as a percentage of home value: 15%

Washington has one of the priciest housing markets, with incomes lagging behind home values, limiting affordability.

Typical home value in West Virginia: $170,514 (48% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $170,514

- Median household income as a percentage of home value: 32%

West Virginia is the most affordable state, with the lowest home prices and the highest income-to-home-value ratio.

Typical home value in Wisconsin: $333,775 (94% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $333,775

- Median household income as a percentage of home value: 21%

Wisconsin offers homes priced just below the national average, with median incomes supporting affordability.

Typical home value in Wyoming: $366,667 (103% of typical U.S. price)

- Typical single-family home value in the second quarter of 2025: $366,667

- Median household income as a percentage of home value: 19%

Wyoming homes are slightly above the national average in price, with incomes close to the median, creating moderate affordability.

How to save when buying a home

With average home prices in the U.S. in flux, you may want to consider how to save if you're thinking of buying a house. Here are a few ways to get ready for a mortgage:

- Take steps to increase your credit score. When applying for a mortgage, home buyers with a FICO® Score of 760 or higher typically qualify for the lowest mortgage rates.

- Save up money for a larger down payment. Putting 20% down means you don't need to pay private mortgage insurance.

- Shop around when choosing a mortgage lender. Be sure to consider the best mortgage lenders. And don't forget to check out online mortgage lenders. Different lenders will offer different APRs, and even a slightly lower one can result in big long-term savings.

Motley Fool Money also has a mortgage calculator that can help you figure out your mortgage payments based on different home prices, mortgage rates, down payments, and other factors.

-

Sources

- Census Bureau (2023). "S1903 Median income in the past 12 months."

- Joint Center for Housing Studies of Harvard University (2021). "Extraordinary and Unexpected Pandemic Increase in House Prices: Causes and Implications."

- St. Louis Fed (2025). "Median Sales Price of Houses Sold for the United States."

- Zillow (2025). "Housing Data."

Our Research Expert