How Do Current Mortgage Rates Compare to Average Historical Mortgage Rates?

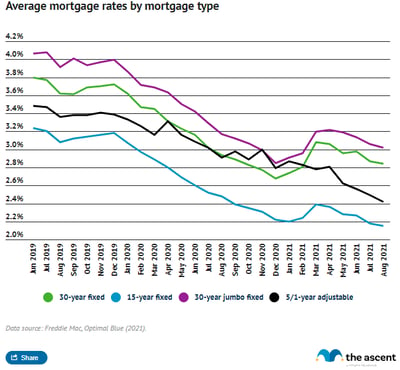

Mortgage rates have experienced historic lows this year, leading new homebuyers to dive into the market, searching for the best mortgage lenders. It's also led to homeowners looking to refinance their mortgages.

To get a better idea of just how low current mortgage rates are, The Ascent and Millionacres took a look at average historic mortgage rates over the past year and decades.

Key findings

- Mortgage rates in major categories are either at or near historic lows.

- The average mortgage rate for a 30-year fixed-rate mortgage was 2.84% in August 2021, close to the lowest rate ever offered in the category.

- The average rate for a 15-year fixed-rate mortgage in August 2021 was 2.15%, which is the lowest average mortgage rate ever recorded.

- The average mortgage rate for a 30-year fixed jumbo mortgage in August 2021 was 3.018%, near all-time lows set in the winter.

- The average rate for a 5/1 adjustable-rate mortgage (ARM) in August 2021 was 2.42%, the record low.

- Although mortgage rates are historically low, lenders take into consideration other factors when deciding what rate to offer, such as the borrower’s credit score, debt-to-income ratio, and employment history. Homebuyers should also keep in mind that other costs, such as closing costs, will impact the annual percentage rate of the home loan their lender offers.

Average mortgage rates in major mortgage categories were at or near all-time lows in August

The average mortgage rates were either at or near historic lows in August for the following mortgage types:

- 30-year fixed-rate

- 15-year fixed-rate

- 30-year jumbo fixed-rate

- 5/1 ARM

(There are other types of mortgages as well, and some of them will be of interest to real estate investors -- be sure to read Millionacres' guide to mortgages to get the details on those types.)

Mortgage rates have been low since early 2020 due to the Federal Reserve slashing interest rates in response to the COVID-19-induced economic slowdown.

The average mortgage rate for a 30-year fixed-rate mortgage in August 2021 was 2.84%

The average mortgage rate for a 30-year fixed-rate mortgage was 2.84% in August 2021, close to the lowest rate ever offered in the mortgage category.

Thirty-year fixed mortgages are loans that do not have a changing interest rate or monthly payment amount and will be paid off in 30 years if all payments are made on time.

This is the most common mortgage term, and is a good choice for most people buying a home. While the interest rate is often higher than the rates offered on 15-year mortgages, the monthly payments are also lower, making this a more feasible option for most homebuyers.

The monthly average for the 30-year fixed mortgage rate hit its all-time low in December 2020 at 2.68%. The average 30-year fixed mortgage rate one year ago, in August 2020, was 2.94%, 0.1% higher than the average 30-year fixed mortgage rate in August 2021.

Here's what the data looks like for the past year:

| Month | Average 30-year fixed mortgage rate |

|---|---|

| September 2020 | 2.89% |

| October 2020 | 2.83% |

| November 2020 | 2.77% |

| December 2020 | 2.68% |

| January 2021 | 2.74% |

| February 2021 | 2.81% |

| March 2021 | 3.08% |

| April 2021 | 3.06% |

| May 2021 | 2.96% |

| June 2021 | 2.98% |

| July 2021 | 2.87% |

| August 2021 | 2.84% |

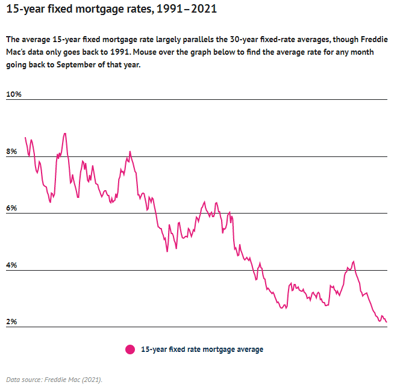

The average mortgage rate for a 15-year fixed-rate mortgage in August 2021 was 2.15%

The average rate for a 15-year fixed-rate mortgage in August 2021 was 2.15%, which is the lowest average mortgage rate ever recorded for the category. This is the lowest average mortgage rate ever recorded for the category and 0.33% lower than it was in August 2020.

Fifteen-year fixed-rate mortgages are loans that do not have a changing interest rate or monthly payment amount and will be paid off in 15 years if payments are made on time.

While the rates are lower than those offered on 30-year mortgages, the monthly payments are quite a bit higher to make up for the shorter term. While this may not be an option for everyone, it's a great way to save money over the life of the loan if you can afford the monthly cost.

Like other mortgage rates, we've seen a decline in the average rates of 15-year fixed loans over the past 12 months:

| Month | Average 15-year fixed mortgage rate |

|---|---|

| September 2020 | 2.39% |

| October 2020 | 2.35% |

| November 2020 | 2.31% |

| December 2020 | 2.22% |

| January 2021 | 2.20% |

| February 2021 | 2.24% |

| March 2021 | 2.39% |

| April 2021 | 2.36% |

| May 2021 | 2.28% |

| June 2021 | 2.27% |

| July 2021 | 2.18% |

| August 2021 | 2.15% |

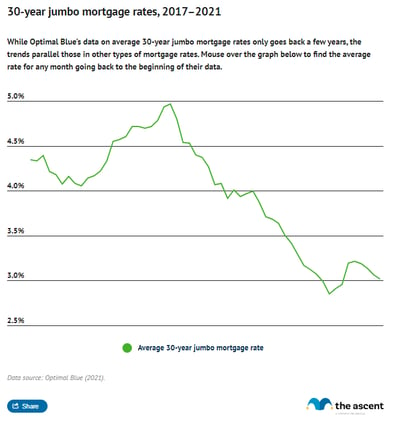

The average mortgage rate for a 30-year fixed jumbo mortgage in August 2021 was 3.018%

The average mortgage rate for a 30-year fixed jumbo mortgage in August 2021 was 3.018%, near all-time lows set in the winter. This was 0.153% lower than the average rate in August 2020 and near the all-time low of 2.849% set in December 2020.

A jumbo mortgage (or "jumbo loan") is one that exceeds limits set by the Federal Housing Finance Agency and therefore cannot be backed by Fannie Mae and Freddie Mac. Jumbo loans allow homebuyers to take out a larger-than-average loan, which is useful if shopping in a competitive and pricey market.

Like other fixed home loans, 30-year fixed jumbo loans do not have a changing interest rate or monthly payment amount and will be paid off in 30 years if payments are made on time.

The past year has seen average jumbo mortgage rates drop, but they're still higher than most conforming loans:

| Month | Average 30-year jumbo mortgage rate |

|---|---|

| September 2020 | 3.119% |

| October 2020 | 3.066% |

| November 2020 | 2.989% |

| December 2020 | 2.849% |

| January 2021 | 2.908% |

| February 2021 | 2.957% |

| March 2021 | 3.197% |

| April 2021 | 3.215% |

| May 2021 | 3.186% |

| June 2021 | 3.137% |

| July 2021 | 3.059% |

| August 2021 | 3.018% |

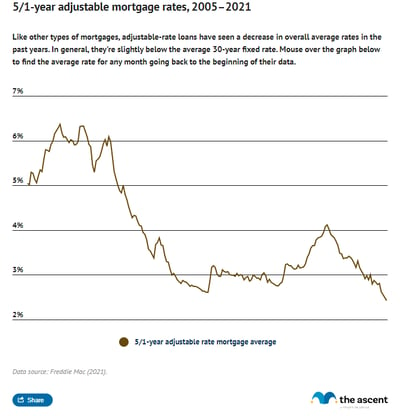

The average rate for a 5/1 ARM in August was 2.42%

The average rate for a 5/1 adjustable-rate mortgage (ARM) in August was 2.42%. This is a record low and 0.49% lower than the average rate of 2.91% in August 2020.

A 5/1 ARM is a loan with a fixed interest rate for the first five years followed by an adjustable rate that generally changes annually.

Adjustable-rate mortgages offer the possibility of getting a lower rate at some point in the future. These rates are based on an index monitored by the lender. While ARMs make sense for some borrowers, they can also result in larger monthly payments that are hard to keep up with. For some insight into when it makes sense to apply for an ARM, see "Should I Get a Fixed- or Adjustable-Rate Mortgage?"

Here's how the average adjustable-rate mortgage rates have looked over the last year:

| Month | Average 5/1-year adjustable mortgage rate |

|---|---|

| September 2020 | 2.98% |

| October 2020 | 2.89% |

| November 2020 | 3.00% |

| December 2020 | 2.79% |

| January 2021 | 2.87% |

| February 2021 | 2.83% |

| March 2021 | 2.78% |

| April 2021 | 2.81% |

| May 2021 | 2.62% |

| June 2021 | 2.56% |

| July 2021 | 2.49% |

| August 2021 | 2.42% |

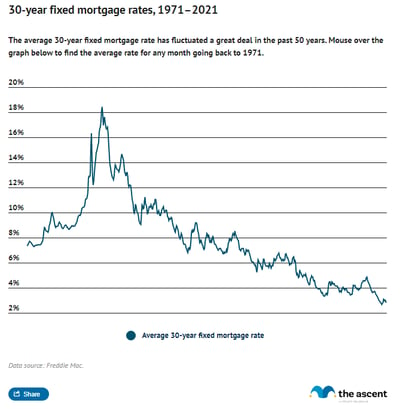

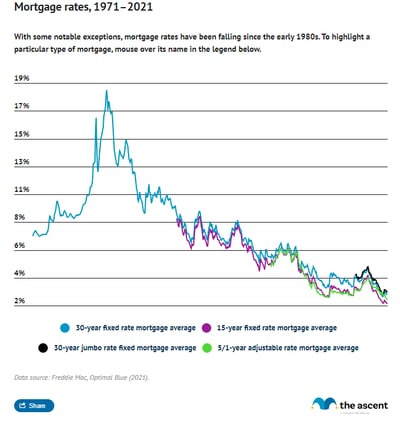

Historic average mortgage rates trends graph: Mortgage rates over the decades

To get a better idea of mortgage rates throughout the years, here's a look at the key findings from the last 50 years:

- The 30-year fixed mortgage rate peaked in 1981 at just over 18% after the Fed raised interest rates in an attempt to rein in inflation.

- Rates for home loans have declined amid slowing inflation and steady economic growth, albeit slowly in the 90s and most of the 2000s.

- Average mortgage rates quickly fell after the 2008 financial crisis as a result of the Fed slashing interest rates.

- Home loan rates held relatively low in the 2010s. Mortgage rates rose slightly due to activity in the mortgage bond market in reaction to the Fed announcing that it would cut back on bond purchases.

- The COVID-19 pandemic and subsequent further interest rate cut by the Fed in early 2020 led mortgage lenders to offer historically low rates. Lenders are expected to continue to offer rates around current levels as the outlook for the economy remains uncertain.

How can you take advantage of low mortgage rates?

With mortgage rates hovering around historic lows, it’s a great time for first-time homebuyers to secure a low interest rate home loan or for homeowners to refinance their mortgage at a lower interest rate.

First-time homebuyers should keep in mind that the housing market is extremely competitive right now, and home prices are at all-time highs -- in part driven by the low mortgage rates that have been around for over a year.

You might also use a low-interest refinance to pay off your mortgage a bit earlier.

A lower mortgage rate translates into smaller mortgage payments, less interest paid over the lifetime of a mortgage, and big savings. Here's how that looks with real numbers using a 30-year fixed-rate mortgage on a $300,000 house with a 20% down payment:

| Price of home | Down payment | Mortgage interest rate | Mortgage type | Monthly payment | Total interest | Total principal | Total cost |

|---|---|---|---|---|---|---|---|

| $300,000 | $60,000 | 3.13% | 30-year fixed | $1,387 | $130,445 | $240,000 | $370,445 |

| $300,000 | $60,000 | 3.23% | 30-year fixed | $1,399 | $134,976 | $240,000 | $374,976 |

| $300,000 | $60,000 | 3.33% | 30-year fixed | $1,413 | $140,108 | $240,000 | $380,108 |

| $300,000 | $60,000 | 3.43% | 30-year fixed | $1,426 | $144,702 | $240,000 | $384,702 |

| $300,000 | $60,000 | 3.53% | 30-year fixed | $1,439 | $149,327 | $240,000 | $389,327 |

If you want to run your own numbers and see what you'll end up paying, be sure to check out The Ascent's mortgage calculator.

While average mortgage rates are at historically low levels, there are a couple other factors that lenders take into consideration when setting interest rates for individual borrowers.

Those factors include the borrower’s

- credit score,

- debt-to-income ratio,

- down payment size,

- loan term, and

- employment history.

Keep in mind that the annual percentage rate (APR) advertised by lenders will be a bit higher than the interest rate advertised. That’s because the APR includes the interest rate of the loan and adds it to certain fees paid by the borrower at closing, such as closing costs.

Taking steps to improve those factors can shave even a fraction of a percent off a mortgage rate and can result in thousands of dollars of savings over the lifetime of a mortgage.

Sources:

- Freddie Mac (2021). "Mortgage Rates."

- Optimal Blue (2021). "Optimal Blue Mortgage Market Indices."

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.