A little while back, DigiTimes reported that Samsung (NASDAQOTH: SSNLF) had disclosed a very juicy tidbit about its upcoming 7-nanometer chip-manufacturing technology -- that it would transition from a transistor structure that's known as a finFET to a gate-all-around (GAA) structure.

If it's true that Samsung plans to adopt this new transistor structure for its 7-nanometer technology -- which could enter mass production at the end of 2018 -- then that could be an indication that chip giant Intel (INTC +2.25%) might be falling behind in terms of key manufacturing technology advances.

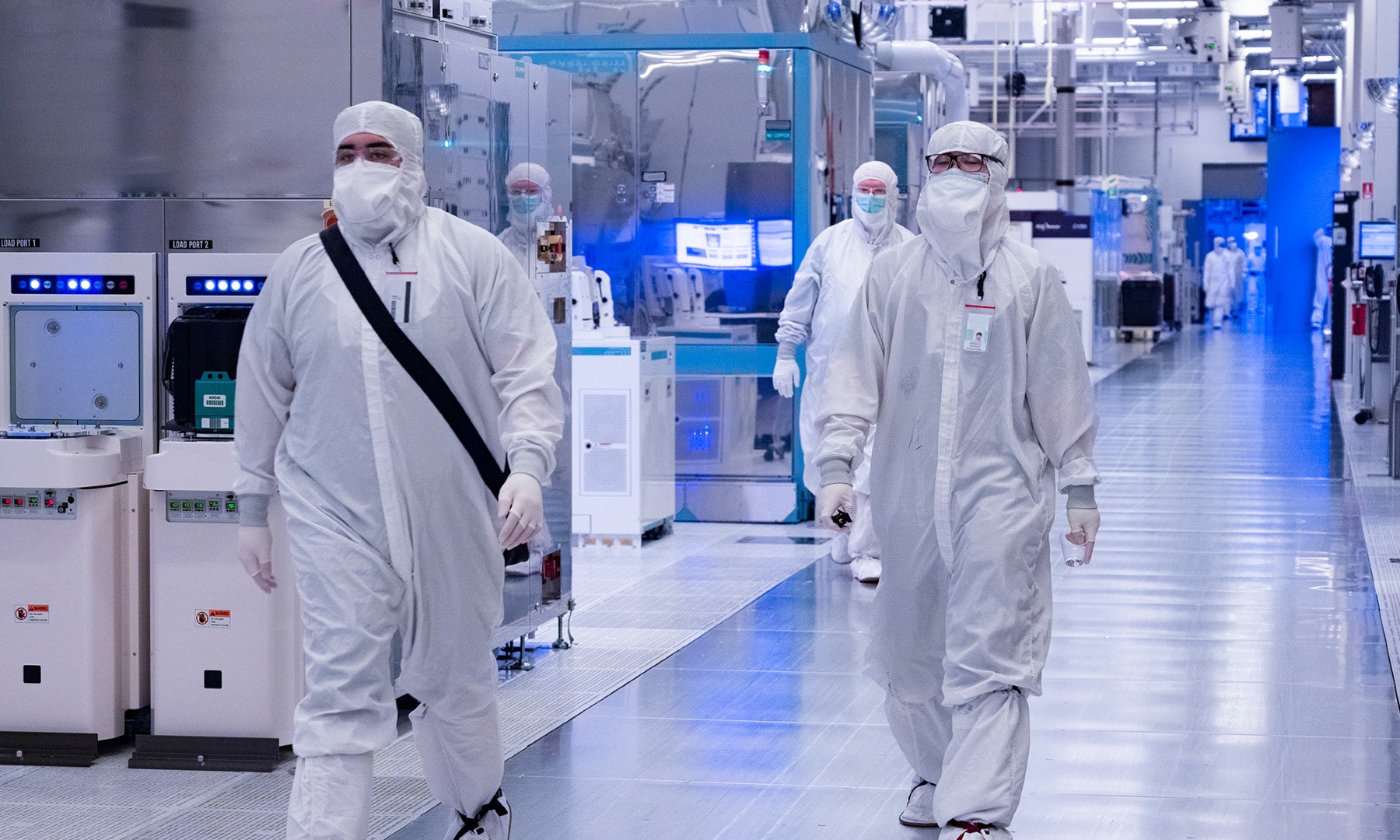

Image source: Intel.

Indeed, Intel's recent disclosures indicate that it will continue to use finFET transistors in its upcoming 10-nanometer technology, with rumors pointing to continued use of finFETs with the company's 7-nanometer technology.

However, during a question-and-answer session at Intel's recent Technology and Manufacturing Day, Intel Senior Fellow Mark Bohr, in response to a question from analyst Stacy Rasgon asking for Intel's thoughts on Samsung's potential use of GAA, seemed to indicate that Intel isn't worried about Samsung's potentially pulling ahead.

Intel tech guru responds

"We are exploring a broad range of transistor options in our research and development groups -- including gate-all-around," Bohr began. "As much as we might like to use an attractive name like that, we make choices based on real, hard engineering data -- density, performance, and power."

Bohr's response was interesting, but it didn't directly answer the question. Fortunately, Rasgon pressed for further insight and received a more direct answer to his question.

Bohr said that even if Samsung were to roll out gate-all-around-based technology in the rumored timeframe, Intel would continue to have a "better technology" in terms of power, performance, and area.

Keeping an eye on this space

It's not clear how often Intel plans to host these Technology and Manufacturing Day events to talk about its progress in chip-manufacturing technologies, but I think Intel should at minimum host one of these events every two years.

The world of chip manufacturing is a fast-paced one, and there constantly are new developments from Intel and its competitors. Keeping investors updated with relatively fresh technology, economic, and competitive insights should be a priority for the chipmaker.

With respect to Samsung's upcoming 7-nanometer technology, if it goes into production in late 2018, then that means we should see products based on it in the marketplace at some point during the first half of 2019.

Once chips built using Samsung's 7-nanometer technology are available to purchase in the marketplace, Intel ought to tear down those chips and measure the performance of the technology -- as well as the density of the technology -- and publicly publish a comparison to whatever technology Intel has in the market at the time.

If Intel winds up having a better technology, as Bohr expects, then that could serve to validate the technical choices that it made relative to what Samsung (or another competitor) made.

On the other hand, if Intel can't score a clear win, or if it winds up comparing some future technology that's at least six months away from mass production from what Samsung has in the market at the time, then it'll be clear that Intel has some work to do to shore up its manufacturing technology competitiveness.