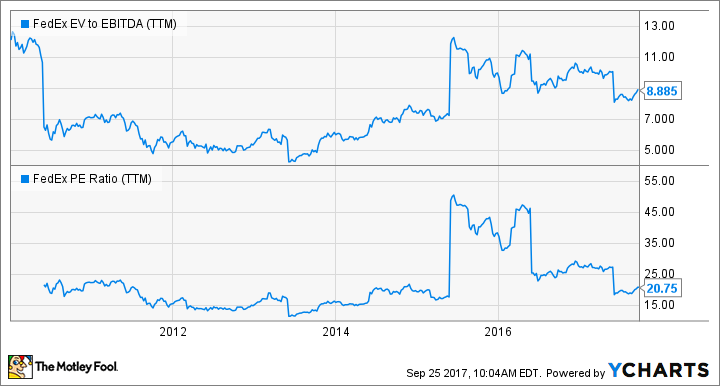

Given the 26% rise in FedEx Corporation (FDX -0.21%) stock in the last year, investors should reassess the value proposition of the stock. After all, as you can see below, FedEx has been trading at a higher valuation than where it was during most of the period since 2010, and it has had a cash outflow of $186 million in its fiscal year ending in May. In this article, I will focus particularly on the bear case against buying the stock and then follow up with the bull case in a future article.

FDX EV to EBITDA (TTM) data by YCharts.

The bear case

Putting valuation aside for the moment, the three strongest bear arguments are as follows:

- E-commerce growth is producing volume growth, but it's also causing margin pressure at FedEx and United Parcel Service, Inc. (UPS 0.53%), and the market may be too optimistic about earnings growth potential.

- E-commerce growth and servicing peak demand periods during the holiday season are forcing FedEx and UPS to increase capital spending on their networks, meaning that free cash flow (FCF) generation growth is constricted.

- The TNT express integration contains execution risk as the acquired company requires significant investment -- as evidenced by the $300 million hit to earnings from the NotPetya malware attack at TNT express.

Growing pains

E-commerce growth is often touted as the key reason to buy FedEx stock but the bears point out that both leading companies' ground operations are coming under margin pressure as a result of servicing this growth. As you can see below, their ground margins have taken a hit in recent years.

Data source: FedEx and UPS presentations. FedEx numbers are adjusted to UPS's most recent quarter. UPS U.S. domestic package segment contains ground.

There are a few reasons for the margin decline at FedEx and UPS including the relatively low margin associated with residential deliveries, the preponderance of lightweight and inefficiently packed e-commerce parcels, and bulky expensive-to-deliver items such as trampolines and mattresses.

Free cash flow pressured

In addition, the necessity to invest in network upgrades and capacity expansions means that capital expenditures have been going up while FCF has been going down for both companies.

As you can see below, trailing-12-month FCF for FedEx (a figure that correlates with FedEx's 2017 as its financial year ends in May) has turned negative. In addition, FedEx plans to increase capital spending to $5.9 billion in its financial 2018 from a figure of $5.1 billion in 2017. Similarly, UPS has been ramping capital expenditures with $4 billion planned for 2017 compared to $3 billion in 2016.

FDX Capital Expenditures (TTM) data by YCharts.

TNT integration might not be straightforward

The TNT integration is a big part of the investment thesis for FedEx. After all, management believes it will increase express segment (which now includes TNT Express) operating income by $1.2 billion-$1.5 billion from the $2.8 billion reported in 2017.

While the TNT integration obviously provides a great opportunity for FedEx to expand market share in Europe and generate synergies from the combined businesses, it also comes with execution risk that recent events have helped to highlight.

In a nutshell, the recent cyberattack -- which impacted TNT Express and not the rest of FedEx -- draws attention to the fact that TNT requires investment. In fact, in the wake of the cyberattack, FedEx increased its planned integration expenses by $75 million to a figure of $350 million for 2018. Moreover, it's worth remembering that even before FedEx announced the deal to buy TNT, the European company was in the process of investing in restructuring in order to improve productivity. Simply put, TNT Express was not a business in good shape and FedEx may find it harder than expected to successfully integrate.

Image source: Getty Images.

Looking ahead

All told, the bearish case for FedEx stock is based on the idea that the valuation is assuming rosy outcomes for e-commerce growth and the TNT Express integration, both of which remain to be proved. In fact, e-commerce growth appears to be bringing margin challenges for FedEx and UPS. In addition, the hit from the cyberattack in the first quarter was solely a TNT affair for FedEx. Meanwhile, cash outflows and growing capital expenditure requirements speak to ongoing growth challenges at FedEx.