Netflix (NFLX -0.40%) soared past expectations during the fourth quarter, posting extremely strong subscriber growth both in the U.S. and internationally. The combination of a rapidly growing subscriber base, a recent price increase, and a weaker U.S. dollar caused revenue to surge nearly 33% year over year last quarter. Management expects revenue growth to accelerate to around 40% in the first quarter.

Investors responded by driving Netflix stock to a new all-time high above $250, up more than tenfold in the past five years. The company's market cap has now reached a stunning $110 billion.

Netflix Stock Performance. Data by YCharts.

Netflix management is taking this strong revenue growth as a cue to ramp up investment even faster than expected. As a result, free cash flow will move even deeper into negative territory in 2018. This seems unnecessarily risky for the company.

Revenue growth is taking off

Netflix's first-quarter forecast calls for domestic streaming revenue to reach $1.8 billion, up 23% year over year. Only half of this revenue growth will come from increases in the subscriber base. While Netflix continues to expand its reach in the U.S. at a steady pace, subscriber-base growth peaked a few years ago. Netflix added 4.9 million domestic paid subscribers in 2017 -- up from 4.5 million a year earlier, but down from 5.7 million in 2015 and 6.0 million in 2014.

The other half of Netflix's domestic streaming revenue growth will come from a roughly 11% increase in average revenue per user. Last fall, Netflix increased its prices again in the U.S. The price of the popular mid-tier offering rose from $9.99 per month to $10.99 per month. Netflix also boosted the price of the four-stream, 4K-compatible option from $11.99 per month to $13.99 per month. Unlike the last price increase, this one didn't come with a lengthy "grandfather" period for existing subscribers.

Meanwhile, Q1 international revenue is set to soar 70% year over year to nearly $1.8 billion, as the user base continues to expand at a phenomenal rate. This growth rate is still considerably faster than the underlying membership growth rate of about 40%. Netflix recently raised prices in some international markets, too. Furthermore, the weaker U.S. dollar boosts the dollar value of sales made in foreign currency.

Locking in massive cost increases

Netflix expects strong revenue growth to enable an improvement in its operating margin of roughly 3 percentage points this year. However, free cash flow will deteriorate even further. Netflix burned $2 billion of cash in 2017, and it is projecting cash burn of $3 billion to $4 billion for 2018.

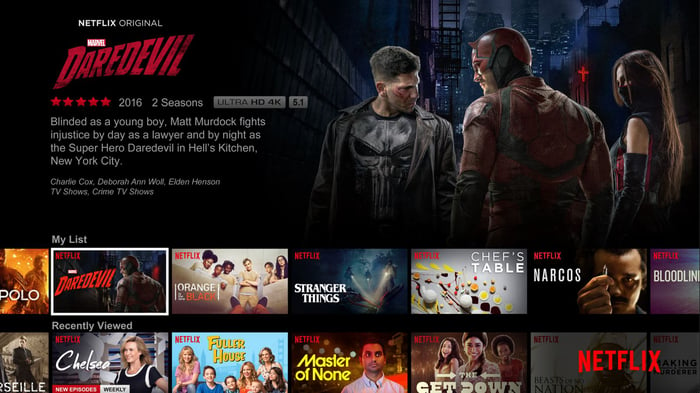

Netflix's free cash flow is negative due to rapidly rising content costs. Image source: Netflix.

Some of this pressure comes from Netflix's plan to increase marketing spending from $1.3 billion to around $2 billion. However, marketing spending has a short payback period, and the return on investment isn't hard to measure. Previous increases in marketing spending have accelerated subscriber growth as expected.

The biggest drag on free cash flow, though, will be rising spending on original content. The company expects to spend nearly $8 billion on an accounting basis in 2018, up from around $6 billion last year. However, based on Netflix's cash flow guidance, it appears that cash spending for content could be more like $12 billion.

Cash spending on content is exploding both because Netflix is relying increasingly on original content and because it wants to own as much of that content as possible. This means it must foot the bill for production costs on content that won't be ready for consumption for up to three years.

The benefits of controlling more content are significant. However, with Netflix's budget rising at an exponential rate, there's a risk that the money won't be spent as well. (For comparison, HBO, a subsidiary of Time Warner, is much choosier about its content spending.) Furthermore, the increased cash spending today means that Netflix has locked in huge cost increases for future years, which could hurt the company if revenue growth decelerates. Finally, it's hard to measure how any one additional piece of content affects subscriber growth.

Will Netflix's gamble pay off?

Given how well Netflix has performed over the past five years, its management team deserves a lot of leeway in terms of investment decisions. It's quite possible that Netflix will continue its smooth ascent during the next five years.

On the other hand, Netflix will reach maturity in many of its older markets within the next few years. Unless it can push through annual price increases, this will lead to a sharp slowdown in revenue growth.

Netflix clearly needs to continue increasing its content spending to draw in more customers. Still, a less aggressive pace of spending growth might be more prudent in the long run.