The message you get when you read through an investor presentation deck for the WD-40 Company (WDFC -0.66%) is growth. The North Star for management is to grow its revenue to $700 million annually by 2025 while maintaining its current margins. So when looking at the company's earnings reports, the first thing that any investor is going to look at is the revenue growth rate.

This past quarter, the WD-40 Company was able to post a significant uptick in sales from the prior quarter, but it is still well off the pace it needs to be at to meet management's goals. Here's a brief look at the company's most recent earnings numbers and how investors in this company may want to view the possibility of management not meeting this lofty sales goal.

Image source: The WD-40 Company

By the numbers

| Metric | Q3 2018 | Q2 2018 | Q3 2017 |

|---|---|---|---|

| Revenue | $107.0 million | $101.2 million | $98.1 million |

| Operating income | $22.3 million | $19.3 million | $20.6 million |

| Net income | $16.1 million | $14.8 million | $14.4 million |

| EPS | $1.15 | $1.05 | $1.02 |

Data source: WD-40 Company earnings release. EPS = Earnings per share.

I think it's fair to say that WD-40 is posting relatively healthy revenue growth. 9% year-over-year growth is certainly nothing to scoff at, especially for a business as mature and selling something as simple as WD-40. A lot of that gain, however, came from beneficial foreign currency exchange rates. Over the long haul, currency exchange rates tend to become a wash, so it's not great to rely on them for continued growth. Backing out the foreign exchange gain, revenue for the quarter was up 5% year over year. It's certainly better than the prior quarter's tepid growth numbers, but it is still well short of the numbers it has to put up if it wants to meet management's stated goal of $700 million in annual sales by 2025.

The one thing that has remained consistent for some time is management's ability to generate earnings-per-share growth that outpaces revenue growth thanks to share repurchases. While the amount of stock repurchased in the quarter was rather low, the board approved another $75 million in purchases that will allow management to continue its trend of reducing its share count.

WDFC Average Diluted Shares Outstanding (Quarterly). Data source: YCharts.

What management had to say

One of WD-40s most effective levers to pull when it comes to driving sales is to leverage the WD-40 brand into other products, which so far has been one of the more successful aspects of the business. Here's CEO Garry Ridge discussing some of the high points in the company's sales numbers and some of the challenges it will face in the upcoming quarters. (You can check out a full transcript of the company's conference call here).

Our maintenance products delivered solid sales increases in the third quarter including 10 percent growth of WD-40 Multi-Use Product and 16 percent growth of WD-40 Specialist. Though fluctuating foreign currency exchange rates favorably impacted our sales results in the current quarter, we still saw a currency adjusted sales growth rate of 5 percent period-over-period.

Unfortunately, we are continuing to see the impact of higher commodity prices which have begun to deteriorate our gross margins in all three of our operating segments. To combat this margin pressure we have made some price increases to ensure our gross margin remains in-line with our 55/30/25 business model.

A quick note, the 55/30/25 refers to a management initiative that means a 55% gross margin, 30% cost of doing business, and 25% EBITDA margin.

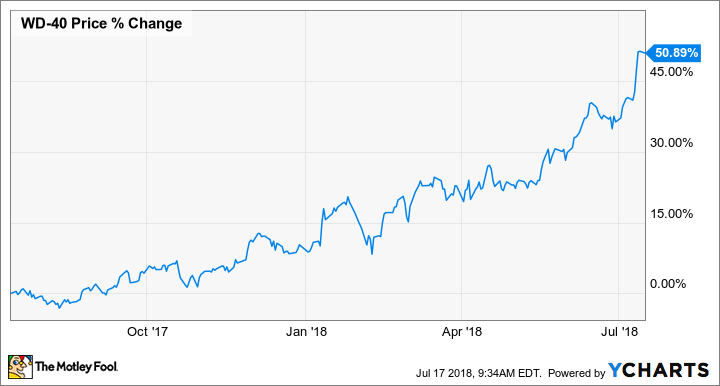

WDFC price change. Data source: YCharts.

Ten-second takeaway

There is an awful lot to like about WD-40 as a business. High margins, high rates of return, it's an asset-light business that doesn't require constant investment, and management has been adept at increasing shareholder value with regular dividend hikes and a reduced share count.

One does have to wonder, though, if management is going to be able to meet these lofty revenue goals, and how much does it matter to the investment thesis for the company? While it isn't ideal that its growth lags the pace it needs to meet that revenue goal, maintaining a pace of 5%-6% sales growth paired with persistent share repurchases should continue to produce double-digit earnings per share gains. For a mature business and product like WD-40, how much more can you really ask for?