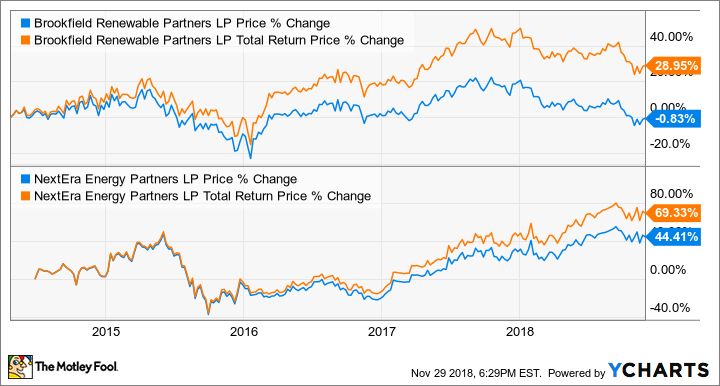

Since going public in 2014, NextEra Energy Partners LP (NEP -1.49%) has been a far better investment than Brookfield Renewable Partners LP (BEP -1.66%). Not only has it delivered more than double the total returns of Brookfield Renewable -- 69% to 29% -- but it has also outperformed the S&P 500 in total returns during a very strong market.

But looking forward, my expectation is that Brookfield Renewable will be the superior investment. Not only has it significantly strengthened its business with major acquisitions over the past couple of years, but the way that it's structured should allow it far more ability to find the best opportunities to grow all around the world.

Image source: Getty Images.

Comparing two great renewable energy investments

There are a few things NextEra Energy and Brookfield Renewable have in common. First, both are limited partnerships, a structure that makes them quite cash-flow efficient since they pay no corporate income tax. This allows them to pass more income back to investors in distributions, which makes them ideal investments for anyone looking for income or long-term dividend growth.

Case in point: Here's a comparison of their stock price change and total returns (adds dividends paid to stock price change) since mid-2014.

As you can see, all of Brookfield Renewable's returns have been a product of its distribution (its stock price is actually slightly down), while just over one-third of NextEra Energy Partners' returns have come from its payout.

Moreover, both are under the control of large corporate sponsors: large utility NextEra Energy Inc. for NextEra Energy Partners, and Brookfield Asset Management Inc. for Brookfield Renewable.

There are substantial benefits to having a big, well-capitalized corporate sponsor for both. Both NextEra and Brookfield are major asset developers, giving their respective subsidiaries access to a pipeline of potential new projects to invest in. Furthermore, both of these companies have strong management that have proven quite capable at navigating their respective businesses and effectively allocating capital.

Here's the one thing that sets one apart

While having a large corporate sponsor is a benefit for these two yieldcos, it can also come at a price. NextEra Energy is a U.S.-focused utility, and that is likely to limit NextEra Energy Partners' ability to participate in the explosive growth of renewables outside of the U.S.

Brookfield Asset Management, on the other hand, is one of the biggest global infrastructure asset developers, also acting as the sponsor for Brookfield Infrastructure Partners LP, Brookfield Property Partners LP, Brookfield Business Partners LP, and more recently acquiring control of TerraForm Power Inc. (TERP).

The big takeaway is that Brookfield Renewable, through its connection with Brookfield Asset Management, is a global player in renewable energy assets, giving it far more optionality and freedom to pursue growth around the world, while NextEra Energy Partners is likely to be far more limited in where and what it can invest in.

For instance, a substantial source of Brookfield Renewables' cash flows and future prospects are tied to TerraForm Power. After making a substantial investment this summer, Brookfield Renewable now owns 65% of its corporate cousin, collecting a substantial payout from TerraForm, which yields almost 7% at recent prices. Right now, TerraForm Power is targeting Europe and Latin America as some of the best markets to develop and invest in, while NextEra Energy Partners isn't likely to shop outside of the U.S.

Optionality, a superior yield, and steady dividend growth make Brookfield Renewable the winner

Simply put, Brookfield Renewable has access to far more renewable energy projects it can invest in or develop than NextEra Energy Partners, due to their very different corporate sponsors. That's a big advantage in the dynamic and ever-changing renewables space.

Furthermore, Brookfield Renewable yields 6.8% at recent prices, about 85% higher than NextEra Energy's 3.7% yield. And while NextEra Energy Partners has a better record of dividend growth in recent years, that may not remain the case over the next five years or more, and it will take a lot of growth to make up for the big difference in their respective yields.

Don't get me wrong -- I like NextEra Energy Partners, and I think it should remain a solid investment. But between the two, Brookfield Renewable looks set to be the far superior dividend growth investment going forward.