What happened

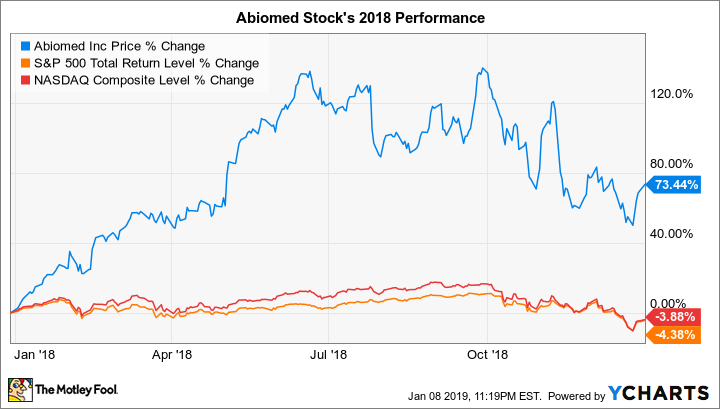

Abiomed (ABMD) stock gained 73.4% in 2018, according to data from S&P Global Market Intelligence, making it one of the best performing stocks on the S&P 500 index. For context, the S&P 500 (including dividends) lost 4.4% last year.

So far in 2019, shares of the Danvers, Mass-based maker of minimally invasive heart pumps have declined 3% through Monday, Jan. 14.

Image source: Getty Images.

So what

We can attribute Abiomed stock's super-healthy 2018 performance to the company posting strong quarterly financial results, along with investor enthusiasm about the continued growth potential for its Impella family of temporary heart pumps.

Data source: YCharts.

Abiomed has been crushing Wall Street's earnings expectations. In the last three quarters (fourth quarter of fiscal 2018, and first and second quarters of fiscal 2019), the company beat analysts' earnings per share (EPS) estimates by 25%, 138%, and 47%, respectively.

Let's look at Abiomed's results for its most recently reported two quarters: In its fiscal first quarter, revenue jumped 36% year over year to $180 million. Net income soared 141% to $90.1 million, which translated to EPS growing 136% to $1.95.

In the second quarter, revenue grew 37% year over year to $181.8 million. Net income surged 104% to $50.1 million, which translated to EPS growing 102% to $1.09. As it did in the previous quarter, management once again raised its full-year fiscal 2019 revenue guidance, as we'll get to in a moment.

Now what

Investors will soon be getting material news about Abiomed, as the medical device maker is scheduled to report its fiscal third-quarter earnings before the market open on Thursday, Jan. 31. For the quarter, Wall Street expects revenue to grow 27% year over year to $195.5 million, and EPS to soar 224% to $0.94.

For fiscal 2019, management expects revenue growth of about 29% to 30% year over year. Wall Street is looking for revenue to increase 30.3% and EPS to rocket 106% higher.

The company appears to have a long runway for growth ahead. CEO Michael Minogue said on last quarter's earnings call that Abiomed only recently surpassed a 10% penetration rate of its total addressable market in the U.S. Moreover, there's also considerable international growth potential. (The U.S. market accounted for 87% of the company's revenue in its most recently reported quarter.)

Abiomed would make a healthy addition to most investors' watchlists.

Check out the latest Abiomed earnings call transcript.