Check out the latest CME Group and Cboe Global Markets earnings call transcripts.

There's been a race in recent years in the financial industry, with exchanges merging and seeking to expand into new areas. CME Group (CME -0.75%) originally specialized in futures, while Cboe Global Markets (CBOE -1.81%) was once best known for its options products. Yet now, both companies have a much broader range of offerings, seeking to serve investors of all kinds.

Given the big pullback in the markets late last year, investors have looked a lot more closely at how resilient financial exchanges will be at times other than a decade-long bull market. Both companies have had to make adjustments to the current market conditions, but both are also confident in their prospects for 2019 and beyond. With that in mind, let's look to see whether CME or Cboe looks like the better buy right now.

Valuation and stock performance

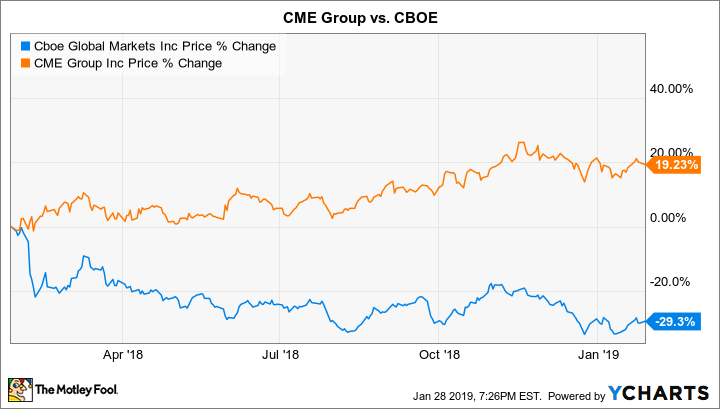

Interestingly, CME and Cboe have had almost opposite reactions to the market environment over the past year. Cboe has lagged badly, falling almost 30% since January 2018. By contrast, CME has done quite well, gaining almost 20% in the same time frame.

Turning to valuation, the main problem comparing these two companies is that they've both seen some fairly sizable one-time impacts over the past year. That's skewed trailing earnings results, so that when you concentrate purely on trailing multiples, Cboe's measure of 21 looks a lot more expensive than CME's valuation of 14 times earnings.

However, when you look forward to near-term expectations, the numbers reverse themselves. Cboe weighs in at under 20, while CME climbs above the 25 mark for its forward multiple. Even so, given the disparity in the way the share prices have moved, the two valuation numbers don't vary by nearly as much as some would expect.

Dividends

Many investors like stocks that pay substantial dividends, and unfortunately, Cboe and CME haven't chosen to prioritize returning capital to shareholders through quarterly payouts. They each do pay a dividend, but CME Group's yield of 1.5% is below the market average, and Cboe comes in even weaker with just a 1.1% yield.

Still, the two companies' dividends have grown a bit. Cboe has boosted its payouts by a total of 50% since 2015, while CME has seen its dividend triple since 2010. But on top of that, CME shareholders have also gotten special dividends of $1.75, $3.50, and $3.25 per share in 2018, 2017, and 2016, respectively. That extra payout is enough to give CME the clear lead in the dividend department.

Image source: Getty Images.

Growth prospects and risks

Both of these exchange companies have done a good job of trying to find growth opportunities, but they've also had to deal with changing market conditions. CME Group has profited from the rising popularity of futures contracts broadly, and its wide array of different products has given it some diversification. For 2018, the company reported record average daily volume of 19.2 million contracts, which was up 18% from 2017 levels. Trading in the interest rate futures markets saw the greatest gains, making up more than half of CME's total volume and rising 22% year over year. New records in the metals, foreign exchange, and options arenas also helped CME have a prosperous 2018. Now that volatile markets have given investors a reason to hedge their bets with futures, CME has an even more attractive value proposition ahead.

The big question for Cboe is whether the market downturn will result in a return to prosperity for its top product. In the third quarter of 2018, the company reported flat revenue, and more than half of the over 40% rise in net income came as a result of lower tax rates. Performance for the Cboe's proprietary Volatility Index futures contracts was poor, with average daily volume falling 28% compared with the previous year's period. Options volume was flat, but market share declined in the options market, and suffered even more dramatic slowdowns in its growth during its most recent quarter. Yet many hope that the future will be brighter for the Cboe, because the big boost in volatility during the fourth quarter should show up in the form of higher revenue and earnings to close 2018. The company still hopes to make progress toward cutting costs and spending on capital investments to boost its market reach further, and it'll be interesting to see what Cboe says about its most recent quarter when it releases its next results in February.

Which is the right pick?

It's pretty clear that CME Group has greater momentum, higher dividends, and a more consistent history of growth recently. However, if you're a growth investor looking for a catalyst to jump on board an exchange stock, now might be the perfect time to look at Cboe -- especially if you think it profited from the return of stock market volatility in the fourth quarter.