Nucor (NUE +0.18%) stock has fallen 20% over the past year and is down 30% from its early-2018 highs. That's not surprising, given that fundamentals in the steel industry have begun to weaken.

However, this could be a buying opportunity for investors looking to own a great company. Here are five charts to help explain why Nucor is an industry leader in the U.S. steel sector.

Image source: Getty Images.

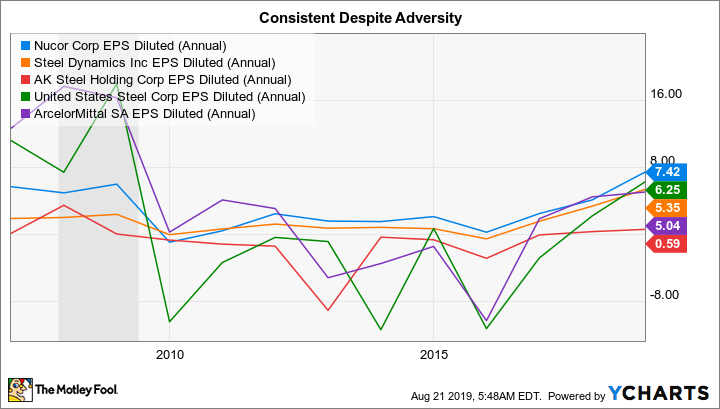

1. Impressive earnings

The steel industry is highly cyclical. The last downturn was particularly deep and long, starting around the end of the 2007 to 2009 recession and lasting until roughly 2016. It was a tough period for steel makers, as they had to contend with both relatively weak markets and an influx of cheap foreign steel. Nucor lost money in 2009, the first time in the company's history that this had occurred. It wasn't alone; peers Steel Dynamics (STLD 0.41%), United States Steel (X +0.00%), and AK Steel (AKS +0.00%) also bled red ink.

NUE EPS Diluted (Annual) data by YCharts.

What differentiates Nucor is that the first time was also the last time, at least so far. It quickly got profits back on the right track and hasn't looked back. That's a consistency that few of its peers have been able to match. In fact, U.S. Steel and AK Steel spent years in the red as they adjusted their portfolios (including shuttering and selling assets) to a changing steel industry landscape. Nucor made changes, but it was mostly buying new businesses and building new mills. Being profitable clearly made a big difference.

2. Margins matter

Although there are a number of different ways to look at margins, one graph is enough to get the point across. Even during the worst of the recent downturn, Nucor's operating margins were near the top of the U.S. steel industry. That's not a one-time thing, either; Nucor has historically had industry-leading margins. Interestingly, its closest peer on this metric, Steel Dynamics, is run by a Nucor alum.

NUE Operating Margin (TTM) data by YCharts.

Wide margins are not an accident. Nucor specifically focuses on being a low-cost provider in all of the various steel niches it serves. One key way it does that is through a unique pay structure that includes profit sharing. Essentially, employees do well when Nucor does well, and they do less well when Nucor is struggling. This allows the steel giant a payroll break when times are tough, helping to protect margins.

It also makes use of electric arc furnaces, which, to simplify things a bit, are easier to turn on and off than the older blast furnaces that underpin U.S. Steel and AK Steel's businesses. Steel Dynamics uses electric arc furnaces, just like Nucor...which shouldn't be much of a surprise given the co-founder and current CEO spent a dozen years at Nucor.

3. Financial strength

Another key differentiator for Nucor is its balance sheet, which is among the strongest in the industry.

NUE Debt-to-Equity Ratio (Quarterly) data by YCharts.

As before, there are various metrics to look at here, but a debt-to-equity comparison is enough to paint the picture. Nucor's debt-to-equity ratio of roughly 0.4 is below those of its peers. (Note that AK Steel was left off the chart above because its balance sheet is heavily leveraged and would distort the graph if included.) Again, that's not a one-time thing, since Nucor has historically sat at the low end of the industry when it comes to leverage. It provides the steel maker with the flexibility to invest through the entire cycle, notably giving it the freedom to buy assets on the cheap during sector troughs.

4. Rewarding the ones that count

The last graph for Nucor may be the most impressive, though the data really don't go back far enough to show just how incredible the story really is. Nucor has increased its dividend every single year on the chart below, which goes back to the 1980s. (The dip around the last recession is a data anomaly. Nucor didn't cut its dividend.) No other major U.S. steel maker has a streak that can match Nucor's run. In fact, the last recession forced U.S. Steel and AK Steel to materially reduce their dividends.

NUE Dividend Per Share (Annual) data by YCharts.

But Nucor's annual dividend streak goes much further back. It has increased its dividend for an incredible 46 consecutive years. That's an amazing record for any company, let alone one that operates in a highly cyclical industry like steel. To be fair, dividend growth has been fairly weak over the past decade. That's largely due to the deep downturn, but Nucor has shown a commitment to returning value to shareholders via dividends that few other companies -- and none of its closest peers -- can match.

You get the idea

Although many more charts could illustrate an article like this, the quartet above paints the picture investors need to see. Nucor is not only a well-run company, but it is a clear leader in the domestic steel space. If you want to own the best run-steel mill in America, and perhaps the world, Nucor is the name to look at. But there's one more chart to consider...

NUE Price-to-Book Value data by YCharts.

As noted in the intro, Nucor's stock price has been falling because of weakening steel industry fundamentals. Nucor is still a great and highly profitable company. But the price drop has pushed its valuation notably below the company's long-term averages. The price-to-book value chart above shows that pretty clearly. Although there could be more downside if the economy falls into a recession, Nucor looks at worst reasonably priced (more likely a little cheap) today. For investors looking at the domestic steel space, a deep dive into Nucor would be a good call. At the very least, this iconic mill should be on your wish list.