Toolmaker Stanley Black & Decker (SWK 0.90%) is spending up to $1.5 billion to acquire privately held Consolidated Aerospace Manufacturing (CAM), diving headfirst into the aerospace supply chain at a time when the industry is reeling due to Boeing's 737 MAX issues.

The move is not without risk, given the current state of the MAX, but Stanley B&D has a history of making bold acquisitions work. The company was forged in 2010, just as the U.S. economy was recovering from the Great Recession, via the merger of Stanley Tool Works and Black & Decker.

Stanley B&D has added other tool brands in the years since, notably the storied Craftsman brand from Sears Holdings, but the company of late has turned its attention to new end markets. The company bought the Nelson industrial stud welding business for $440 million and the attachments business of International Equipment Solution for $690 million, but the CAM purchase is by far the biggest move in Stanley B&D's push into new areas.

A new platform for growth

CAM is a manufacturer of specialty fasteners and components for aerospace and defense applications, generating about $375 million in revenue over the trailing twelve months. The deal creates a new platform for growth at Stanley Black & Decker, with aerospace revenue expected to go from zero in 2017 to 15% of pro forma sales this year.

The target generates about 87% of its revenue from commercial aerospace, with 9% coming from defense and the remainder from industrial applications.

Image source: Getty Images.

Stanley B&D CEO James M. Loree, on a call with investors, said that the company has been on the prowl for businesses with a global presence, strong engineering capabilities, and the potential for recurring revenue thanks to aftermarket, or spare part, sales. Aerospace parts businesses can be particularly profitable because the fasteners must meet exacting specifications and cannot be easily replicated, limiting competition and pricing pressure in many cases.

"This business has strong brands, a proven business model, deep customer relationships, and an experienced management team, which will create a pathway for profitable growth and value creation," Loree said. "We're very, very happy to have made this acquisition. It's a strategic platform. There are multitude[s] of bolt-on opportunities as well as some larger opportunities that may or may not become available over time."

The buyer did not disclose exact CAM profitability figures, but Loree said: "[I]t's a high-growth, high-margin business and has substantial EBITDA and EBITDA growth potential ahead of it."

Aerospace is flying into headwinds

The deal comes at a difficult moment for commercial aerospace suppliers, as the industry grapples with Boeing's move to shut down 737 MAX production as it awaits recertification of the plane.

In mid-January, Spirit AeroSystems, maker of the plane's fuselage and other parts, announced the layoff of 2,800 employees as it looks to cut costs and preserve cash. And earlier in the month suppliers Woodward and Hexcel announced plans to merge and create a $6.4 billion entity better able to manage through the ups and downs of the industry.

Stanley B&D did not detail how exposed CAM is to the 737 MAX, but the supplier is definitely affected. Terms of the agreement to buy CAM include $200 million held back and contingent on the 737 MAX receiving "timely" authorization to return to service and Boeing achieving certain, unspecified, production levels.

Despite its current problems, it still seems likely that Boeing will eventually be able to get the 737 MAX airborne and the plane will end up being a roaring success for the company. Airlines are expected to increase capacity by about 3.5% annually over the next 20 years, according to the International Air Transport Association, and Boeing enjoys a duopoly with Airbus that gives customers few alternatives if they need new aircraft.

Stanley Black & Decker, in doing this deal for CAM, is trying to take advantage of near-term turbulence and uncertainty on the belief that Boeing and the 737 MAX will fly high eventually. And the company has the resources to be a consolidator and aggressively add businesses to its new CAM platform should the grounding last longer than expected and suppliers become more distressed.

A powerful collection of tools

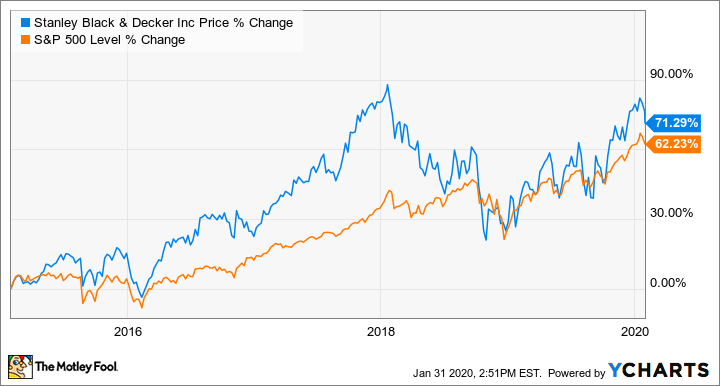

Shares of Stanley Black & Decker have outperformed the market over the past five years, but back in October, the company warned that macroeconomic headwinds including "commodity inflation, currency, and tariffs" were taking their toll. The company managed to hit its targets in the fourth quarter, but its 2020 earnings guidance midpoint was $0.10 per share below the consensus estimate.

Late last year the company announced a cost reduction program aimed at generating about $200 million in annual savings, but there is only so much that can be done with its mature tool business. Stanley B&D was a company in desperate need of new ways to generate growth, and CAM is its solution to that problem.

SWK vs. S&P 500 data by YCharts

Acquisitions are fraught with risk, especially as buyers move into new areas outside of their traditional expertise. To its credit, Stanley Black & Decker has an established track record of doing deals well, and it helps that CAM's experienced management team will be there to help build the aerospace business.

The bull case for Stanley Black & Decker heading into 2020 was that a thawing of trade tensions, coupled with stable commodity prices and the company's efforts to restructure and reboot some of its tool brands, would help drive earnings higher. With CAM coming on board, the company potentially has a new way to win. It's going to take some time to play out, but I like the direction Stanley Black & Decker is heading.