To the long list of COVID-19's business victims, you can add dividend-paying companies.

For generations, a truism of investing had been that dividend-paying companies, on average, outperform their non-dividend-paying counterparts. No longer.

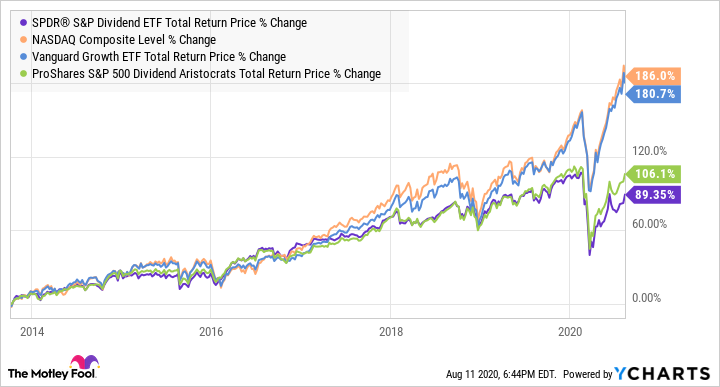

Returns from income-generating stocks have significantly lagged those of their non-dividend-paying peers this year, and there's little reason to expect that pattern to reverse itself. The chart below shows how two popular dividend-paying ETFs have performed this year against the Nasdaq, which leans toward tech and growth stocks, and a well-known growth ETF.

SDY Total Return Price data by YCharts

There's no contest. As you can see, growth-oriented stocks have crushed the dividend-focused group -- tacking on gains of more than 20% so far this year -- while the dividend funds have lost money, even when factoring in their dividends.

Image source: Getty Images.

A perfect storm

What's unique about the coronavirus pandemic is that it's been a catastrophe for some types of stocks, but a tailwind for others. By and large, the stocks getting hit hardest are dividend payers, as many of the sectors that are most vulnerable to the pandemic are cyclical industries known for paying dividends. Oil and gas companies, for example, have long been attractive to investors as high yielders. ExxonMobil (XOM -2.78%) and Chevron (CVX 0.37%) are both Dividend Aristocrats, stocks that have increased their dividend payouts every year for 25 years in a row, and are popular with income investors.

However, with the crash in oil prices, both stocks are suffering. Chevron is down about 25% this year, while Exxon has fallen around 35%, and dividend payouts at both companies are coming under serious pressure. Exxon already delayed its usual springtime dividend hike, after a loss of $1.1 billion in the second quarter, while Chevron lost $8.3 million in the same period, due to writedowns on some of its oil-and-gas properties. Both companies can borrow to fund dividends, but that strategy becomes dubious as losses mount.

The financial sector faces similar challenges, as banks like Wells Fargo (WFC -0.03%) have carved out billions in loan loss reserves in anticipation of massive defaults from the pandemic. Wells Fargo stock has tumbled 53% year to date, in addition to slashing its dividend by 80%. Additionally, other cyclical sectors, which tend to pay dividends, have been hit hard, including consumer discretionary stocks like restaurants, retail, entertainment, and travel, as well as manufacturing. A number of those companies have been forced to eliminate, cut, or pause their dividends. Even stalwarts like Disney (DIS -0.04%) have skipped dividend payments.

Meanwhile, the top-performing stocks during the pandemic hail from the tech sector, which has seen demand for products and services increase as consumers stuck at home have embraced tech tools like e-commerce, videoconferencing/streaming, and cloud computing to work from home and meet other needs effectively. Since most tech stocks don't pay dividends, that's given the non-dividend-payers an advantage this year.

The new math

While the pandemic has been particularly challenging for dividend-paying companies, the circumstances that favor growth stocks over dividend payers are likely to endure beyond the crisis.

First, interest rates are at historic lows. The Federal Funds Rates, the Federal Reserve's benchmark rate, is near zero, and the Fed doesn't expect it to move higher until at least 2022 as liquidity and low borrowing rates will be key for the economic recovery. Low interest rates favor stocks over bonds. They therefore tend to lift stock valuations as well, as investors don't demand the same level of value from stock when interest rates are low since there are fewer alternatives. The S&P 500 price-to-earnings (P/E) ratio has drifted up to 28.7, and it's likely to remain elevated even after the crisis due to a low-interest-rate environment.

There's a direct relationship between the price-to-earnings ratio and the dividend yield. Other things being equal, the higher the P/E ratio, the lower the dividend yield will be as investors are paying more for those profits and the dividend that comes from them. That favors non-dividend-payers over dividend-paying companies, as lower yields make dividends less appealing.

Tech is supreme

The biggest reason why the leadership of growth stocks is likely to endure is because tech stocks have come to dominate the market. Prior to the pandemic, the five most valuable American companies were Apple (AAPL -0.35%), Microsoft (MSFT 1.82%), Amazon (AMZN 3.43%), Alphabet (GOOG 9.96%) (GOOGL 10.22%), and Facebook (META 0.43%), and the gap between them and the rest of the market has only widened during the crisis. Of those five, only Apple and Microsoft pay dividends, and neither one offers a yield of more than 1%. At no other time in stock market history have the biggest companies returned so little to investors.

Tech stocks tend to avoid paying a dividend for a number of reasons. They often have few or no profits, or are priced at high valuations that make dividends a poor choice for returning capital to shareholders. There's an ethos in Silicon Valley that associates dividend-paying with maturity. It means your growth days are over. Steve Jobs, the co-founder and longtime CEO of Apple, famously refused to pay a dividend, saying it didn't create shareholder value. Similarly, it's hard to imagine Amazon under Jeff Bezos, who likes to say it's always Day One, paying a dividend, which seems like a distinct Day Two move.

Tech leaders tend to be visionaries, and returning profits straight to investors eliminates the potential of making needle-moving investments like a big acquisition. That's what Alphabet is seeking to do with other bets like Waymo, its autonomous vehicle division, even as it has more than $100 billion in cash and equivalents on its balance sheets.

Looking at the massive returns on stocks like Amazon, Alphabet, or Facebook, investors have little reason to complain, despite the lack of dividends. Though Facebook and Alphabet could both support average dividend yields, neither company seems likely to start paying a dividend.

A permanent change

Though the gap between dividend stocks and non-dividend-payers has widened during the pandemic, this pattern isn't new. In fact, growth stocks have outperformed dividend payers for most of the last decade, as the chart below shows.

SDY Total Return Price data by YCharts

Interest rates have been low in the U.S. since the financial crisis, and political pressure as well as the recent track record of low rates means they are likely to remain that way even long after the pandemic has ended. Meanwhile, the dominance of tech stocks in the cultural mores in the industry against paying dividends at the same time that classic dividend-paying companies like Exxon are being squeezed means that these companies have lost their favored status.

Income investors may choose to own high-yield stocks for the quarterly payouts, but the best performers will be growth stocks, including those that reinvest profits in areas that strengthen the company like new businesses, emerging technologies, and savvy acquisitions.

The tech titans have spoken. Dividend investing may not be dead, but to them, it's a thing of the past.