It's hard to describe Deere's (DE -0.14%) recent third-quarter earnings report as anything less than a "blowout." The company exceeded external and internal expectations, and the underlying development of the business suggests that the stock remains attractively priced. Let's take a look at why Deere stock remains a good value, even after rising 21% so far this year.

What happened in the quarter

The best way to see how strong the quarter was is by looking at how management adjusted its full-year revenue and earnings guidance. As you can see in the table below, there was a significant improvement in both segments' full-year revenue outlooks. As such, the agriculture and turf segment outlook is now reaching the low point of the guidance given in November -- a great result given the impact of the coronavirus pandemic on the economy.

Deere's precision agriculture technology is helping farmers be more productive. Image source: Getty Images.

In addition, the outlook for construction and forestry is better, due to what Deere's manager of investor communications, Brent Norwood, described as a "modest improvement" in the construction equipment segment and "strong" performance in road building.

|

Metric |

Full-Year Guidance, Current |

Full-Year Guidance, in May 2020 |

Full-Year Guidance, in February 2020 |

Full-Year Guidance, in November 2019 |

|---|---|---|---|---|

|

Agriculture and turf sales growth/(decrease) |

(10%) |

(15%) to (10%) |

(10%) to (5%) |

(10%) to (5%) |

|

Construction and forestry sales growth/(decrease) |

(25%) |

(40%) to (30%) |

(15%) to (10%) |

(15%) to (10%) |

|

Net income |

$2.25 billion |

$1.6 billion to $2 billion |

$2.7 billion to $3.1 billion |

$2.7 billion to $3.1 billion |

|

Net operating cash flow |

$2.8 billion |

$1.9 billion to $2.3 billion |

$3.1 billion to $3.5 billion |

$3.1 billion to $3.5 billion |

Data source: Deere presentations.

Of course, revenue is only one part of the story; it's also necessary to improve profit margin on sales. Here again, Deere did not disappoint. In fact, the margin performance in the agriculture and turf segment in the quarter was nothing short of outstanding. The agriculture and turf segment's operating profit expanded significantly even as revenue declined, with margin improvement coming down to a combination of pricing improvement and cost-cutting measures.

In fact, the company's overall pricing improvement of 4% is hugely impressive given the current environment, where farmer sentiment toward spending remains weak.

|

Equipment Segment |

Q3 Operating Profit |

YOY Change |

Q3 Revenue |

YOY Change |

Margin |

YOY Change |

|---|---|---|---|---|---|---|

|

Agriculture and turf |

$942 million |

54% |

$5,642 million |

(5%) |

16.6% |

630 bp |

|

Construction and forestry |

$205 million |

(46%) |

$2,187 million |

(28%) |

9.4% |

(310 bp) |

Data source: Deere presentations. YOY = year over year. bp = basis point; 100 basis points equals 1%.

Is Deere stock a good value?

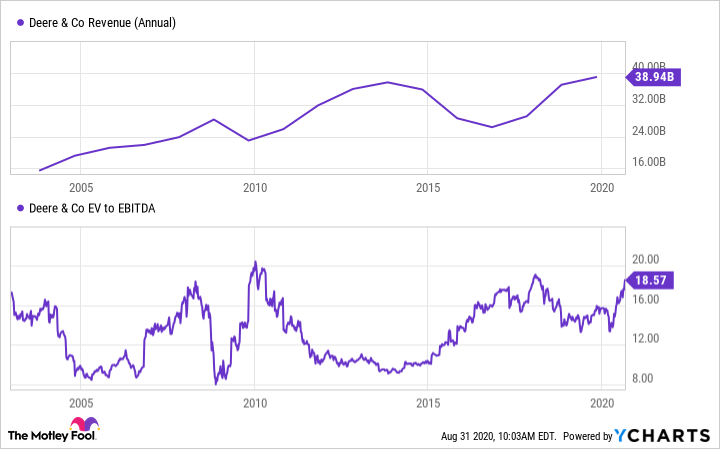

Deere is a cyclical stock, so its valuation tends to peak as its revenue hits a trough. This is perfectly rational as the market is starting to price in an upturn at the revenue trough. Similarly, Deere's valuation tends to bottom just as its cyclical revenue peaks. You can see this relationship in the chart below.

EV = enterprise value (market cap plus net debt). EBITDA = earnings before interest, taxation, depreciation, and amortization. Data by YCharts

Turning to expectations for 2020 and beyond, Wall Street analysts are expecting 2020 to mark a mini-trough in sales and earnings, with Deere's EV/EBITDA valuation hitting nearly 20. That's pretty much consistent with where Deere has traded at during previous revenue troughs in recent times.

|

Metric |

2019 |

2020 Est. |

2021 Est. |

2022 Est. |

|---|---|---|---|---|

|

Net sales |

$34,886 million |

$30,635 million |

$33,199 million |

$35,047 million |

|

EV/EBITDA |

17.7 |

19.7 |

16 |

15.4 |

Data source: Deere presentations.

There are reasons to believe Deere's sales and margin could expand on a multiyear basis:

- Take-up rates of its precision agriculture sales have been very strong, and this is showing up in improvements in pricing.

- The construction and forestry segment will surely recover from a COVID-19-induced slump, particularly as the housing market appears to be strengthening.

- Management continues to believe that an aging U.S. farm equipment fleet will bring about a replacement demand cycle when sentiment improves.

- Overall farmer sentiment in North America should improve in the coming years with a combination of a recovery from the initial impact of the trade conflict with China and the eventual receding of the coronavirus pandemic.

All told, Deere's execution has been very strong in 2020 and its end markets look likely to recover in the coming years. The stock isn't expensive on a historical valuation perspective, and provided there isn't another external shock to its revenue growth prospects, the stock remains a good long-term value option for investors.