This year has been tough for mortgage real estate investment trusts. The stocks were buffeted by volatility in the bond market during the early days of the coronavirus crisis, and the Federal Reserve had to step in and begin buying mortgage-backed securities. That provided a calming influence, and the market began to recover. Still, every mortgage REIT was forced to cut its dividend amid declines in book value per share. One of the better-performing stocks during this period was Annaly Capital Management (NLY 0.59%), and I think it's still a buy today.

Image source: Getty Images.

Mortgage REITs are different than most other REITs

It is important to understand that mortgage REITs have a fundamentally different business model than traditional REITs. Most of the usual suspects -- apartment REITs, office REITs, retail REITs -- are in the business of investing in physical real estate, and then renting it out. Essentially, they are landlords on a large scale. Mortgage REITs don't own property or charge rent. These companies buy real estate debt (i.e., mortgages) from lenders and earn interest. While traditional REITs generally trade based on dividend yields and multiples of funds from operations (FFO), mortgage REITs trade based on their dividend yield and their premium or discount to book value.

Annaly Capital is what's known as an agency mortgage REIT, which means it invests in mortgage-backed securities guaranteed by U.S. government agencies. Agency mortgage-backed securities are often the destination for your home mortgage. For example, if you got a mortgage using the Rocket Mortgage app, Rocket will not hold your mortgage as a long-term asset on its balance sheet. It will package it into a mortgage-backed security and sell it into the market. A mortgage REIT like Annaly would then buy these securities and build a portfolio of them. Annaly will then use borrowings (leverage) to fatten the returns, similar to the way margin does for a stock investor.

The discounts to book value are beginning to disappear

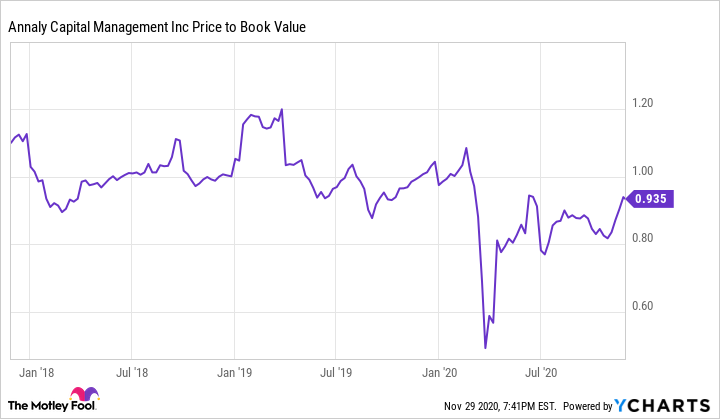

The entire mortgage REIT sector had a horrific start to the year, and nearly all of them traded at sizable discounts to book value. Since then, the mortgage REITs have been slowly erasing these discounts; however, many still exist. Below is a chart of Annaly's price to book value over time. You can see that the stock typically trades at or above book value.

NLY Price to Book Value data by YCharts

Annaly's book value per share is $8.70, which means the stock was trading at a 6.5% discount to book value at recent prices, with a 10.8% dividend yield. This works out to a potential 17% return over the next 12 months if Annaly returns to book value.

As you can see from the chart above, this sort of discount to book value was a rare event pre-pandemic. JPMorgan Chase was out with a call for a return to negative GDP growth in the first quarter of this year, based on a resurgence of COVID-19 cases and the economic fallout. If JPMorgan is correct, then many of the office REITs will still struggle with vacancies, and retail REITs might see a depressed holiday shopping season. Apartment REITs will struggle with tenants who cannot make their rent payments.

Mortgage REITs, which benefit from a stable interest rate environment, might be the most attractive sub-sector in the REIT space. Annaly has the highest dividend yield of the agency mREITs and is one of the best-run mortgage REITs out there. It's also one of my CAPS picks.