Novavax (NVAX -4.82%) represents the dream investment. At the beginning of the year, you invest in an interesting clinical-stage biotech trading at less than $5 a share. Then, in a matter of months, positive investigational product news drives its stock price up. And by the end of the year, it's the best performer in the entire market.

Novavax started 2020 at $3.98 a share. From there, it soared more than 2,700% on optimism about its potential coronavirus vaccine as well as the promise of its flu vaccine candidate. So, how much would you have now if you had invested $1,000 in Novavax in January? Let's do the math.

Image source: Getty Images.

About 252 shares

With $1,000, you would have purchased about 252 shares at the Dec. 31, 2019 closing price. Today, the stock is trading at about $116 a share. That means your investment would be worth $29,232. And if you'd locked in your gains at its August high of about $178 a share, you would have made a profit of $43,856.

Now, you might ask yourself what the chances are that Novavax could extend its steep ascent into 2021. In recent days, share prices of a number of vaccine makers have slid. Investors are worried about whether current vaccines and vaccine candidates will protect against a new COVID-19 variant that has been detected in the U.K. Moderna (MRNA -2.45%) and Pfizer (PFE -3.85%), both authorized to sell their vaccines in the U.S., are optimistic. And they've started new studies to confirm the effectiveness of their inoculations against the mutated strain, according to press reports. If those studies' results are positive, coronavirus vaccine stocks should bounce back. Pfizer and Moderna have both said they expect their vaccines to be effective against various strains, including the latest one.

Beyond this near-term issue, Novavax has plenty of share-price catalysts to come.

In September, the company launched a U.K.-based phase 3 trial for its coronavirus vaccine candidate. It expects to be able to report interim results from that study early in the first quarter of 2021. Those results could support its requests for emergency use authorizations from various countries' healthcare regulators. If Novavax follows a timeline similar to those of Moderna and Pfizer, it may make those EUA requests in the first quarter. That could lead to marketing authorization in the weeks to follow.

This week, Novavax announced the start of a second phase 3 trial for its investigational coronavirus vaccine. This trial is based in the U.S. and will enroll as many as 30,000 participants.

Novavax also is preparing to request FDA approval for NanoFlu, its investigational flu vaccine. NanoFlu this year met all primary endpoints in a pivotal clinical trial, so it's reasonable to be optimistic about its chances.

Reason for long-term gains

If Novavax gets emergency use authorization for its coronavirus vaccine candidate or a standard regulatory approval for NanoFlu, its shares are likely to jump immediately. But beyond those two catalysts, there are reasons to expect a longer-term share price climb. Right now, Novavax doesn't have any product revenue. So, two products reaching the commercialization stage in a short period of time would be a big deal.

But Novavax is also exploring the possibility of combining its flu and coronavirus vaccines into a single shot. This could be a game-changer for two reasons. First, it means fewer jabs. Most people would prefer getting one shot instead of more. Second, for doctors and healthcare systems, a combination shot would streamline the process of administering the vaccines -- from transport and storage to inoculation. Still, we should keep in mind that this is a long way off. The company hasn't offered a timeline, but in October Novavax announced its "exploration" of such a vaccine. That means it still must develop a candidate and take it through preclinical and clinical trials. Under a traditional timeline, this could take years.

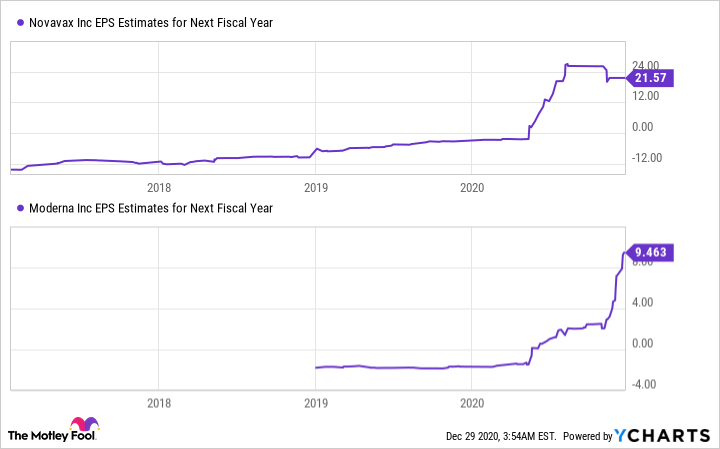

Novavax's forward earnings per share estimate for the next fiscal year is $21.57. That's more than double that of rival Moderna. If Novavax indeed reaches that level or higher -- and surpasses peers -- positive stock performance is likely to follow.

NVAX EPS Estimates for Next Fiscal Year data by YCharts

So, there are certainly elements that could drive Novavax shares higher in the coming year -- adding to 2020's gains. While that's exciting, keep in mind that the stock remains risky.

Novavax's share-price performance in the coming year will depend on the results from its coronavirus vaccine studies. Anything can happen in clinical trials -- and many drugs and vaccines don't pass muster in the final stages. Bad news on that front could send Novavax stock plunging. This biotech stock offers the potential for additional great gains, but also the potential for significant losses. You should only invest in it -- or hold onto your current position -- if you're comfortable with that idea.