Shares of Moderna (MRNA 0.61%) and Abbott Laboratories (ABT 0.45%) both climbed last year due to the companies' potential to combat the coronavirus. Moderna, developer of one of the first coronavirus vaccines, soared more than 400%. Investors bet on the then-clinical stage company and the possibility of it launching its very first product. Abbott, a leader in COVID-19 testing, advanced 26%. Here, investors bet the company would benefit from a growing need for coronavirus testing.

Now, revenue is on the horizon for Moderna and quickly growing at Abbott. Let's take a closer look at why 2021 may be another winning year for these two healthcare companies -- and their shareholders.

Image source: Getty Images.

In December, the U.S. Food and Drug Administration (FDA) granted Moderna Emergency Use Authorization (EUA) for its investigational coronavirus vaccine. Canada followed later in the month. Today, the European Commission authorized Moderna's vaccine for use in the European Union.

125 million vaccine doses

In an update last month, Moderna said it aims to produce as many as 125 million doses for use worldwide in the first quarter. So, investors should expect to see product revenue in the biotech's first-quarter earnings report. Let's make a quick estimate. If Moderna delivers only half the promised number of doses and charges the $15 price paid by the U.S., that amounts to $930 million in product revenue. Nearly $1 billion in a quarter is a big deal for a company that, until this time, didn't have product revenue.

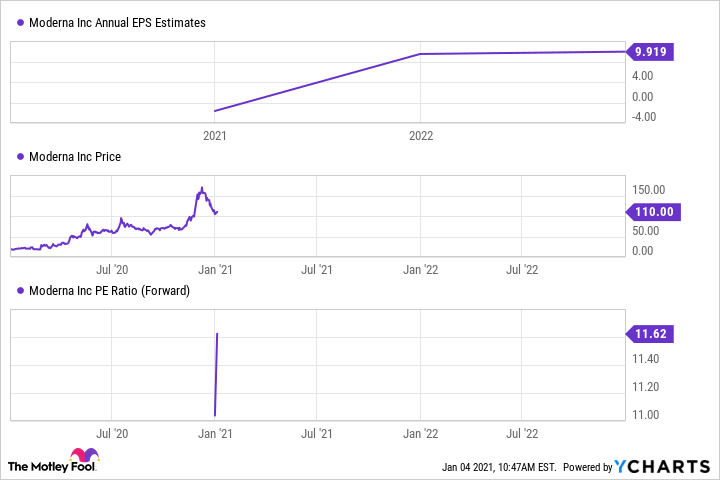

Looking ahead, the annual earnings per share (EPS) estimate is more than $9.91. At the current share price, that gives Moderna a valuation of about 11 times forward earnings.

MRNA Annual EPS Estimates data by YCharts. P/E = price-to-earnings.

What this means is that Moderna shares aren't expensive, in spite of last year's gain. By comparison, Pfizer (PFE 0.53%), maker of the coronavirus vaccine authorized days before Moderna's, is trading at more than 23 times earnings.

You might wonder if competition may get in the way of Moderna's earnings prospects. Considering the global need for a vaccine, this isn't likely. Even if Moderna, Pfizer, and close rivals all produce at full capacity, demand won't be met. So, there should be plenty of revenue opportunities for each player. And President-elect Joe Biden plans to make vaccination a priority.

Now, let's turn our attention to Abbott. First of all, Abbott doesn't depend solely on its COVID-19 tests for revenue. The company has four businesses: nutrition, diagnostics, pharmaceuticals, and medical devices. Together, those units generated nearly $9 billion in sales in the most recent quarter. And annual profit has climbed for the past two years. So, with or without coronavirus testing, Abbott is thriving.

An at-home test

But its strength in COVID-19 tests will surely give revenue an extra boost in the months to come. The FDA has granted Abbott EUAs for eight coronavirus tests. The most recent is the BinaxNOW for at-home use. The FDA earlier authorized its BinaxNOW rapid test for professional use. Support from Washington is also a positive for Abbott. Along with vaccination, Biden is making testing a key element in the plan to conquer the coronavirus pandemic.

Revenue from Abbott's COVID-19 tests has climbed from quarter to quarter -- to $881 million in the third quarter, from $615 million in the second. But these figures only include a few weeks of BinaxNOW for professionals sales. Abbott said it plans to ship 30 million of the at-home version of the test in the first quarter and 90 million in the second quarter.

With Abbott ramping up production of the BinaxNOW tests, it's clear the biggest gains in testing revenue are yet to come. Like Moderna, Abbott shares aren't expensive considering future earnings. Abbott's EPS estimates continue to climb -- and its forward price-to-earnings ratio has declined.

ABT Annual EPS Estimates data by YCharts

Last year, investors imagined the roles Moderna and Abbott might play in the fight against coronavirus. Now, things are taking shape. This year, product orders and revenue clearly will be the catalysts for Moderna and Abbott share performance. And with the U.S. favoring testing and vaccination, it's likely these healthcare companies will post another winning year.