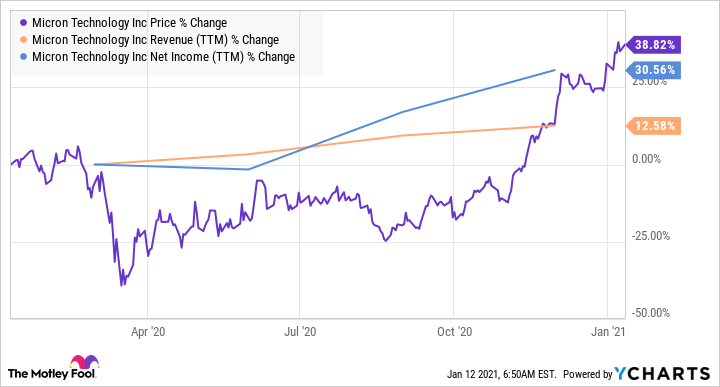

Micron Technology (MU -0.18%) was struggling a year ago thanks to unfavorable demand-supply conditions in the memory market, but the outbreak of COVID-19 and the economic disruptions it caused ended up being a boost the chipmaker's business as the year progressed.

Supply chains were disrupted by the pandemic, and the demand for memory chips in data centers and computers increased at the same time. This created an ideal situation for Micron Technology to thrive in.

As a result, the chipmaker's results improved consistently throughout the year and it ended fiscal 2020 on a solid note. The good news for Micron's investors is that it could raise its game in fiscal 2021 as well, as evident from its recent results that led to a spate of analyst upgrades.

Micron started the new year with a bang...

Micron recently released results for the first quarter of fiscal 2021, which ended on Dec. 3, 2020. Its revenue rose 12% year over year to $5.77 billion, which comfortably beat the Wall Street estimate of $5.66 billion. Its earnings jumped from $0.48 per share in the prior-year period to $0.78 per share last quarter, again beating the $0.69-per-share consensus estimate.

More importantly, Micron's margins improved substantially during the quarter, which points toward an improved pricing environment. The company's non-GAAP (adjusted) gross margin increased to 30.9% during the quarter as compared to 27.3% in the year-ago period. The non-GAAP operating income increased to 16.9% from 11.5% a year ago, as Micron's operating expenses remained flat year over year at $811 million.

Micron's outlook for the second quarter of fiscal 2021 indicates that its terrific momentum is all set to continue. It anticipates $0.75 per share in earnings during the quarter on revenue of $5.8 billion. Non-GAAP gross margin is expected at 31% during the quarter. Micron had delivered non-GAAP gross margin of 29.1% in the same period last year along with earnings of $0.45 per share. It had posted $4.8 billion in revenue, which means that the company's revenue is on track to increase 20% year over year in the current quarter.

So, Micron's top and bottom lines are all set to switch into a higher gear, and the company is likely to sustain its momentum for a long time to come.

Image source: Getty Images.

...and it won't run out of steam anytime soon

Micron's terrific quarterly results and guidance have prompted a series of price-target upgrades. Of the 29 analysts who have a buy or overweight rating on Micron stock, 22 have raised their price targets. The stock now has an average price target of just over $97, which translates into an upside of more than 20% from current levels.

However, don't be surprised to see Micron deliver stronger-than-expected gains in the future, thanks to a bunch of solid catalysts driving the DRAM (dynamic random access memory) market. In 2021, Micron expects the DRAM industry's bit demand to increase by a percentage in the high teens, while supply is expected to grow at a slower pace. This bodes well for Micron, as DRAM produced 70% of its revenue last quarter.

The DRAM market is sitting on several lucrative catalysts, such as 5G smartphones, personal computers, graphics cards, and cloud computing. For instance, 5G smartphones are using more memory than their 4G predecessors, and 5G phone shipments are expected to jump from an estimated 300 million units last year to 500 million units in 2021.

The data center market is turning out to be another tailwind for the DRAM market, because operators are using bigger memory chips now, according to Micron's management. Meanwhile, memory chips used in graphics cards are also in short supply because of overwhelming demand. All of this indicates that the price of DRAM is likely to increase in 2021.

TrendForce estimates that the price of DRAM will be slightly up in the first quarter of 2021, following a decline of 8% to 13% in the final quarter of 2020. As DRAM accounts for most of Micron's business, the upswing in this market will positively affect the company's financial performance. According to analyst estimates, Micron's revenue could rise by 13.8% in fiscal 2021, followed by a much stronger increase of 25.4% in fiscal 2022.

Throw in an improving margin profile, and it's not surprising to see that Micron's earnings are expected to increase to $7.30 per share in the next fiscal year, as compared to $2.83 per share in fiscal 2020. This sharp jump expected in earnings makes Micron an ideal bet for investors looking to buy a growth stock without paying through the nose, as the stock trades at 20 times forward earnings, which is lower than the NASDAQ-100 Technology Sector Index's price-to-earnings ratio of over 31.