Investors have a wide range of attractive growth options to choose from in the restaurant and prepared foods niches. Those areas are proven winners, whether it's through fast-food service or the marketing of packaged food products. Just look at the long-term earnings generation of companies like PepsiCo and McDonald's for a taste of what's possible in this arena.

Today, we're looking at a few companies that hope to follow in those big footsteps. Both Beyond Meat (BYND 4.62%) and Domino's Pizza (DPZ 1.45%) have delivered market-thumping growth in the past few years.

But which one is the right investment to buy now? Let's dive right in.

Image source: Getty Images.

Growth matchup

An investment in Domino's would be focused on achieving modest but persistent market share growth in a proven global industry. The fast-food pizza industry has expanded through most selling environments in the last several years, and Domino's consistently added to its dominant lead over that time. Its share of the U.S. home delivery niche rose to 63% in 2020 from 61% a year earlier. And that metric sat at 56% five years ago. Those gains have helped the chain boost annual sales to over $4 billion last year compared to $2.2 billion in 2016.

Buying Beyond Meat, on the other hand, is far more about securing growth potential than owning an established market leader. Sure, the plant-based meat specialist logged a 37% sales spike in the past year. But its annual revenue is still just $400 million, or a small fraction of Domino's haul.

Recent distribution agreements with giants like McDonald's and PepsiCo have investors predicting accelerating growth well into the future, with revenue expected to rise 40% in 2021 and nearly 50% next year. Domino's is targeting mid-single-digit gains over that time.

Price is what you pay

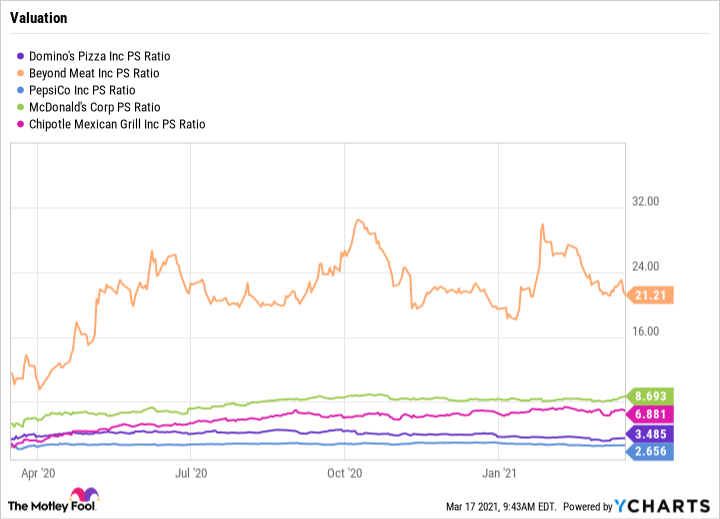

There's no denying that you have to pay a premium for that brighter growth outlook. Beyond Meat is valued at nearly $9 billion, or over 20 times its latest annual sales result. You'd have to pay just 3.5 times sales, or $14 billion, for Domino's.

That's even cheap compared to other successful fast-food giants including Chipotle Mexican Grill and McDonald's.

DPZ PS Ratio data by YCharts

Besides valuation, the other major risk to picking Beyond Meat over Domino's is the potential that growth will fall short of expectations. Even a bad year for the pizza leader could still translate into significant sales and earnings growth. Its efficient operating model means its stores can produce tons of cash flow without requiring huge delivery volumes.

But Beyond Meat could underperform investors' high expectations in several ways over the next few years. These include competitive introductions from rivals like Impossible Foods or other companies, from Kroger to Tyson Foods, that are busy crafting their own plant-based products. The company might stumble in a major product launch or strike an unfavorable distribution deal that limits its potential in a key time for the industry, too.

Value is what you get

These differences all make Beyond Meat a stock for investors with higher risk appetites. If you can accept volatile price swings, including some likely significant declines, as a trade-off for a chance at supercharged returns, then this growth stock will appeal to you.

If you're more interested in proven brands, proven markets, and established growth and earnings track records, then Domino's is your stock. Not only is this business likely to enjoy much higher global sales a decade from now, but it's also a relative steal at less than four times annual sales today.