What happened

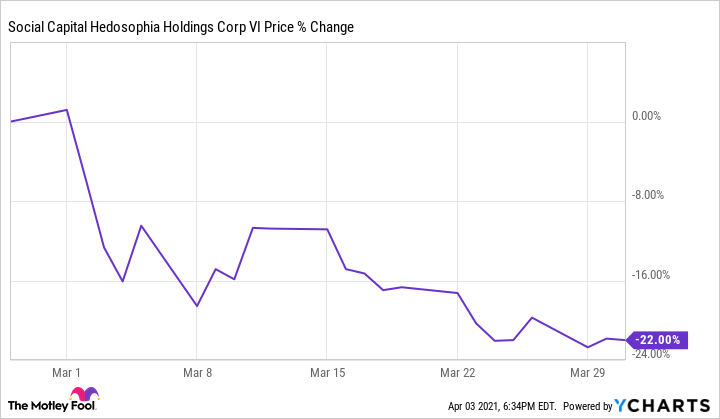

Shares of Social Capital Hedosophia VI (IPOF) slumped 22% in March, according to data from S&P Global Market Intelligence. The special purpose acquisition company (SPAC) led by venture capitalist Chamath Palihapitiya saw its stock sell off in conjunction with the broader pullback for growth-dependent technology stocks that hit the market last month.

Palihapitiya's Social Capital Hedosophia has been using SPACs to take companies public over the last year, and success for its mergers has meant that many investors are keeping a close eye on its spinoff units. The Social Capital Hedosophia VI company has yet to announce its merger target, but the market's waning appetite for growth-dependent tech stocks was enough to drive a substantial sell-off for the SPAC stock last month.

Image source: Getty Images.

So what

Some SPAC stocks have posted explosive gains following the announcement of merger plans or after mergers have taken place and the target company is brought public. However, investors who buy SPAC stocks before any acquisition plans have been announced typically won't have any insight into the actual business they'll own a stake in following a merger. So, while many SPACs have posted big gains, buying these stocks prior to any substantive information about their acquisition plans is closer to gambling than investing.

Now what

Social Capital Hedosophia VI stock has inched higher early in April's trading. The company's share price is up roughly 0.8% in the month so far.

Social Capital Hedosophia Holdings VI has roughly $1 billion in funds to deploy for acquisition and business-funding purposes. Palihapitiya has an impressive track record in the SPAC space so far, but backing the stock right now is basically a low-visibility bet that he'll be able to deliver another winner.