Bang! Went the gavel at Sotheby's auction house on May 18, 2017. It was a historic night. Untitled, a painting by Jean-Michel Basquiat, had just sold for $110.5 million -- a new record for the most expensive artwork by an American artist.

The COVID-19 pandemic dampened fine art sales, but the industry is coming back. Just two weeks ago, a lesser-known Basquiat painting, Warrior, sold for $41.9 million. Fine art has been a reliable asset class for centuries. Limited supply is a powerful thing. And in the minds of many, the best works are priceless.

In fact, buying the best of any asset class tends to be a home run. In January, a Mickey Mantle baseball rookie card sold for a staggering $5.2 million. First-edition Pokémon cards from the late 1990s have seen their values surge -- with some up tenfold in the last few years. In late 2020, a first-edition holographic Charizard Pokémon card in mint condition sold for $360,000.

Additionally, the rise of non-fungible tokens (NFTs), which prove ownership of a digital asset, in the form of LeBron James highlights or Jack Dorsey's first-ever tweet, have spurred a new form of collecting.

Bitcoin has emerged as the best in its asset class, too. Its meteoric gains eclipse rival cryptocurrencies' in a similar fashion to top-tier works of art and trading cards.

Investing in the best in breed of any asset class can be a noble endeavor. But the consequences for picking wrong can be catastrophic. Cryptocurrency, fine art, and trading cards are interesting investment choices, but are inherently riskier than buying stocks.

Here's why stocks are the best asset class for predicting future value and driving long-term wealth.

Image source: Getty Images.

Publicly traded companies surround our everyday lives

Behind every stock is a company. We encounter many of these companies on a daily basis. While it may be hard to understand an industry you're unfamiliar with, it's easy to see that long lines at Chipotle Mexican Grill are a tell-tale sign business is doing well.

Walt Disney (DIS -0.49%) is one of the most relatable recent examples. While the pandemic plummeted park and studio entertainment revenue, tens of millions of folks subscribed to Disney+. Whether it was entertaining kids stuck at home or catching the latest episodes of The Mandalorian, the rise of Disney+ in 2020 was a trend that was fairly easy to see coming. The results speak for themselves: Shares of Disney have doubled over the last year and are now within striking distance of an all-time high.

Disney isn't the only example. Far from it. You may be reading this article on an Apple device, or one produced by Alphabet's Google. I wrote this article using Microsoft Word. There's also a good chance you passed by a McDonald's or Starbucks today. Cleaned dishes or did laundry with Procter & Gamble products. Adjusted the temperature of your house with a Honeywell thermostat. Bank with JPMorgan Chase. Receive packages from FedEx. End your night watching Netflix.

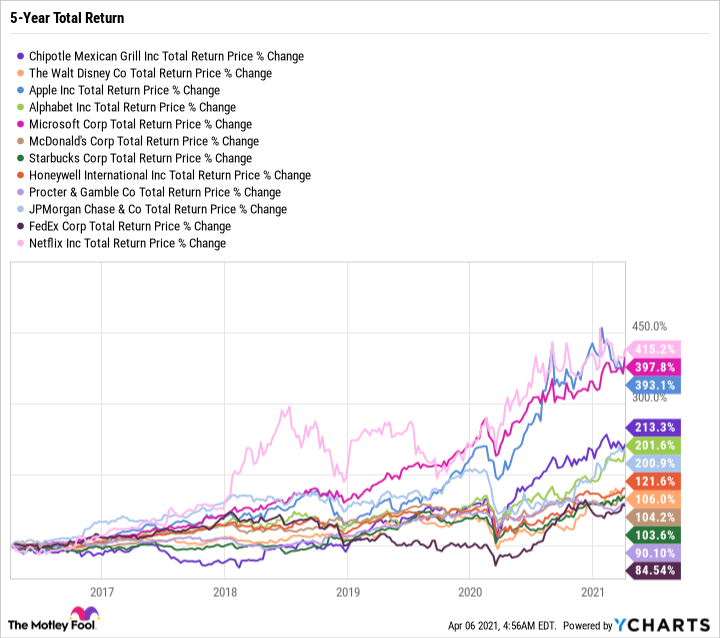

The list goes on and on. Here's how those companies performed over the last five years.

CMG Total Return Price data by YCharts

Stocks are liquid assets

One of the biggest advantages that stocks have over other asset classes is liquidity. Not only is it difficult to choose the right art to invest in, you also have to maintain the quality of the art, possibly pay for insurance, and protect against theft. Art can be hard to sell, and prices can vary wildly.

The same goes for trading cards. Bend, or so much as smudge, a prized card and the value may decrease by 90%.

Stocks are the opposite. There's a narrow spread between the bid and the ask price.

The beauty of the stock market is that folks like you and me can become partial owners in businesses that we like and believe will be successful for years to come. While some of our favorite companies may be expensive buys, there are ways to make them more affordable. Fractional shares make it easier to purchase a stake in high nominally priced stocks like Amazon.

Additionally, many brokerages now offer free online trading, when just a decade ago, fees could be as high as $10 per transaction. Turning stocks into cash or cash into stocks is now effortless and free.

One of the biggest trends over the last year has been a surge in housing prices. While having a home appreciate in value can be nice, selling also means finding a new place to live. The hassle of moving and piles of paperwork can be a strain, not to mention your family may not be keen on jumping around from city to city in pursuit of a quick buck.

Securities that invest in real estate such as a real estate investment trust (REIT) are a much more liquid alternative. REITs offer similar advantages to stocks.

Image source: Getty Images.

Investing with confidence

Many of us follow sports and even watch our favorite teams regularly. But do we win our fantasy leagues every year? Or really know if a rookie Magic Johnson card is more valuable than a rookie Larry Bird? Hard to say. We may appreciate fine art, but it doesn't pervade our daily lives like many companies do. And what edge do we have over professional collectors who attend galleries on a weekly basis?

Since we are familiar with many companies and can see their success unfolding right before us, it's easier to be confident that they will continue to be useful and valuable 10 years from now.

Peter Lynch, one of my favorite investors of all time, believed that folks without a finance or accounting background can make money in the stock market by simply investing in businesses they understand. You could have never owned stock in your life and still have an edge over Wall Street by investing in an industry you know and love.

Investing in a business you understand inspires confidence. So does the long-term track record of U.S. stocks, which is better than bonds, cash, commodities, global markets, and currency. The S&P 500 is chock-full of losers, yet has averaged a return of roughly 7.5% over the long term.

Image source: Getty Images.

It's OK to be late

Some of the market's biggest winners have been household names for years if not decades. If you had bought $3,000 worth of Netflix (NFLX -0.61%) stock in 2005, it would be valued at over $1 million today. But Netflix's success wasn't so obvious back then.

Digital streaming began taking form in 2007. By 2010, Netflix was a household name. The stock has gone up over 60-fold since then. Still, digital streaming was largely unproven and there were questions surrounding Netflix's global rollout.

What about if you had invested in Netflix in 2015? It may surprise you to hear that investing $1,000 in Netflix at the start of 2015 would have turned into over $5,000 today.

For years, there was doubt that any U.S. corporation could be valued at over $1 trillion. Today, there are more than four, including Apple being worth over $2 trillion dollars.

Winners keep on winning, and many of them are hiding in plain sight.