Desktop Metal (DM -1.27%) is slated to report its second-quarter 2021 results after the market close on Wednesday, Aug. 11. An analyst conference call is scheduled for the same day at 4:30 p.m. EDT.

This will be the 3D printing company's third quarterly report since going public in December 2020 via a reverse merger with a special purpose acquisition company (SPAC).

Investors will probably be approaching the report on a mixed note. On the positive side, 3D Systems on Monday released Q2 results that beat Wall Street expectations on both the top and bottom lines, and Stratasys did the same last week. The better-than-expected results for these two larger 3D printing companies suggest that conditions in the overall industry are improving. (That said, investors should keep in mind these are long-established companies, while Desktop Metal was founded in 2015.)

On the other hand, many investors are probably thinking this release will be a repeat of last quarter's release in a way they weren't happy about. In the first quarter, management didn't provide organic revenue growth, just total revenue growth, which includes contributions from acquisitions. Without such a metric, investors won't know how the company's core metals business performed.

In 2021 to date (Aug. 9), Desktop Metal stock is down 46.2%. 3D Systems and Stratasys stocks are up 171% and 5.8%, respectively, while the S&P 500 has returned 19% so far this year.

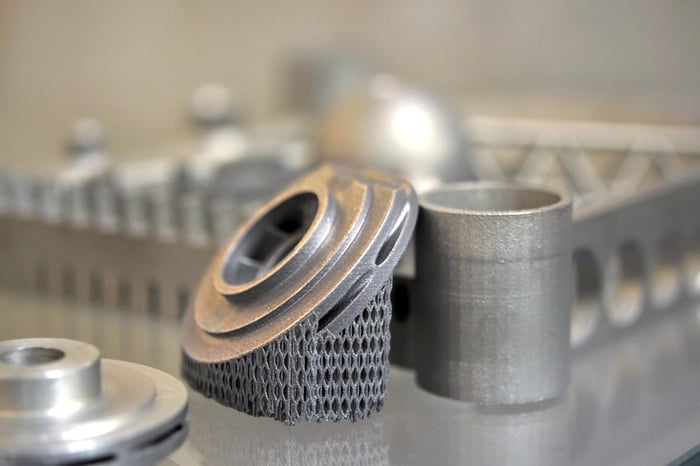

Image source: Getty Images.

Key numbers

Below are Wall Street's estimates and the company's results for the prior quarter to use as benchmarks. (Such a chart would typically provide year-ago results rather than prior-quarter ones, but Desktop Metal wasn't publicly traded at that time.)

|

Metric |

Q1 2021 Result |

Q2 2021 Wall Street Consensus Estimate |

Projected Sequential Change |

|---|---|---|---|

|

Revenue |

$11.3 million |

$19.1 million |

41% |

|

Adjusted earnings per share (EPS) |

$0.03 |

($0.09) | N/A. Result expected to flip to negative from positive. |

Data sources: Desktop Metal and Yahoo! Finance.

Second-quarter revenue will include a full quarter of contribution from Germany-based EnvisionTec, which Desktop Metal acquired in February. This acquisition expanded the company's 3D printing materials capabilities into categories beyond metals, including polymers and ceramics. It also launched the company into the bioprinting space.

In addition, Adaptive3D will contribute to the company's Q2 revenue. In mid-May, Desktop announced it had acquired this Texas-based company, which it described in its first-quarter earnings release as "a category leader in printable elastomers."

For some context, in the first quarter, the company's revenue surged 234% year over year to $11.3 million. This result -- which also included a contribution from EnvisionTec -- was 35% higher than in the prior quarter, the fourth quarter of 2020.

Adjusted for one-time items, Q1 net income was $7 million, or $0.03 per share, up from a loss of $20.4 million, or $0.13 per share, in the year-ago period.

P-50 launch status

CEO Ric Fulop said on last quarter's earnings call in mid-May that the company was on track to begin shipping its speedy flagship Production System P-50, which uses binder jetting technology, in the second half of this year.

Investors will probably not take well to the date of the rollout of this metal 3D printing system being pushed back.

2021 guidance

Last quarter, management reiterated the full-year outlook it had previously issued. For 2021, it expects revenue of over $100 million. It also projects it will exit the year with an annualized revenue run rate of $160 million.

Of course, any changes to this guidance either up or down could move the stock in the same direction.