Both Home Depot (HD 0.27%) and Lowe's (LOW 0.49%) recently reported their second-quarter financial results to mixed Wall Street reactions. It was uncertain how these companies would perform in their first comparison to the surge in demand last year, but some key data points stood out.

While on the surface these giant home-improvement retailers might appear similar, there is a very important difference that makes Home Depot the higher-quality business between the two. Read on to see what this difference is.

Image source: Getty Images.

Stocks respond differently

During Q2, Home Depot's same-store sales (or comps) rose a healthy 4.5% year over year. However, this underperformed Wall Street's estimates, and the stock price fell 4% on the news. Lowe's, on the other hand, saw a 1.6% decrease in comps compared to Q2 2020. But because management raised the full-year sales outlook, the stock price popped 10% the day after Lowe's announced results.

Mind you, both of these companies are coming off massive demand spikes when the pandemic first took hold of the economy. Consumers increasingly focused their attention and dollars on renovation projects last summer. So, regardless of the market's negative reaction, this makes Home Depot's gain that much more impressive. It was able to continue expanding comps against a difficult comparison, and that helps to explain a significant advantage the Atlanta-based retailer has versus its smaller rival.

Catering to professionals

Compared to Home Depot, which generates 45% of its revenue from professional (or Pro) customers, Lowe's derives a much smaller (approximately 25%) percentage of its sales from this highly sought-after group. Pro customers are stickier and spend more, so this has major implications for the fundamental performances of these large-cap businesses.

During the depths of the pandemic, people held off on bigger renovation projects because they didn't want outsiders inside their homes. This was obviously a boon for Home Depot, but more so for Lowe's since do-it-yourself (DIY) customers account for a larger share of its business.

Things have changed over the last six months for the industry. "We've seen our Pro business strengthen for several quarters in a row with the last two quarters where the Pro outperformed the DIY customers for the first time since the pandemic started," Home Depot CEO Craig Menear said on the Q2 earnings call. It appears as though consumers are now ready to take on more complex home-improvement projects that were put on hold, which will clearly boost Home Depot's prospects more than Lowe's as the economy tries to move past the ongoing pandemic.

In addition to the previously mentioned positive comps, Home Depot had strong results in some other key retail metrics. While transaction counts were down year over year for both businesses, Lowe's experienced more than double the percentage fall that Home Depot did. And the growth in big-ticket purchases (those over $1,000) at Home Depot grew 24%, again demonstrating the comeback of the Pro customer.

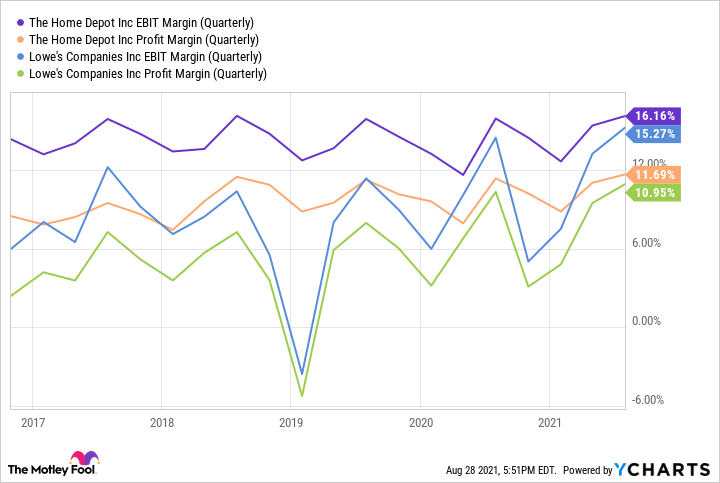

Having more of its business dependent on professionals has also resulted in higher margins for Home Depot, which leads to greater profitability.

HD EBIT Margin (Quarterly) data by YCharts

In the most recent quarter, Home Depot's operating margin and net income margin were 16.2% and 11.7%, respectively. With the business doing greater than $41 billion in revenue over the last three months, seemingly tiny margin improvements can have profound impacts on profit generation.

Some final words

Lowe's management definitely sees how critical the Pro customer is in the home-improvement industry, and the company is making great strides to catch up to Home Depot. "Every day, we are striving to demonstrate that Lowe's is the new home for Pros," Joe McFarland, executive vice president of stores, boldly claimed during the Q2 earnings call. Even with this initiative in place, Lowe's still trails Home Depot by a wide margin.

Home Depot is the better business, and unsurprisingly trades at a higher price-to-earnings ratio than Lowe's. Investors can take their pick depending on what they prioritize -- quality or value. But one thing is certain: Watching these two heavyweights battle it out in the next several years will be very interesting for shareholders.