The Labor Day sales may be over, but that doesn't mean your chance to bargain hunt is done -- at least in the world of stock market investing. Opportunities don't just happen on a given date. Instead, they're around us constantly. But it's up to us to find them.

In my latest treasure hunt, I've come up with three healthcare stocks that have slumped this year but have simultaneously delivered strong revenue. Even better, their future prospects are bright. So right now in September, it's a great moment to pick up shares of these players. Let's take a look at each one.

Image source: Getty Images.

1. Teladoc Health

Teladoc Health (TDOC 4.18%) provides virtual medical visits in more than 450 specialties. The service offers 24/7 access to online appointments with doctors and nurses.

The company's acquisition of Livongo last year helped it step up its game in chronic-illness management. Now, more than 20% of chronic-care members are enrolled in multiple Teladoc programs. That's up from 6% a year earlier, which is key because more than 40% of adult Americans suffer from more than one chronic condition.

The coronavirus pandemic offered Teladoc a huge boost last year. People eager to avoid medical offices flocked to online appointments. That movement didn't slow down, even as coronavirus cases declined earlier this year. In fact, Teladoc reported revenue increases of 151% and 109% for the first and second quarters, respectively.

At the same time, Teladoc's share price has dropped about 30% so far this year, even though annual revenue has been growing steadily and topped $1 billion last year. The company isn't yet profitable, but I expect consumers' interest in telehealth and Teladoc's investments in growth will help it get there.

TDOC Revenue (Annual) data by YCharts.

2. Vertex Pharmaceuticals

Vertex Pharmaceuticals' (VRTX 1.69%) share price just hasn't been the same since the company announced two failures in its alpha-1 antitrypsin deficiency (AATD) program. AATD is a genetic disease that impacts the liver and lungs. The first disappointment came in a clinical trial back in October, and the second came eight months later.

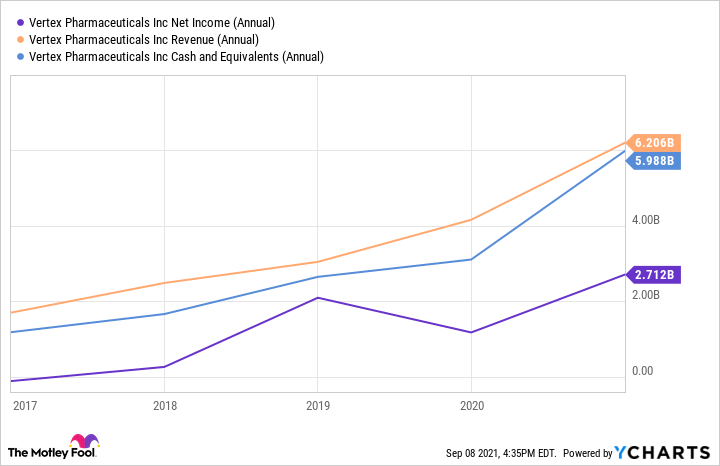

These days, shares are trading at 25 times trailing-12-month earnings. That's down from about 50 from 1-1/2 years ago -- before the AATD news. At the same time, revenue, net income, and cash all have been on the rise.

VRTX Net Income (Annual) data by YCharts.

Vertex's global leadership in cystic fibrosis (CF) treatment is the reason behind the bright financial picture. And the company expects that leadership to last until at least the late 2030s.

So why did investors sanction the company so severely after the AATD failures? In spite of Vertex's CF strength, investors want the company to successfully expand into other treatment areas, and that may be on the horizon. Vertex has the cash to invest if it decides to buy a late-stage program.

Otherwise, it's reported positive clinical trial data on its gene-editing therapy for blood disorders. If all goes well, it may file for regulatory approval for this game-changing treatment in the coming 18 to 24 months.

3. Seagen

Seagen (SGEN) shares have slipped 13% so far this year. And they're trading only a few dollars higher than Wall Street's lowest 12-month share-price forecast.

Meanwhile, the oncology company has steadily reported good news for quite some time. It all started with the regulatory approval of Padcev, a treatment for the most common form of bladder cancer, in late 2019. Then the U.S. Food and Drug Administration (FDA) approved Tukysa, Seagen's breast cancer drug, only four months later.

More recently, the FDA approved a new indication for Padcev. This allows the treatment to be used for a wider set of bladder cancer patients. And in April, the FDA granted Seagen's tisotumab vedotin -- a candidate for cervical cancer treatment -- priority review. A regulatory decision is expected by Oct. 10. If the FDA gives the candidate a nod, this will be Seagen's third product approval in less than two years.

How are these products doing commercially? The company recently reported record quarterly sales for Padcev, Tukysa, and its older drug, Adcetris, for Hodgkin lymphoma.

Seagen is just at the beginning of its growth story. Getting in on it at this stage -- and at the current price -- sounds like a great idea to me.