Investors who bet on the right coronavirus vaccine stocks a year ago quickly reaped rewards. And I think there will be more to come. Governments are placing future orders. That makes revenue -- and in some cases, profit -- recurrent. A perfect reason for the share prices to move higher. But vaccine stocks probably won't be the only area in the coronavirus space to generate great returns for investors.

Another coronavirus investing trend has arrived. And like vaccines, it may be long-lasting. Let's take a close look at the area smart investors are watching right now.

Image source: Getty Images.

Regeneron, Lilly, and Vir

I'm talking about coronavirus treatment stocks. First, monoclonal antibody treatments. The U.S. Food and Drug Administration has authorized such treatments by Regeneron (REGN -0.49%), Eli Lilly (LLY 1.05%), and Vir Biotechnology (VIR 5.96%). In fact, it gave the nod to Regeneron and Lilly late last year. So, these therapies aren't exactly new to the market.

However, they got a bit of a rough start. At the time, all of these treatments required infusion. (Regeneron's treatment now can be administered subcutaneously as well.) In some cases, healthcare facilities didn't have the resources to set up special infusion centers. And in other cases, potential patients didn't feel sick enough to go for treatment.

There are a few reasons why that's no longer the situation. First, researchers have collected more and more data on the effectiveness of antibody treatments. At the same time, the delta variant emerged. It's so highly transmissible that it's even caused breakthrough infections in fully vaccinated individuals. And that has prompted more and more people to opt for antibody treatments.

The government hasn't ignored any of this. States hard hit by COVID-19 like Florida and Texas have been opening more infusion centers. And orders of antibody treatments during August surged by 1,200%, ABC News reported, citing the Department of Health and Human Services.

800,000 doses shipped

At the same time, President Biden's new initiative to fight the pandemic specifically includes increasing use of these treatments. Biden said last week that the country would up the weekly number of antibody shipments to states by 50%. The government shipped more than 800,000 doses over the past two months, according to CNBC.

Regeneron already generated $2.59 billion in antibody treatment sales in the second quarter after fulfilling a contract with the U.S. government. And the company just announced a new government contract worth more than $2.9 billion. Regeneron will supply 1.4 million doses to the U.S. through January. This brings the total order from the U.S. to about 3 million doses so far. I don't expect the orders to end here, but clearly the size of the orders will depend on coronavirus case numbers.

Regeneron dominates the U.S. COVID-19 antibody market. Lilly and Vir are smaller players; here's why. Regulators say Lilly's product isn't efficacious against certain variants -- so use is only permitted in states where these variants represent few cases. As for Vir, it's newer to the market. The FDA authorized its product this spring. Still, all three of these companies may benefit in the months ahead if coronavirus cases continue to increase.

Another part of this treatment trend includes possible antivirals ahead. And now I'm going to talk about a company very familiar to those investing in vaccine stocks. It's none other than vaccine leader Pfizer (PFE 0.38%).

Pfizer is working on an oral coronavirus treatment that could be given to individuals right after diagnosis -- as soon as the first symptoms appear. It's a simple pill to be taken for five days. The company began a phase 2/3 trial in July and expects to report results in the fourth quarter. It goes without saying that a pill people can take at home to treat COVID-19 would be a game-changer.

What about stock performance?

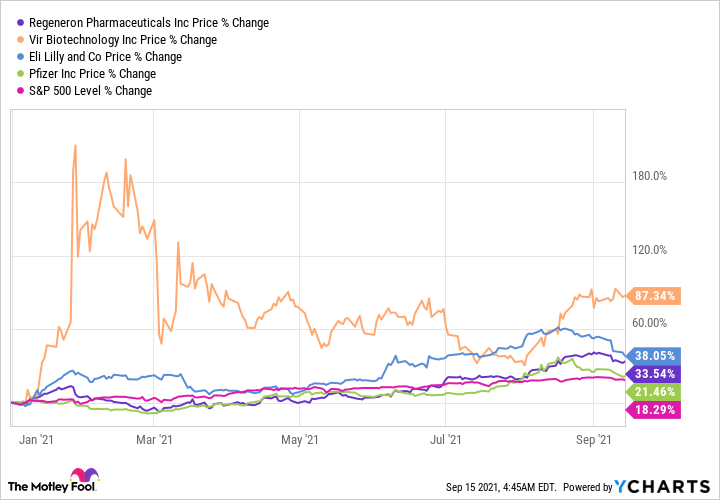

How have these treatment companies been doing when it comes to stock performance? They're all outperforming the S&P 500 index year to date.

But I expect more increases on the horizon. Monoclonal antibody treatments are just starting to gain ground. If coronavirus cases climb, sales of these treatments should follow. Pfizer's antiviral candidate will be important to watch for clinical trial data later this year. If data are solid and a regulatory authorization follows, a resulting product clearly could become a blockbuster -- and fast.

So, what about buying these shares right now? Investing in Vir currently requires some appetite for risk. Its antibody treatment is the company's only commercialized product. But the other companies I've mentioned here don't rely only on coronavirus treatments. They have many other revenue-generating products, meaning they may be better options if you're not a big fan of risk.

In any case, whether you are ready to buy now or not, now is a great time to join investors watching this trend -- and these dynamic companies.