I love steel as an investment sector and happily own industry giant Nucor (NUE -0.35%), with no plans to sell anytime soon. However, I recognize that steel is a highly cyclical industry for which the time to buy is when pessimism abounds and the time to worry is when everyone else is excited.

Right now, Wall Street is excited about steel companies and has pushed some of the most cyclical of the steel names higher. United States Steel (X -0.30%) is a prime example and it may be worth considering dumping the stock.

Image source: Getty Images.

A little history

U.S. Steel is an iconic name in the steel space, tracing its history back to 1901. It's got a great backstory, but that legacy has left it highly dependent on blast furnaces for production. That's an older technology that needs to operate at high utilization rates in order to be profitable. More modern technology like electric arc mini-mills, which underpin Nucor's business, are more flexible and can operate profitably even during industry downturns. To be fair, U.S. Steel is adding electric arc mills to its portfolio, but its blast furnaces should still be a material concern for investors.

This is relevant because steel demand is cyclical, waxing and waning with the economy. When steel demand is high, U.S. Steel can be very profitable. But when demand falls off, U.S. Steel's bottom line often dips into the red. As you might expect, its stock price tends to be high when steel demand is high. And the price is usually low when steel demand is low.

Right now steel demand is on the rise, and so is U.S. Steel's stock price:

X data by YCharts

This is the time to worry about the future, not get excited about what is yet to come. Indeed, trees don't grow to the sky, as the old saying goes. But what will help, given the nature of the steel industry, is a look at U.S. Steel's operating margin.

X Operating Margin (TTM) data by YCharts

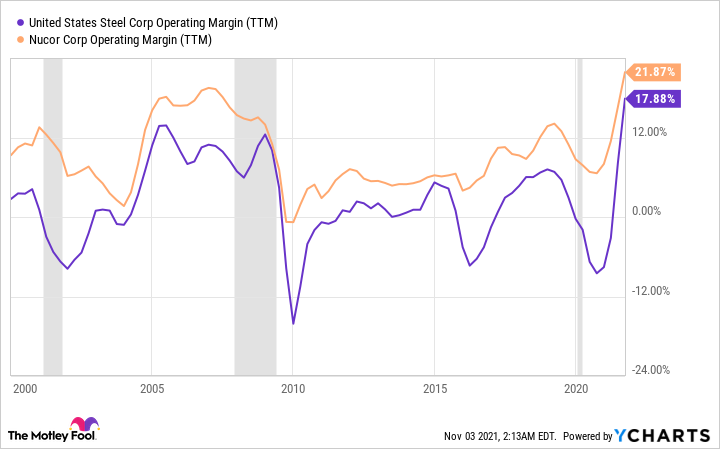

You can see how U.S. Steel's operating margin has shifted materially higher over the past year or so as the steel industry has picked up. But note where the operating margin was prior to the uptick -- well below that of Nucor. When you consider the cyclical nature of the steel industry and compare U.S. Steel's graph to Nucor's smoother trend, U.S. Steel's improvement doesn't look so alluring. However, a longer look will really bring the story home.

X Operating Margin (TTM) data by YCharts

Look at the variability in U.S. Steel's operating margin and compare it to Nucor's line. Clearly, when U.S. Steel's business starts to make lots of money, noted by a high operating margin, its stock is likely to be expensively priced. That makes sense. But given the cyclical nature of the industry and the high operating costs of its blast furnaces, this is probably the time to start thinking of selling U.S. Steel stock, not buying it. If history is any guide, eventually the margin trend will change, and so will the fate of U.S. Steel's stock price.

Be more worried than excited

I noted in the intro that I own Nucor stock. It is a consistent and well-run steel mill that I have no intention of selling. But it is expensive today, and I certainly wouldn't buy more right now. U.S. Steel stock, meanwhile, is also expensive. However, given its less consistent business model, built on older blast furnaces, not only would I not buy it today, but if I owned it I would be very worried about the next industry downturn.

And if I had material profits, I would be thinking about locking them in now, before its operating margins collapse along with the next downturn that's waiting in the wings. That's not to suggest a downturn is imminent; nobody has a crystal ball. But in a cyclical industry like steel, downturns invariably follow upturns -- and you should never forget the impact a downturn can have on a company like U.S. Steel.