Some companies don't get the credit they deserve. They continue flying under the radar despite delivering steady growth and attractive income streams.

Three relatively unknown stocks that currently stand out to our contributors as attractive buys this December are New Jersey Resources (NJR -0.92%), National Fuel Gas (NFG -0.67%), and Crestwood Equity Partners (CEQP). Here's why investors shouldn't overlook these companies.

Image source: Getty Images.

A tiny utility expanding into new areas

Reuben Gregg Brewer (New Jersey Resources): At its core, $3.5 billion market cap New Jersey Resources is a natural gas utility. It delivers natural gas, for things like heating and cooking, to around 550,000 customers in its namesake state. This business makes up around 60% or so of the company's earnings. It is regulated by the government, which must approve the rates it charges, and has provided consistent, though slow, growth over time. It's a solid foundation.

On top of that business, New Jersey Resources has layered a midstream energy business, a home services company, and, most notably, a clean energy operation. The midstream business, which includes pipelines, storage, and services, makes up 15% to 20% of earnings and complements the core utility operation. The home services segment, which basically sells into the utility's customer base, is tiny, contributing at most 1% to earnings. The real star of the show is the 20% of earnings that comes from clean energy investments, including things like commercial and residential solar projects. Basically, New Jersey Resources is using its legacy businesses to expand into the fast-growing renewable power space.

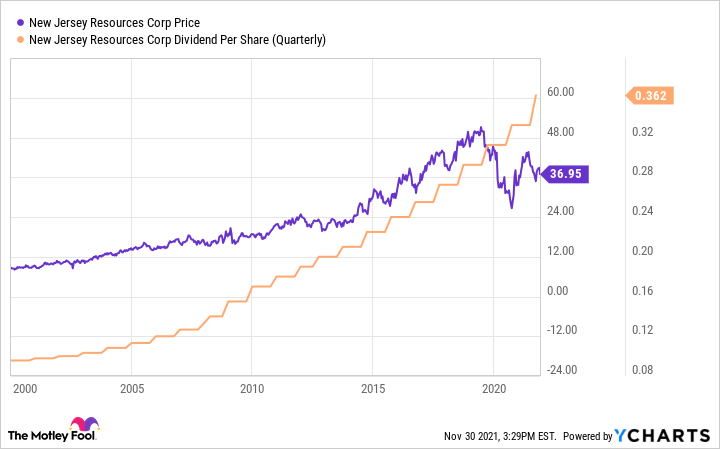

But why is this so notable? Because New Jersey Resources' 3.8% dividend yield is near its highest levels over the past decade. The dividend, meanwhile, has been increased annually for 26 consecutive years, putting the utility into Dividend Aristocrat territory. Annualized dividend growth over the past 10 years has been around 6% or so, which is pretty impressive for a utility. So, all in, this reliable high-yield stock with a strong core business supporting growth efforts in clean energy looks like it is on sale today.

51 years of dividend increases, and still counting

Neha Chamaria (National Fuel Gas): Although one of the oldest gas utilities in the U.S., National Fuel Gas is less of a utility and more an upstream and midstream gas company today. Yet it pays a dividend like a utility, and that's a pretty compelling mix that not many investors seem to have noticed.

National Fuel Gas explores, produces, stores, transports, and sells and distributes natural gas. Almost 46% of National Fuel Gas' earnings before interest, tax, depreciation, and amortization (EBITDA) came from natural gas production in its financial year ended Sept. 30, 2021, while 38% came from its midstream business. It was a solid year, with National Fuel Gas generating $363.3 million in net income versus a loss in 2020. Major drivers include the company's acquisition of Appalachia assets from Royal Dutch Shell (RDS.A) (RDS.B), higher oil and gas prices, and expansion of pipeline, storage, and utility systems.

Right now, National Fuel Gas has multiple expansion projects in progress, including the Empire North and FM100 pipelines that could together generate incremental revenue worth $75 million. Meanwhile, natural gas prices are on the rise, which directly flows to the company's free cash flow (FCF). In fact, National Fuel Gas expects to generate solid FCF in 2022 as its capital expenditures are also expected to taper. For now, National Fuel Gas expects to generate roughly $320 million in FCF at natural gas price of $4.50 per MMBtu in 2022.

Those cash flows should be enough to support higher dividends -- National Fuel Gas has increased dividends for 51 consecutive years now. With the stock yielding a good 3.2%, you might want to give National Fuel Gas a look if you still haven't.

A monster yield from a relatively unknown MLP

Matt DiLallo (Crestwood Equity Partners): Crestwood Equity Partners isn't a well-known name in the energy industry. At a $5 billion enterprise value, the master limited partnership (MLP) is tiny compared to many of the industry's largest plays, some of which produce more than $5 billion in cash each year.

However, what Crestwood Equity Partners lacks in overall size, it more than makes up for in the magnitude of its cash distribution, which currently yields 9.7%. While a payout that high might seem suspicious, that's not the case at all. The company generates more than double the amount of cash needed to cover that payout. That provides it with money to expand its operations with room to spare to strengthen its already solid balance sheet.

Because of its sound financial position, Crestwood has started to become a consolidator in the MLP sector. The company recently agreed to acquire fellow MLP Oasis Midstream Partners (OMP) in a $1.8 billion deal. That combination will enhance its operations while maintaining a healthy financial profile. As a result, Crestwood plans to increase its already monster distribution by 5% when the deal closes.

The company's growing scale and solid financial profile should enable it to continue consolidating the midstream sector in the future. Those future deals should further enhance its operations and boost its cash flow, which could support more distribution growth. Combined with its attractive yield, that upside makes Crestwood stand out as a compelling buy this month.