We are all ready to move past COVID and return to normality. Nonetheless, there's a new variant in town called Omicron, and we don't know yet how serious or not-serious this variant will be. The last highly contagious variant was Delta, and there were several other not-so-serious variants discovered between Delta and Omicron.

What stocks should we buy when we don't know how dangerous this new variant will be? Our Foolish writers suggest you take a look at Moderna (MRNA -2.45%), Novavax (NVAX -4.82%), and Inari Medical (NARI -0.29%). Here's why.

Image source: Getty Images.

Moderna shareholders should brace for even more upside

Alex Carchidi (Moderna): Given the ongoing need for active development of its vaccines, it's a no-brainer that Moderna is going to crush the market next year just like it did this year.

Demand for Spikevax is still growing, and the rise of the Omicron variant has shown that the pandemic is far from over. The company estimates that it'll bring in between $15 billion and $18 billion for this year in total. More than $17 billion in sales are already on the books for 2022 via advance purchase agreements. Management thinks there could be as much as another $5 billion on top of that depending on forthcoming approvals and options to expand the agreements.

But for the stock to beat the market in 2022, investors need to believe that the company will make even more money in the future than it will next year. After all, if the pandemic looks like it'll be ending in 2023, Moderna's jab sales will be expected to contract sharply, and its stock may fall accordingly.

To mitigate this risk, the company is also working on version 2.0 of its flagship coronavirus jab. Among other potential benefits revealed by early-stage clinical trials, the updated vaccine is likely to require a smaller dose to achieve comparable results to the older version. That means Moderna may be able to cut down its cost of goods sold (COGS) and thereby juice more earnings out of the same volume of sales, which could contribute to its outperformance even if demand starts to fall.

In the long-term, Moderna plans to develop a once-yearly pan-respiratory vaccine that it hopes will be effective against coronavirus, influenza, respiratory syncytial virus, and perhaps other types of respiratory infections. If it succeeds, the jab will be an extremely convenient public health tool, and it'll likely see very wide adoption. So, expect the market to react favorably when there's more information about this project released throughout 2022, as it could eventually become one of the foundations for the company's base of recurring revenue after the pandemic.

Embrace the volatility

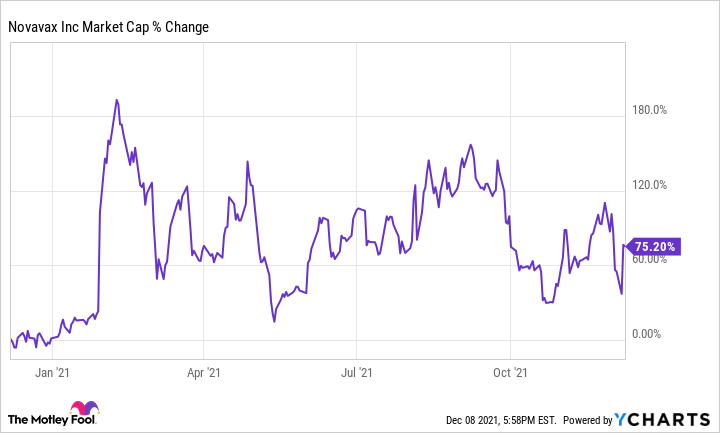

George Budwell (Novavax): Holding shares of the COVID-19 vaccine maker Novavax is undoubtedly a gut-wrenching experience. A chart of the biotech's stock performance over the past 12 months resembles a roller-coaster ride:

NVAX Market Cap data by YCharts

Novavax's stock has been on the volatile side over the past several months for a variety of reasons. The two most critical factors have been concerns about Novavax's ability to manufacture its COVID-19 vaccine at scale and the ever-evolving coronavirus landscape.

Right now, for instance, the preliminary data on Omicron suggests that this variant might be able to overcome the immune protection conferred by these first-generation COVID-19 vaccines. Novavax, for its part, has reportedly been hard at work modifying its recombinant nanoparticle, protein-based vaccine to address the galaxy of mutations that make Omicron so worrisome.

The fact still remains that Novavax's shares are probably grossly undervalued right now. Even though Omicron might require Novavax to modify its vaccine, the biotech's shares are likely trading at well under three times 2022 sales at the moment. Novavax's stock may even be valued at less than two times 2022 sales at current levels, depending on the accuracy of Wall Street's most optimistic forecast. The take-home message here is that Novavax's stock easily sports the lowest valuation among the top-tier COVID-19 vaccine developers.

This mid-cap biotech stock thus appears poised to post market-beating returns in 2022. The Omicron variant isn't likely to undercut global demand for vaccines.

Removing clots outside the ICU

Taylor Carmichael (Inari Medical): One of the problems we see in healthcare during this pandemic is that so many of our resources are spent fighting COVID. But there are plenty of other medical conditions that can't be ignored. For instance, what do you do if you have a dangerous blood clot and there's no room in the ICU for you to be treated?

Here's what happened with one patient: A woman in Houston who had just given birth to a baby reported to the emergency room with shortness of breath and chest pains. X-rays revealed large blood clots in both her lungs. The hospital was full of COVID patients, and there was no room in the ICU to treat her. So the hospital sent her home with oral anticoagulants (blood thinners). These drugs reduce the risk of new clots but do nothing to treat existing clots.

The next day she got worse. Her condition was so bad, she couldn't even go upstairs to feed her baby. The ambulance took her to a different hospital. But this hospital was also overwhelmed with COVID patients and had no room in the ICU. However, the second hospital had been using Inari's devices to remove clots for over a year.

Inari's minimally invasive devices -- the ClotTriever and the FlowTriever -- do not require a visit to the ICU. An hour after the woman's arrival at the hospital, the doctor was able to remove all the clots from both lungs. Her symptoms resolved, and she was fine. (Not surprisingly, the first hospital -- after hearing about the success at the second hospital -- is now using Inari's devices as well.)

I'm super bullish on Inari regardless of what happens with Omicron. The company's minimally invasive devices are a big improvement over the standard of care. And this is glaringly obvious during a lockdown environment where there's no room in the ICU. Inari's revenues are already up 88% in the most recent quarter. I think the company will continue to thrive regardless of what happens with COVID. So this is a great stock for Fools to own in an uncertain environment.