Investing site Robinhood (HOOD -1.10%) is known for its risk-leaning investors, many of whom have been responsible for the meme stock crazes of 2021. It seems like history long past at this point, but in January of this year, Reddit group WallStreetBets created a short squeeze for GameStop investors that took down a Wall Street hedge fund. Since then, there's been a slew of almost-short squeezes and a guessing game of who's going to be next.

But not all Robinhood investors are risk-happy, and not all top Robinhood stocks are fundamentally poor investing picks. Some of them should be on your buy list, too. You might be surprised to hear that one of the top Robinhood investor holdings is e-commerce giant Amazon (AMZN -1.65%). Does this plain vanilla stock really offer market-crushing potential? Yes, it does.

Image source: Amazon.

Amazon is growing faster than you realize

Unless you've been hiding under a rock for the past two years (maybe not such a bad idea), you've seen Amazon catapult from the market leader it already was to absolutely take over American retail. You're likely to be one of Amazon's Prime members since that number topped 200 million last April. If you're already an investor, you might have been disappointed in Amazon's third-quarter earnings report, in which sales and income came in at management's expected range: a 15% year-over-year increase in sales to $111 billion and $4.9 billion in operating income, down from $6.2 billion last year. However, earnings per share of $6.12 were well below average analyst expectations of $8.92.

That looked like a huge setback, but in reality, it was compared to a monster Q3 the year before, with a 37% year-over-year sales increase that stood well above expectations of 24% to 33%. Supply-chain issues and a tough year to match obscured some of the real growth that's very much still going on here.

One obvious place we see that is in Amazon Web Services. The company's cloud computing operations continue to demonstrate strong growth -- 39% year over year in the third quarter -- while representing an outsized portion of Amazon's profits. This segment accounted for nearly all of the operating income in Amazon's Q3 report.

Amazon is also growing its other businesses, such as its "Just Walk Out" store management technology. This cashier-less technology enables customers to use an app while they shop, and it calculates whatever they take from the shelves without going through checkout. Amazon has opened Amazon Go stores in four U.S. cities. It also now has 23 Amazon Fresh stores after opening its first in California just last year. The company recently opened an Amazon + Starbucks location in New York City, and it also recently got its first international third-party client in U.K. supermarket giant Sainsbury's.

The steep decline in Q3 income didn't look too good either, but it represented fixed fulfillment costs from when the company needed to ramp up capabilities last year -- they still aren't being put to full use. Management said that this pressure would continue into the fourth quarter, but the company is also well-equipped to handle its seasonal growth, as there has historically always been an uptick in sales in Q4.

AMZN Revenue (Quarterly) data by YCharts.

Amazon Prime remains a strong source of revenue. Since Prime members engage more overall, that should translate into continued growth, even if it's decelerating right now. While management called for even slower growth in Q4 of only 4% to 12% year over year, analysts are still expecting 22% for the full year.

How does this translate into market-crushing potential?

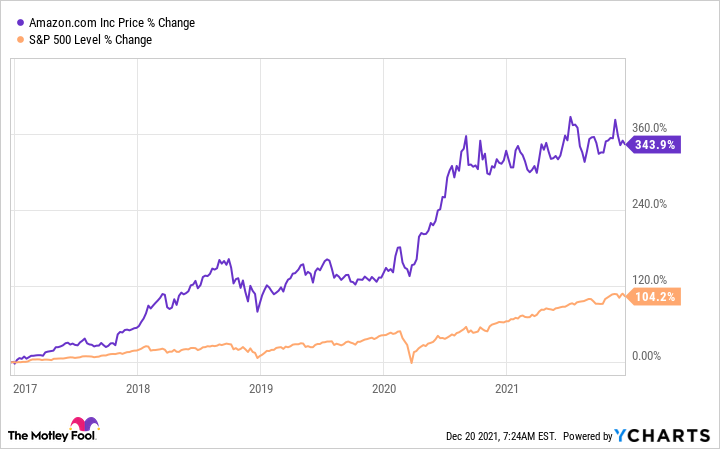

When we say a stock beats the market, it refers to some kind of aggregate measure of how the market is doing, such as an index like the S&P 500. The index represents a lot of stocks, making it a good measure of the broader market. It includes a diverse set of stocks, including large and not-so-large (all S&P 500 stocks need to meet a minimum market cap requirement), growth and value, and various industries. Amazon has beaten the S&P 500 over the past five years by a wide margin, even though its days as a hypergrowth stock have passed.

AMZN data by YCharts.

Compared to the broader market, Amazon has an unusual mix of growth and value. Even though it's not a classic value stock, it offers stability and industry-leading prowess that give it might against competitors. Even value king Warren Buffet has some Amazon stock in the Berkshire Hathaway portfolio.

Between its strength and opportunities, Amazon still offers many years of market-crushing potential, and it's a great stock to have in your portfolio, whether you're a Robinhood investor or not.