Judging by the market's reaction, it isn't too excited about Meta Platforms' (META 0.43%) ambitions to become the metaverse leader. Instead, it would have rather just let its Facebook and Instagram platforms print money and reward shareholders. However, CEO and founder Mark Zuckerberg has different ambitions.

Over the last six months, Meta's stock has lost more than 40% after setting an all-time high in September. However, most of the decline came after Meta reported fourth-quarter earnings on Feb. 2: a drop of more than 30% in less than a week. Meta is going all-in on the metaverse and will be spending heavily, which cuts profits -- something Wall Street hates. Is this short-term pessimism a blessing in disguise for long-term investors?

Image source: Getty Images.

A quarterly report that shifted market sentiment

At face value, Meta's quarterly results were a mixed bag. Quarterly revenue grew 20% to $34 billion year over year (YOY), but costs and expenses grew even faster at a 38% clip to $21 billion. Because of the increased spending, the operating margin dropped from 46% in Q4 2021 to 37%. This all trickled down to the bottom line, where Meta reported $3.67 earnings per share (EPS) but analysts were expecting $3.84 according to Refinitiv.

Perhaps the biggest metric investors keyed on were Facebook's daily active users (DAUs), which dropped for the first time since it went public. In Q3, Facebook had 1.930 billion users worldwide, but that number was reduced to 1.929 billion in Q4. While this is a mere 0.5% loss, it could be a warning sign. Further complicating matters, Mark Zuckerberg mentioned on Meta's conference call TikTok's growth and popularity is hurting business. Putting it in perspective, Zuckerberg mentioned TikTok five times during the conference call -- where he mentioned Facebook and Instagram 11 times each.

Meta also broke out its Reality Labs segment for the first time, which includes its augmented (AR) and virtual reality (VR) hardware, software, and content. The results were not pretty. Reality Labs brought in $877 million during Q4 but lost $3.3 billion during the same time frame. After this segment was broken out, investors realized how much capital it will take bring AR and VR technology to the masses.

Image source: Getty Images.

Heavy spending expected in 2022

Guidance for 2022 was also concerning. Q1 revenue is only expected to grow between 3% and 11% -- not attractive when many other big tech stocks are growing quicker with fewer bumps in the road. Impacting its growth are Apple's new iOS privacy changes, which Meta predicts will modestly increase its ad targeting spend. Additionally, currency exchange rates and tough prior-year comparisons will provide additional headwinds.

Meta will be heavily investing in growth this year, as expenses are expected to tally between $90 and $95 billion -- a 30% increase on 2021's expenses. Becoming the Metaverse leader isn't going to be cheap, but Meta Platforms is going all-in.

The case for Meta Platforms stock

If you're expecting instant metaverse success for Meta Platforms business and stock, you probably should pass on the stock. If you're committed to investing the Motley Fool way -- buying and holding great businesses for at least three to five years -- then Meta Platforms stock could be attractive.

Few other companies on earth have Meta Platforms' financial resources and none are as committed to bringing about the metaverse. If Meta can't do it, no one likely will. If you're a metaverse or AR and VR believer, Meta Platforms is a must-own.

Meta is also unbelievably cheap right now.

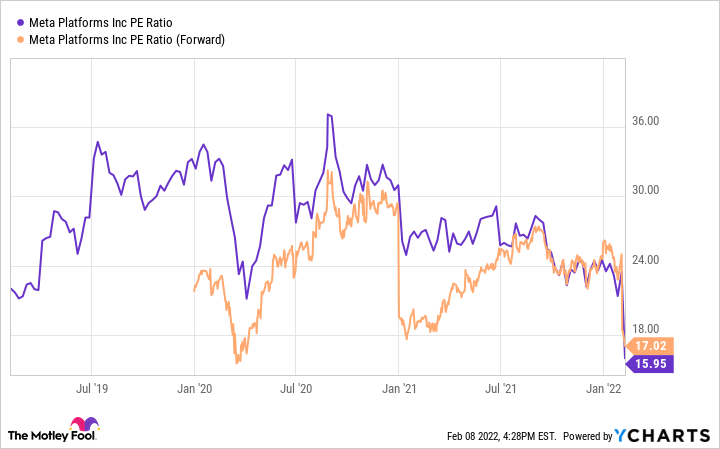

FB PE Ratio data by YCharts

That it is sitting at 16 times earnings (PE) and 17 times forward earnings implies there will be little if any earnings growth this year. However, companies often trade around 16 times earnings when the stock is associated with a mature business and bleak growth prospectives.

FB PE Ratio data by YCharts

Meta Platforms is trading for significantly less than yawn-inducing names -- sorry, value investors -- like Proctor & Gamble and Coca-Cola. Trading among the likes of Pfizer and Bank of America is unheard of for a business with long-term growth prospects like Meta Platforms.

The market is freaked out about Meta Platforms right now. All Wall Street can see is one year into the future, and it doesn't look bright. As individual investors who don't answer to management or clients, we can take a much longer view and judge Meta's future plans. Two scenarios are likely with Meta:

First, the metaverse is ushered in by Meta Platforms and is a huge success. Anyone who held shares or purchased at the low benefits from increased revenue and profitability. While this is the best-case scenario for shareholders, the stock is priced as if this will never occur.

Second, the metaverse could be a disaster, with Meta lighting billions of dollars on fire in the process. While this outcome would make shareholders angry, the ramifications aren't disastrous. Meta might change its name back to Facebook and shutter its Reality Labs division, but in the process would cut out more than $10 billion in expenses and increase its net income by around 20%. The company could have paid the money to shareholders in dividends or buybacks, but without its metaverse aspirations, Meta Platforms goes back to being the same business it was for the previous five years -- a cash-printing machine that traded in the mid-30s PE range.

The recent market sell-off seems like a prime buying opportunity for the stock, but only with the right time horizons. It's not often the market gives investors a "heads I win, tails you lose" situation, but Meta Platforms stock fits the bill. Consider buying the dip if you're committed to owning the stock for at least three to five years.