The meme stock craze has generated swings in GameStop (GME -19.73%) stock that have nothing to do with its business lately. Shares have been up (and down) 40% several times within the past year.

But the stock's movement in the next week might be more rational. GameStop is set to announce fourth-quarter earnings results that detail how well the video game retailer did over the key holiday shopping season. And, while customer traffic trends will look better than they did in late 2020, there are several ways the company could disappoint investors in a few days.

Let's take a closer look at what to expect from the Thursday earnings report.

Sales trends

GameStop didn't issue any short-term guidance in its last conference call back in early December, but most investors are looking for sales to rise about 4% to $2.2 billion. Hitting that result would put the company roughly in the same position it was back in 2019, although today it operates fewer stores and has divested a few unprofitable business lines.

Management said it believed it had enough inventory on hand to satisfy demand over the holidays. However, Best Buy (NYSE: BBY) and Walmart (NYSE: WMT) both revealed in recent earnings announcements that the video game segment underperformed in late 2021. The big question on Thursday will be whether GameStop struggled to grow in that weaker environment.

Image source: Getty Images.

Cash flow

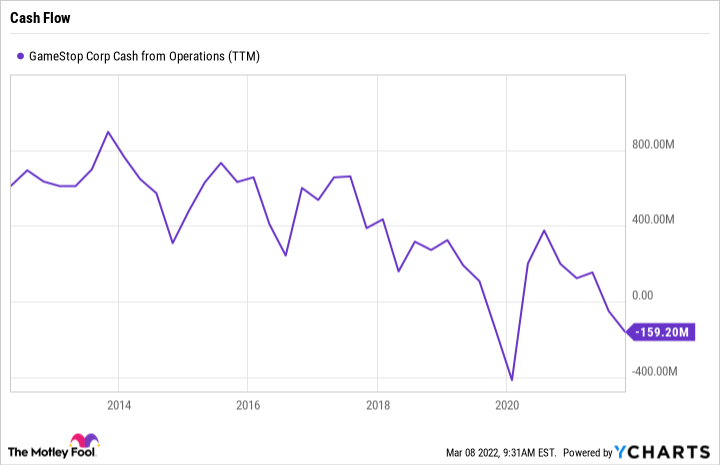

GameStop's rebound strategy starts with securing sustainable revenue growth as the foundation for solid financial returns. To date, investors haven't seen much to show that this initiative is paying off.

Operating cash losses over the first three quarters of 2021 were $324 million compared to $41 million a year earlier. GameStop burned through almost $300 million just in the third quarter, and the long-term trend appears to show steady deterioration on this key metric.

GME cash from operations (TTM). Data by YCharts. TTM = trailing 12 months.

The company holds only a small amount of debt, and so it isn't in danger of a liquidity squeeze or higher costs due to surging interest rates. Still, GameStop needs to change this cash flow trend, which explains why it has been closing hundreds of stores in a bid to reduce its cost burdens. Watch for signs that the trimming strategy is helping profitability, even at the expense of sales.

Looking ahead

GameStop's comments on 2022 might be the main focus of Wall Street's attention on Thursday. Heading into the report, most investors are looking for sales to fall slightly in the new fiscal year as gains in e-commerce and in new initiatives like non-fungible tokens (NFTs) and blockchain offset some of the loss from the shrinking store base.

If management's forecast is about the same, then shareholders are looking at a third consecutive year of annual sales below $6 billion. The company's record was over $9 billion in 2017.

A lot has changed in the video game industry since then, but one consistent trend has been GameStop's struggles to stay relevant to its fans as power shifted toward hardware and software developers and away from retailers. The pressure from that continued move will surely affect GameStop again through 2022.