The Trade Desk (TTD 2.42%) has been capitalizing on the growing share of advertising dollars moving to digital channels. The company works with marketers to optimize their spending and increase their return on investment and ad buyers continue allocating money to The Trade Desk. Success with clients has led to impressive shareholder returns.

The Trade Desk stock has been on fire in the last five years, rising a whopping 1,800%. The rapid rise has some investors asking if it's too late to buy The Trade Desk stock.

Industry tailwinds are boosting revenue

The Trade Desk's booming stock price has been fueled by explosive revenue growth. Between 2014 and 2021, sales increased from a meager $46 million to $1.2 billion. And yet. it has plenty of runway for growth. The global advertising industry was worth $763 billion in 2021, up 22.5% from the previous year.

Embedded within the rising trends in advertising is a shift in where marketers are spending that money. Over the years, a growing share of spending has moved to digital channels. That's understandable. Spending on digital media is more efficient. Consider the alternative. By placing an ad on a billboard, in a newspaper, or during a radio broadcast, a marketer has little means of measuring the return on that investment. How many people purchased your product as a result of that radio advertisement? There is no precise way to measure that. Of course, you can approximate the figure by looking at average purchases of comparable periods, but your results will be imprecise and open to many measurement errors.

By advertising on digital channels like connected TVs, social media sites, and search engines, marketers can precisely measure how many clicks, views, and purchases result from their ad placement. That gives them greater confidence in investing in the type of marketing that delivers the highest return. Further, it lessens the negative impact on a brand when its ads are shown to consumers who are not interested.

Image source: Getty Images.

Is The Trade Desk too expensive?

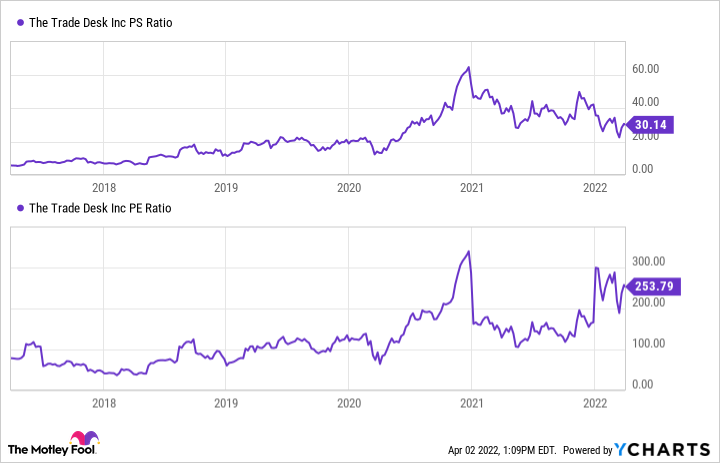

Unfortunately for potential investors, The Trade Desk's impressive performance and prospects are no secret to the market. The stock has risen sharply over the years, and it is certainly not cheap. It's trading at a price-to-sales ratio of 30 and a price-to-earnings ratio of 247. One comparison I use at times to determine if the price-to-sales is too expensive is to look at the average revenue growth rate of the previous three years; which was 36% for The Trade Desk. A price-to-sales ratio (30) below the three-year average revenue growth rate (36), tells me the stock is not too expensive.

TTD PS Ratio data by YCharts

Further, it accelerated revenue growth to 43% in its fiscal year ended Dec. 31. Considering its revenue is a relatively small piece of the massive total addressable market, and industry tailwinds at its back, the surge could continue for several years more. It is certainly not too late to invest in The Trade Desk.