The investment world is buzzing with talk of artificial intelligence (AI), soaring stocks like Nvidia (NASDAQ: NVDA) and Microsoft (NASDAQ: MSFT), and the immense possibilities for other companies. Hey, I am, too -- if you have a minute, take a look at this stealthy AI stock you may have never heard of. But, while everyone is looking one way, it can pay handsomely in the long run to also look elsewhere.

I look for a few criteria in companies to invest in. These include positive cash flow, stock buyback programs, growing revenue, and desirable business models. Booking Holdings (BKNG 0.86%) and The Trade Desk (TTD 0.10%) check all the boxes for me.

Is Booking Holdings a good investment?

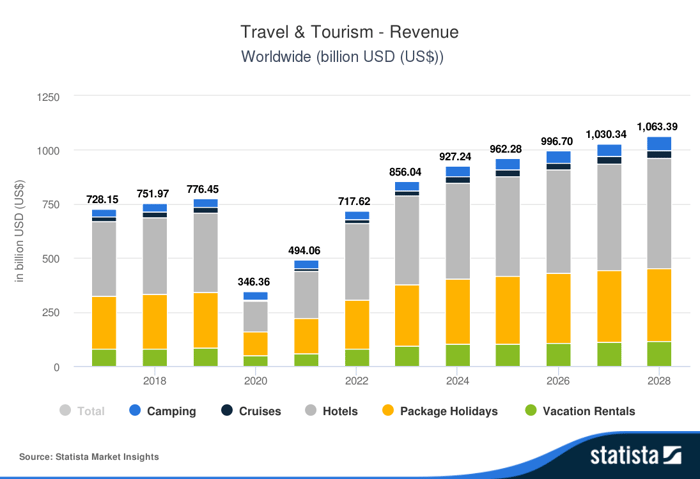

The travel industry is back in full force with the COVID-19 pandemic finally abating. Forecasts expect $927 billion in global travel spending this year and continued growth thereafter, as depicted below.

Many people prefer to book directly with the hotel or airline, but others take advantage of sites like Booking.com, Priceline, Kayak, and Agoda, all owned by Booking Holdings. A recent study by Self Finance showed that travelers often save significantly on hotels and flights by using third-party booking services, especially when bundling them. Booking also owns the popular restaurant booking app OpenTable and offers short-term rental stays. The company's massive presence in the travel industry is great news for investors.

Booking's business model is excellent. Since it is essentially a software platform with few physical infrastructure needs, the company spends very little on property and equipment, just 1.5% of revenue in 2023. Amazon, which requires trucks, warehouses, and data centers, spent 9% of its revenue on capital expenditures last year and even more in prior years.

This lean business model allows Booking to generate a 33% free-cash-flow (FCF) margin -- for each revenue dollar, $0.33 goes right into the company's pocket. Over the last 12 months, Booking recorded $7 billion FCF in sales of $21 billion. And Booking doesn't hoard the cash; it returns it to shareholders through stock buybacks. As you can see below, it spent over $10 billion in just over two years, reducing the number of shares outstanding by 15%.

BKNG Free Cash Flow data by YCharts

I prefer buybacks to dividends because buybacks aren't taxed to the investor annually like dividends are. Buybacks reduce the outstanding shares, increasing earnings per share and the stock price. This also means that if the stock falls, the company can take more shares off the table for the same investment -- a terrific cushion for long-term investors.

Booking trades at a price-to-earnings (P/E) ratio of 30, ahead of Expedia Group's P/E of 24; however, Booking has reduced its average diluted shares outstanding by 15% since January 2022, compared to 6% for Expedia. Booking also posted 25% revenue growth in 2023 compared to just 10% for Expedia.

It all adds up to Booking being an excellent long-term investment.

Is The Trade Desk stock a good buy?

Advertising in 2024 is much different than in prior decades because there are so many mediums to consider, like mobile video ads, website displays, and connected television (CTV). CTV refers to any television content streamed through the internet. Advertising on streaming television is essential; The Trade Desk reports that 95% of advertisers will maintain or increase their programmatic CTV budgets in 2024. This will benefit demand-side platforms (DSPs) like The Trade Desk tremendously.

Programmatic advertising works like this: When a user visits a website or watches a streaming program, the publisher requests bids on the ad space. A DSP like The Trade Desk bids on behalf of its customers and tries to match them with the target audience. It happens instantaneously. Since 2019, the amount advertisers spent using The Trade Desk's platform tripled from $3.1 billion to $9.6 billion, while The Trade Desk's revenue grew from $661 million to $2 billion.

Like Booking Holdings, The Trade Desk is a lean business that is growing FCF and revenue, as depicted below.

TTD Revenue (TTM) data by YCharts

The company instituted a stock buyback program in 2023 and used $647 million to repurchase shares. The Trade Desk is a younger company and is more high-risk and high-reward than Booking. The stock trades for 22 times sales, which is on the high side, although less than its five-year average. The high valuation is due to the excellent business model, growing industry, and the company's opportunities for expansion. Right now, only 11% of The Trade Desk's revenue comes from outside North America; however, 67% of the world's advertising dollars are spent elsewhere. This is fertile ground for growth. The company is also making inroads with retail advertising, including deals with Walmart, Walgreens Boots Alliance, and Target.

Given the rich valuation, rushing into a full position with The Trade Desk stock is unnecessary. Consider buying a little at a time to take advantage of dips in share price. This is called dollar-cost averaging, and it's excellent for hedging risks.

The Trade Desk and Booking operate in different industries but share many characteristics that make them attractive long-term investments. If you're looking outside the world of AI, you should consider these two candidates.