Understanding financial terms is essential to being a successful investor, and that includes understanding the three financial statements: the income statement, balance sheet, and cash flow statement.

On the cash flow statement, one of the most important components is capital expenditures.

What does capital expenditures mean?

Capital expenditures, often called capex, are often listed on the cash flow statement as payments for property and equipment under cash flows from investing activities.

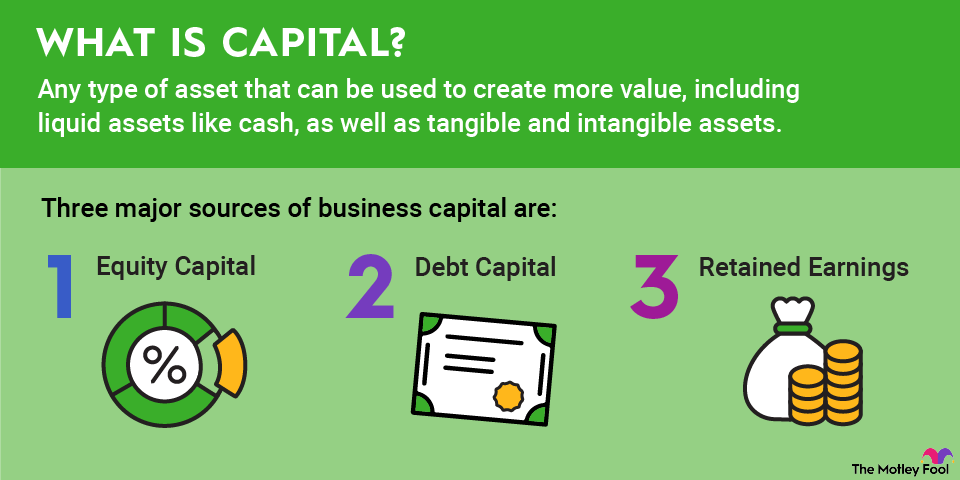

As the name implies, this is spending on capital goods and projects, as opposed to operating expenses.

What qualifies as a capital expenditure?

Capital expenditures often refers to spending on buildings and maintenance that are essential parts of most businesses. For example, a retailer like Walmart (NYSE:WMT) spends billions on capex to ensure that its stores are clean and up to date. A tech company like Meta Platforms (META -1.48%) or Amazon (AMZN -0.39%) might spend billions on capex, building out new data centers or filling existing ones.

A capital expenditure is typically depreciated or amortized, as opposed to an operating expense, which is expensed.

That's an important distinction that you should be aware of when evaluating a business. Operating expenses typically refer to the direct spending needed to run a business. For example, at a restaurant, operating expenses would refer to labor costs, food costs, and occupancy costs like rent and utilities, as well as things like marketing expenses and even research and development. Capex would refer to spending on items such as building maintenance, new store buildouts, and other infrastructure.

Free Cash Flow (FCF)

Capital expenditures don't affect the income statement directly, but they affect the cash flow statement -- the free cash flow statement, in particular, which is operating cash flow minus capital expenditures.

How to use capital expenditures

Because capital spending isn't "required" in the way that operating expenses are, businesses have more flexibility on the timing of capex, so it's worth paying attention to see if businesses are cutting back on spending to conserve cash.

Capital expenditures also give a sense of how aggressively a business is investing in growth. Comparing capital spending between companies can offer information on which one is spending more on growth. It's worth looking at the percentage of revenue going to capital expenditures, for example. A company that's spending more than its competitors could be preparing to outgrow them, although it could also be spending on capital inefficiently. Still, it's worth investigating why a company is increasing capex since it could be paving the way to a growth opportunity for the company.

Wall Street often punishes stocks for increasing spending on capex since they see it as eating into profits. As long as the money is spent wisely, however, it generally pays off in long-term profits and growth. It's a good idea to look for unloved stocks that are raising capital expenditures.

Related investing topics

What's an example of a capital expenditure?

To explore what capital expenditures look like in a real business, let's take a look at capital expenditures for Walmart in its most recent fiscal year.

In fiscal 2023, which ended on Jan. 31, 2023, Walmart spent $16.9 billion on capital expenditures. The company allocated $9.2 billion to the supply chain, including customer-facing initiatives and technology, with another $5 billion for store and club remodels and $2.6 billion for Walmart International. Only $33 million was allocated to new stores; Walmart has essentially stopped opening new stores.

Walmart said its capex strategy includes improving customer-facing initiatives, creating a seamless omnichannel experience, and improving the supply chain.

The retailer has stepped up capex from $10.2 billion in fiscal 2021 to $13.1 billion in fiscal 2022 and $16.9 billion in fiscal 2023 as a result of company goals to become more competitive with Amazon on the e-commerce front and improve its tech capabilities.

Walmart is able to fund that capex out of its operating cash flow with $28.8 billion in operating cash flow in fiscal 2023, giving it almost $12 billion in free cash flow last year. Walmart spent the remainder on dividends and share buybacks.

Understanding the cash flow statement can give you key insights into a business, and capital expenditures are one of the most important components of the cash flow. It's essential to follow if you want to know how a business is spending its cash.