In biotech, there's always a hot new trend around the corner. Over the last few years, the new hotness was -- you guessed it -- coronavirus vaccines. But, if experience is any guide, the next big thing is already on the way.

While I'm not going to make any predictions about what that next thing might be, one thing is clear. Investing in vaccine stocks is no longer the speculator's ticket to riches, and as a group, the stocks might be headed for a decline.

Let's examine two arguments for why that might be the case.

Image source: Getty Images.

1. Vaccines aren't projected to continue as a major growth segment

The first reason the reign of vaccine stocks may be ending is that coronavirus vaccines aren't expected to rake in as much cash compared to medicines from other segments as the pandemic eases over the next few years.

Take a look at this chart:

Between now and 2026, it's entirely possible that the market for vaccines may shrink.

Without white-hot demand for coronavirus jabs, businesses like Moderna (MRNA -2.45%) and Novavax will face falling revenue, and they might not have any other products ready to replace what's lost, considering their thin late-stage pipelines at present. For reference, Moderna brought in $18.5 billion in 2021 from sales of its jab, and it expects to make as much as $22 billion this year. But, if investors expect to find more growth for their buck elsewhere, the company's billions mean little.

In contrast to the market for shots, the market for oncology drugs is projected to grow by quite a bit over the next few years, along with immunosuppressants. As oncology biotechs continue to sprout up and oncology companies labor to commercialize their medicines and deliver profits at larger and larger scales, investors will likely react accordingly, piling into oncology stocks -- and potentially out of "pandemic" stocks like Moderna and Novavax.

2. The top-selling medicines of the near future aren't expected to be vaccines

A second reason vaccine stocks might be a thing of the past is that few expect coronavirus jabs to retain their high rank among the best-selling products in biopharma.

Pfizer says that this year it'll probably make at least $32 billion on sales of its coronavirus jab, Comirnaty. That's enough to make it a shoo-in for the top-grossing medicine of 2022, just like it was in 2021. Likewise, Moderna's Spikevax sold enough last year to earn it a spot in the top 10 pharmaceutical products by revenue, and the same will likely be true this year.

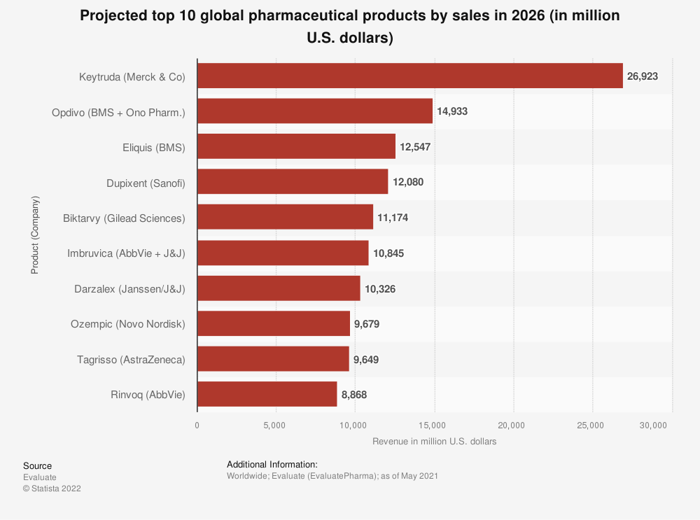

Now, consider the medicines on this chart:

Though it's true that the expected sales of Spikevax and Comirnaty in 2022 would crush these rankings, as I discussed previously, the picture in 2026 will likely be entirely different. None of the predicted, top-grossing medicines are vaccines.

That doesn't mean that vaccine makers are doomed to go out of business, but it does mean that investors are more likely to be hearing about other types of products. And with more buzz surrounding these medicines than preventative shots, it seems inevitable that investors will eventually allocate their funds accordingly.