With coronavirus vaccine maker BioNTech (BNTX 0.58%) announcing March 31 that it plans to conduct share repurchases of up to $1.5 billion over the next two years, investors are right to wonder whether the company is starting a new phase of its life. Given that share repurchases are typically the purview of mature companies, the move is somewhat of a surprise for the biotech's investors.

It also opens the question of whether now is the right time to invest as the buybacks will push the stock a bit higher over time. Let's look at this issue more closely and then tie in how the repurchases might change the way investors look at this company.

Image source: Getty Images.

There's a lot more to think about than share buybacks

First and foremost, you probably shouldn't be buying stocks solely on management announcing buybacks -- and Germany-based BioNTech is no exception.

While it's true that profitable companies will have more money to spend on buying back shares to support their price, doing so is often a concession that there aren't lucrative places to invest for growth. After all, if there are growth opportunities worth pursuing that might result in adding value rather than merely redistributing some of the company's existing value to shareholders, it wouldn't make sense to opt for redistribution.

Nonetheless, it's easy to understand why a business like BioNTech has extra cash on hand, considering the world-renowned coronavirus vaccine it developed in conjunction with Pfizer. With $22.4 billion in revenue in 2021 and annual net income of $12.1 billion to boot, it has more than $1.9 billion in fully liquid assets.

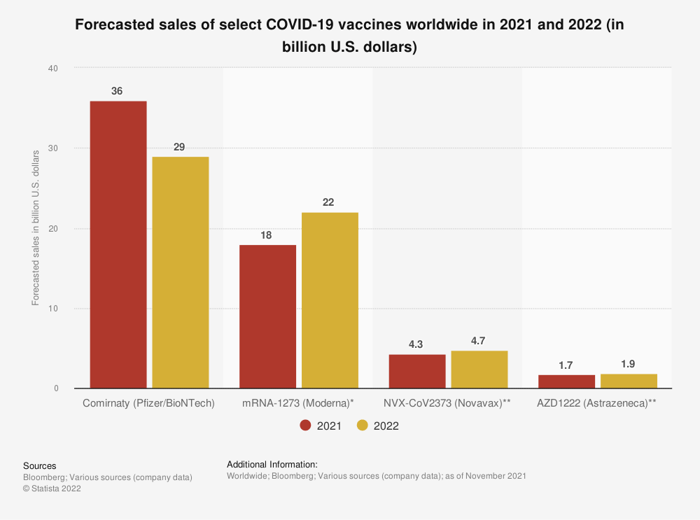

Buybacks aside, management claims it plans to reinvest most of the windfall into expanding its pipeline and hitting the gas on its oncology and infectious disease programs. That's a good thing, and this chart explains why.

Image source: Statista.

As you can see, sales of Comirnaty are projected to shrink this year, and management's guidance largely concurs. By changing tack to focus on its other programs, the company will guard its future against the continued decline of expected or actual jab sales as the pandemic (hopefully) becomes less of a revenue driver.

Walking and chewing gum at the same time

In the context of the anticipated drop in jab revenue, the share buybacks look like a way for management to buy time (and goodwill with shareholders) during BioNTech's push into new markets, which might take several years as a result of the lengthy drug development process.

While BioNTech will probably forever be known for working on Comirnaty, pivoting outside of the vaccine market is a better long-term decision than it would be to remain. Consider the following chart.

Image source: Statista.

The segments that represent a majority of the biopharma market by revenue are where the company hopes to compete in the future. That might encourage investors to buy the stock, especially if its efforts in the clinic continue to see some mid-stage successes.

But investors should still expect BioNTech's top line to contract in 2022 and perhaps beyond. Its most advanced, non-coronavirus pipeline programs are in phase 2 of clinical trials, which means it'll take quite a while for them to bear revenue, assuming they ever do. There's no guarantee that it'll avoid late-stage failures.

And the share repurchase program can't possibly change any of the above, though it could potentially prevent the business from utilizing some of the cash for research and development (R&D) expenses in the future. For reference, in 2021's Q4, it spent more than $260 million on R&D, so thankfully it isn't as though there is any under-investment going on to pay for the repurchases at present.

Therefore, BioNTech isn't a stock you should be racing to buy right now due to its share repurchase announcement specifically; however, if it can use the next couple of years to reorient itself to new disease markets with its newfound riches, it will have a shot at becoming a great investment once again.