Meta Platforms (META -10.56%) is scheduled to report first-quarter 2021 earnings after the markets close on Wednesday, April 27. The company formerly known as Facebook faces headwinds as Apple's (AAPL 0.52%) privacy changes make it harder for it to serve targeted ads.

To make matters worse, TikTok is swiftly gaining popularity among consumers and taking up more of their leisure time. Meta's stock has arguably already priced in the downside risks from the headwinds mentioned above, falling 52% off its highs.

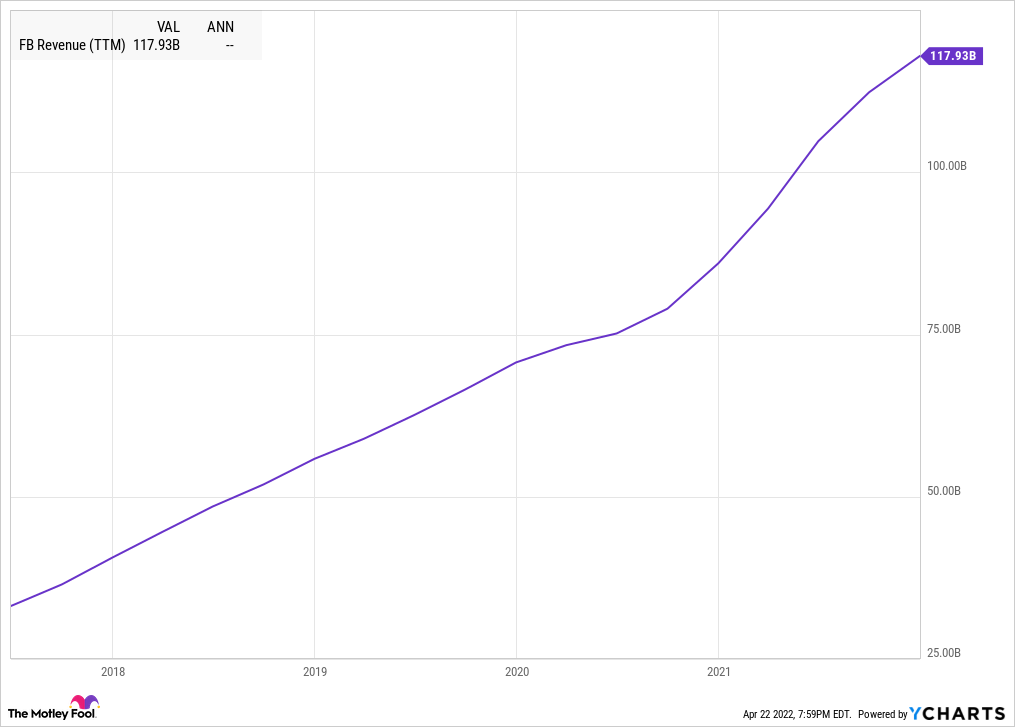

FB data by YCharts.

Meta Platforms has a massive audience

Meta Platforms' family of apps, including Facebook, Instagram, Messenger, and WhatsApp, is home to over 2.8 billion daily active users. The figure was up by 8% compared to the same quarter a year ago. It's worth emphasizing that the 8% growth amounted to 220 million daily active users.

One of its main rivals, Snap (SNAP 2.89%), which reported first-quarter results on April 21, has 380 million daily active users in total. That goes to highlight Meta's massive size and market dominance.

Meta primarily makes revenue by showing advertisements to users browsing its app and platform. Marketers are willing to pay more if they can get the chance to influence more individuals. In that regard, they covet the broad scale Meta's billions of daily active users provide. Every year, advertisers allocate more spending on Meta's platform, which has boosted Meta's revenue from $18 billion in 2015 to $118 billion in 2021.

FB Revenue (TTM) data by YCharts.

Moreover, serving advertisements is not a costly endeavor. As a result, a large percentage of the revenue flows to the bottom line. To prove it, look at Meta's operating income, which has climbed from $6.2 billion to $46.7 billion in that same time. Indeed, Meta boasted an operating profit margin of 39.6% in 2021.

There's terrible news for Meta Platforms

All that is great, but what has Meta stock crashing are the near-term headwinds caused by Apple's privacy changes and rising competition. Meta uses the information it gathers on users to sell precision advertising. Marketers are willing to pay more if they know the prospect is qualified. Apple's changes make it harder for Meta to collect that data, which harms its ability to target advertisements.

The consequence is decreased spending from marketers who will instead look to other places to allocate capital. Meta has forecasted revenue growth of 8% at the midpoint in Q1. If it hits that target, it would be the lowest quarterly growth rate in several years.

To make matters worse, Meta faces increased competition from short-form video site TikTok. People are spending more of their leisure time on TikTok, taking time spent away from Meta. As mentioned earlier, marketers pay for the opportunity to influence, so if folks are spending less time on Meta, that's less opportunity to influence.

Selling of Meta Platforms stock is overdone

FB Price to Free Cash Flow data by YCharts.

The sell-off of Meta Platforms stock has it trading at a price-to-earnings ratio of 13 and a price-to-free-cash-flow ratio of 13. Among its peer group, including Snap, Twitter, and Pinterest, it is, by a considerable margin, the cheapest stock using the aforementioned metrics. The selling in Meta Platforms stock appears to be overdone, and investors have an excellent opportunity to buy this dominant business at a discount.