The U.S. equity market has been reeling for the past few months. Rising inflation, higher interest rates, escalating geopolitical tensions, and COVID-19 lockdowns abroad continue to bear down on market sentiment.

However, these challenging times have also created buying opportunities for patient investors. Despite solid fundamentals and robust industry outlooks, growth stocks such as Block (SQ 2.23%) and Unity Software (U 3.02%) are currently trading at attractive valuations.

Here's why these two stocks stand a solid chance of withstanding any recession and should prove to be promising picks in April.

Image Source: Getty Images

1. Block

Block (formerly known as Square) operates an integrated, fintech ecosystem comprising two major parts: the consumer-focused Cash App platform and a seller-focused Square platform. Cash App is a one-stop mobile application that enables individuals to perform various quasi-banking activities, such as sending, receiving, or investing money, free debit card services, peer-to-peer payments, and tax payment services.

Block's Square ecosystem offers a range of services to merchants, such as point-of-sale, payroll, payment processing, marketing, social media management, and custom application development. Square also operates a global music and entertainment platform called TIDAL and a developer platform to access Bitcoin and blockchain technologies without institutional intermediaries.

With Block positioned as a one-stop shop for most of its customers' personal finance needs and its sellers' business infrastructure needs, it becomes costly and less necessary for clients to switch to other platforms. Block's Square and Cash App also benefit from significant network effects since an increasing number of users leads to the generation of more data and insights. These, in turn, can be leveraged to make the platforms even more efficient and convenient for users.

Block's network effects is also based on tight integration of its two-sided platform. Sellers increasingly are opting for the Square platform to take advantage of Cash App's expanding customer base. And customers are increasingly using Cash App to benefit from the seamless shopping experience offered by merchants using the Square platform.

According to Apptopia, Cash App is currently the eighth-most-downloaded application on the iOS platform and the fourth-most-downloaded application on the Android platform in the U.S. In December 2021, the application reported 44 million monthly active users, a year-over-year jump of 22%. While the customer-acquisition cost (CAC) per customer for Cash App increased from $5 to $10 in 2021, it is still lower than that required by online banks or traditional banks. Further, despite the doubling of CAC in 2021, the payback period for early 2021 customer cohorts is less than one year.

In fiscal 2021, Block also reported increasing adoption of its Square platform products by more complex sellers. These sellers also generated 10 times more profit than that generated by those with a single product. The improving client mix can prove to be a solid positive for Block's margins in the coming years.

Despite the many pros, Block's share price is currently down by over 33% so far this year.

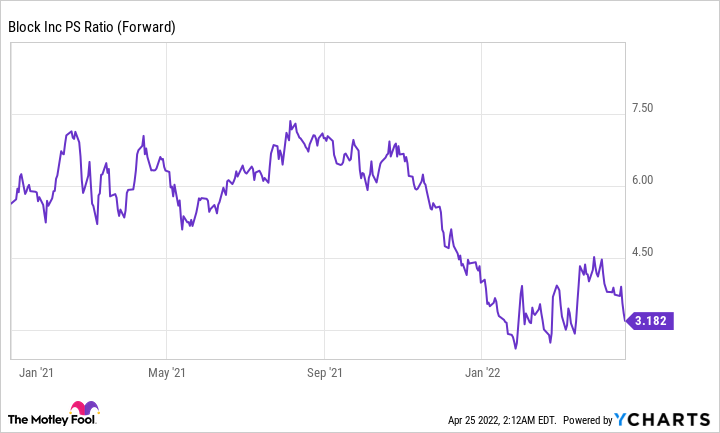

SQ PS Ratio (Forward) data by YCharts

With shares now trading at 3.2 times forward sales -- almost at the bottom of their historical range -- this exaggerated pullback can prove to be an attractive entry point for retail investors.

2. Unity Software

Unity Software is a "pick-and-shovel" player currently focused mainly on the gaming industry. The company provides tools that enable game developers and publishers to create real-time 2D and 3D mobile and console games and monetize them effectively through advertising revenue and in-app purchases. Additionally, the company offers targeted advertising services to advertisers, made possible by leveraging data collected from 22.9 billion monthly global ad impressions shown to around 2 billion monthly active users globally.

Unity's game engine (a framework of tools used to create games) accounted for almost a 48% share of the global game engine market in March 2021. The company is well-poised to benefit from the rapid expansion in the global gaming market -- estimated to grow from $184.6 billion in 2021 to $314.8 billion in 2027.

Besides gaming, Unity is also focused on leveraging its tools in other areas. The company has built a solid presence in the virtual reality and augmented reality development space -- technologies that are being increasingly used for simulation, training, and robotics. The recent acquisition of Weta Digital has further added highly sophisticated visual effects (VFX) tools to its portfolio. When integrated with the Unity platform, these tools can enable the creation of next-generation, real-time 3D games as well as help build the metaverse.

Unity's top-line momentum has kept pace with its operational growth. Analysts are estimating Unity's revenue to grow year over year by 34.9% in fiscal 2022 and by 29% in 2023. Although not yet profitable, the company boasts a solid balance sheet with cash of $1.74 billion and total debt of $1.82 billion at the end of fiscal 2021.

U PS Ratio (Forward) data by YCharts

Unity is currently trading at 15.2 times forward sales, which is at the lower end of its historic range. Moreover, the company's fiscal 2021 revenue of $1.1 billion accounted for only around 2% of its estimated addressable market of $45 billion. Against the backdrop of significant growth potential, robust value proposition, and attractive valuation, I am quite bullish on this stock.