Walt Disney Co (DIS -0.12%) is an entertainment juggernaut, which makes the stock's 40% or so decline over the past year look very enticing. The problem is that the drop may make more sense than investors think, given the huge price advance that took place during the early days of the coronavirus pandemic.

The reason for both the rise and fall of Disney's stock is the same: streaming. And the fate of this business could be the difference between Disney being a good long-term investment or not.

The rally made no sense

There's no question that Disney owns iconic media brands, from Mickey Mouse to Iron Man and Luke Skywalker. The collection of customer-pleasing names here definitely gives the company a huge edge in the entertainment industry. And the company's amusement parks deftly bring those media properties into the real world in a way that few others can.

This brings up the oddity of 2020.

Image source: Getty Images.

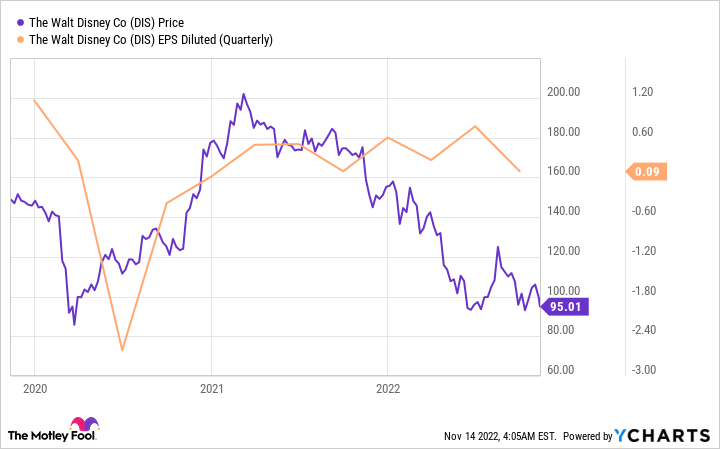

That was the year when the world was introduced to the coronavirus pandemic, with governments around the globe shutting non-essential businesses. That meant that movie theaters and amusement parks were closed, removing an important revenue source from Disney's quiver. At first, the stock plunged, but then it started to rally, largely because it was building out a streaming service known as Disney+.

The launch was very successful, so there was some reason for investors to be excited. However, the new division was still in growth mode, which meant it was spending more than it was earning.

And then there were the headwinds at the rest of the company. Earnings fell deep into the red in 2020 and didn't get back into the black until 2021, at about the same time that the stock began to fall again.

Back to Earth

At this point, Disney stock trades at around the same level it did during the worst of the coronavirus-driven bear market. With the company's movie and amusement park operations coming back, the big problem is now the streaming business.

This business is losing money, pushing the direct-to-consumer division to a $4 billion operating loss in fiscal 2022, which ended in October. That was more than double the loss in fiscal 2021.

The basic problems are that creating content is extremely expensive and there's something of an arms race going on in the streaming space. Indeed, every major media company, along with companies like Netflix and Amazon, is trying to dominate the space. Disney has a shot at being an important player, but it's still unclear which companies will actually be the biggest winners when it comes to streaming platforms.

That uncertainty, given the importance of content to Disney's long-term future, should be enough to keep conservative investors on the sidelines. Another problem is valuation -- notably, the stock's price-to-earnings ratio is around 55, compared to a historical average of around 18.5.

To be fair, the company looks relatively cheap when you examine its price-to-sales and price-to-book ratios. However, neither of these metrics take into account the huge cash outflows going to the building of the streaming business, which are a drag on earnings. Disney is well aware of the problem, recently announcing cost-cutting initiatives to assuage worried investors, now that its stock has sunk toward 52-week lows.

Another problem here is the dividend, which was eliminated in 2020 and has yet to be restarted, suggesting that Disney is well aware of how much cash it's going to have to spend on Disney+. Dividend investors specifically shouldn't even consider the stock until the dividend is reinstated. But all investors should be looking at the dividend, because it's a statement about the company's view of its long-term future. Right now, the company appears to be saying it needs all the cash flow it can get its hands on.

Too much risk

The uncertainty around the media business as it adjusts to the relatively new streaming-distribution channel is a risk that should probably keep most investors away from Disney. There's no way to know if it winds up a winner or an also-ran at this point, and the current financial performance of this business is less than inspiring.

Just having a lot of customers isn't enough. Disney needs to find a way to make its direct-to-consumer efforts profitable. Until it does, investors should remain cautious.