What happened

Shares of WeWork (WE) took a dive last month as fears continued to build around the company's ability to stay solvent in a potential recession.

There was no major company-specific news that impacted the stock, but a report in The Wall Street Journal and the Federal Reserve's forecast that interest rates would rise into 2023 both seemed to help push shares lower.

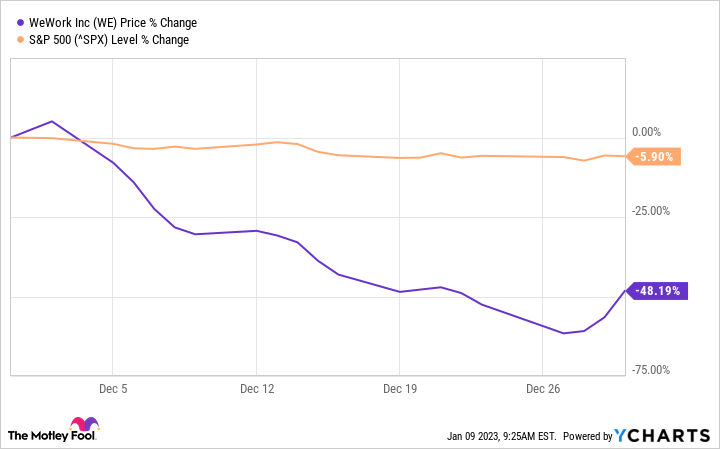

According to data from S&P Global Market Intelligence, the stock finished December down 48%. As the chart below shows, the stock fell steadily over the course of the month.

So what

WeWork was already limping into December after the company reported a wider-than-expected loss in its third-quarter earnings report in November and said it would close 40 U.S. locations as it adapts to higher expenses and a stronger U.S. dollar, which makes international revenue less valuable.

A report on Dec. 13 in The Wall Street Journal detailed the company's liquidity troubles, saying that it was set to end 2022 with $300 million in cash, less than a third of it what it had at the end of 2021.

The company is still holding expensive office leases that date back to before the pandemic, and concerns about a recession and layoffs in the tech industry have also weighed on the stock, cutting a key demand source for co-working spaces.

Additionally, Fitch Ratings downgraded the company's debt, pointing to deteriorating macro conditions and adding to fears that it would go into default. In mid-December, its bonds were trading at just 48 cents on the dollar, a sign investors think it's more likely than not that the company won't repay them.

Now what

The company is cutting its losses and growing its revenue, but it may be too little, too late. Among investors, WeWork may be best known for its failed IPO in 2019, which led to a drastic markdown in the company's valuation. The company went public as a special purpose acquisition company in 2021, but its brand seems to have been tarnished since then, and the company is still suffering from expanding too quickly in its earlier years.

As a concept, WeWork could benefit from the current moment as the rise of remote work should lend itself to increased co-working demand. However, with the value of office real estate plunging, the company is stuck paying elevated prices.

With shares now trading at just above $1, investors seem to be betting that the stock is heading for insolvency.