What happened

At one point in 2022, shares of software company Workiva (WK -0.16%) were down 62% from their all-time high. As of this writing, however, Workiva stock is only down 46% from its high because it gained 27% in the second half of the year, according to data provided by S&P Global Market Intelligence.

Do recent gains means the worst is over for Workiva stock? As we'll see, the answer is more complicated than you might expect.

So what

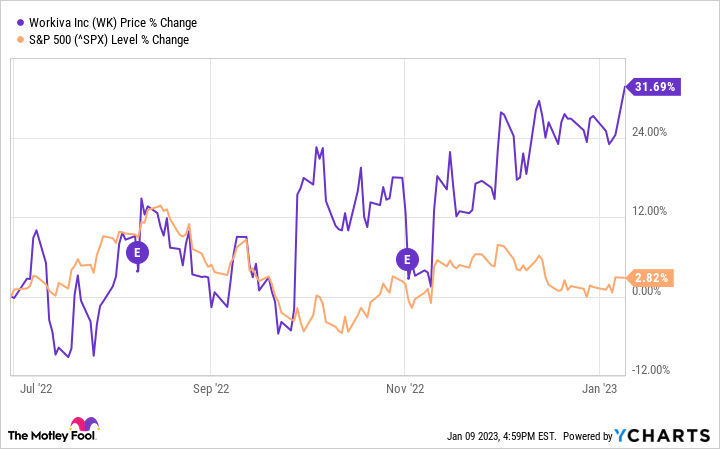

Workiva helps businesses generate reports that are used for regulatory compliance purposes. Over the last six months, Workiva has reported financial results twice -- in August for the second quarter of 2022 and in November for the third quarter. The company beat expectations in both reports. But these events weren't the biggest catalysts for Workiva stock as the chart below shows.

Rather, the biggest moves for Workiva stock resulted from rumors that it's a private-equity acquisition target. According to Bloomberg, both Thoma Bravo and TPG are interested in taking the company private. And as reported by Seeking Alpha, Truist analyst Joe Meares believes Workiva stock could be worth $117 per share if a deal emerges.

Workiva also had an investor-day presentation in September during which it updated its financial targets for 2027. The short synopsis is that the company believes it can increase its gross-profit margin to 82% -- more than it previously projected. And it believes it can lower its operating expenses over time by more than what it told shareholders before.

The market seemed underwhelmed with the investor-day presentation, considering the stock trended lower in the days following. This underscores how big the buyout rumors were for Workiva; they overshadowed everything else.

Now what

For this reason, it's hard to say whether or not the worst is over for Workiva stock. On one hand, the business is doing well. Q3 revenue jumped nearly 18% year over year to almost $133 million thanks to a big 21% jump in customers spending more than $100,000 annually.

With a growing customer base and high customer retention, Workiva looks well positioned for the future.

On the other hand, there's no denying that the buyout rumors have pushed Workiva's valuation up as the price-to-sales (P/S) valuation chart below demonstrates.

WK PS Ratio data by YCharts.

While Workiva's P/S valuation is down from its peak, it's still above average and boosted by the market's hope of a buyout premium. If a deal fails to materialize, then Workiva stock could drop back down to a more normal valuation regardless of what the business is doing.

That said, a high stock valuation can be overcome in time with enough growth. And Workiva does look positioned for that, in my opinion. Therefore, for long-term investors, the buyout rumors could prove to be inconsequential.

However, for investors looking for a good entry point to buy, Workiva stock will be unpredictable as long as acquisition rumors are floating around.