While not always a guarantee, stocks with a rich history of dividend growth are generally a great way for shareholders to build passive income over time. This is because hiking a payout to shareholders over long periods of time requires growing profits to sustain. Rising profits can only be realized by running a business that provides customers with highly sought-after goods and/or services.

As an asset manager with hundreds of mutual funds and exchange-traded funds, T. Rowe Price (TROW 0.78%) is necessary to countless institutional and retail investors. But should income investors hit the buy button on this stock? Let's closely look at T. Rowe Price's fundamentals and valuation to decide.

T. Rowe Price will endure the short-term pain

T. Rowe Price closed out the fourth quarter of 2022 with yet another difficult quarter. But given the challenges presented by external forces throughout the entirety of the year, this isn't surprising, and it shouldn't dissuade investors from still believing in the investment thesis.

The Baltimore, Maryland-based asset manager recorded $1.5 billion in net revenue during the fourth quarter. For context, this was down 22.3% over the year-ago period. What was behind the precipitous drop in net revenue in the quarter?

T. Rowe Price's average assets under management fell 22.3% year over year to just under $1.3 trillion. This can be attributed mostly to the meltdown in the broader equity markets, as well as a $17.1 billion net client outflow for the quarter. Since the asset manager derives its investment advisory fees from its AUM base, the lower AUM base was mostly what led net revenue lower during the quarter.

T. Rowe Price's non-GAAP (adjusted) diluted earnings per share (EPS) plunged 45.1% over the year-ago period to $1.74 in the fourth quarter. As the company's net revenue fell significantly, operating expenses edged 3% higher to nearly $1.1 billion for the quarter. This caused the asset manager's non-GAAP net margin to plummet 1,450 basis points year over year to 26.2% during the quarter. A 1% reduction in T. Rowe Price's outstanding diluted share count wasn't nearly enough to offset the reduced profitability. This is why adjusted diluted EPS dropped at a much faster pace than net revenue in the quarter.

The good news for T. Rowe Price is that 71% of its funds outperformed the passively managed peer fund median performance over a 10-year period as of last June. This signals to both institutional and retail investors alike that the company is still worth trusting as an asset manager. As financial markets inevitably recover in the years ahead and again soar to reach new all-time highs, T. Rowe Price's AUM, net revenue, and adjusted diluted EPS will all rebound.

Image source: Getty Images.

Profitability can support future dividend growth

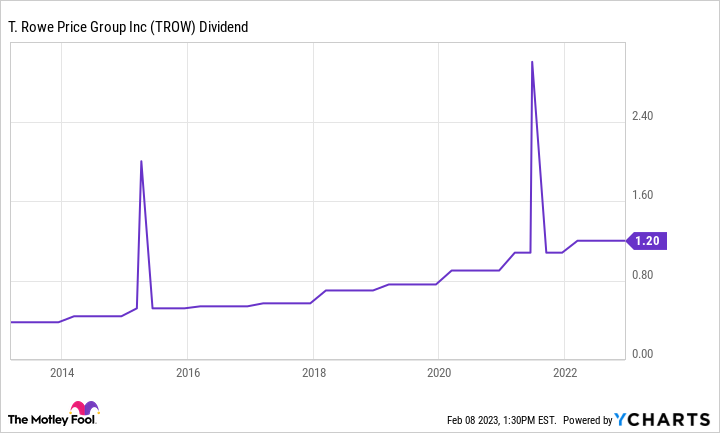

T. Rowe Price's most recent 1.7% increase in its quarterly dividend per share to $1.22 doesn't seem all that impressive. But it's worth noting that the company has raised its dividend for 37 consecutive years. And aside from several special dividends that were paid in the last 10 years, T. Rowe Price's quarterly dividend per share has more than tripled during that time from $0.38 a share in 2013.

TROW Dividend data by YCharts.

It is anticipated that the company's dividend payout ratio will come in around 72% in 2023. While this is on the high side for an asset manager, it's important to remember that profits are expected to bottom out this year. Because the payout ratio will need to come down moderately over the next few years, dividend growth will likely remain in the low single digits. But income investors should be able to tolerate these reduced near-term dividend growth prospects because the stock's 4% dividend yield is far above the S&P 500 index's 1.6% yield.

The stock is worth putting on your watch list

T. Rowe Price's business has struggled over the last year. But it's a safe bet that investors will always lean on asset managers, and the company is one of the best out there.

T. Rowe Price's price-to-sales (P/S) ratio of 4.3 is meaningfully lower than its 10-year median P/S ratio of 5.3. But this is still quite a ways from its 10-year low of 3.2, and a worse-than-expected recession can't yet be ruled out. That's why income investors may be better off nibbling on the stock at most right now and waiting for more economic data in the months to come before aggressively buying.