Stocks continue to make significant gains in 2023, but for the most part, they're still off their highs. In fact, the S&P 500 is up 8% so far this year as investors regain confidence in many top stocks. One of these top stocks is Chipotle Mexican Grill (CMG 1.09%). Chipotle's stock is up 18% in 2023 after losing 20% of its value, which is almost exactly the amount the S&P 500 lost, in 2022.

Chipotle posted a nearly flawless performance last year, and it seemed logical for investors to bolster its sagging price. However, its fourth-quarter earnings missed analyst expectations on both the top and bottom lines. Does that mean this top stock isn't so hot anymore?

Let's see if Chipotle's stock might be worth your interest this year.

This restaurant stock looks unstoppable

Chipotle continues to post double-digit sales increases and strong comps growth. Sales increased 11% year over year to $2.2 billion in the first quarter of 2022, and comps increased 5.6%. That's a slowdown from previous quarters.

In-restaurant sales increased 17.5% over last year, while digital sales remained steady at 37.4%. Its operating margin increased from 8.1% last year to 13.6% this year, and adjusted earnings per share (EPS) of $8.29 increased from $5.58 last year.

Wall Street was expecting $2.2 billion in sales at the low end, and $8.90 in EPS. So these results were disappointing. But there were many signs of progress, such as the huge improvement in operating margin, as well as the continued success with digital.

CMG EPS Diluted (Quarterly) data by YCharts

Does Wall Street matter?

Analysts do many modeling scenarios to create their forecasts and price targets. If companies miss expectations, it will affect the forecasted price targets. However, forecasts are just that, and real performance will almost never meet expectations exactly. If a company never meets expectations, that could be a red flag. But growth isn't linear, and one quarter of missed expectations needs to be looked at in a broader context.

Add to this that none of the 34 analysts who cover Chipotle changed their ratings after the fourth-quarter report, and 21 have a buy rating, despite the miss.

The pressure is on, even for Chipotle

With inflation still affecting consumer pockets and company costs, and a quarter that spooked investors, Chipotle has a lot to prove this year.

Management provided upbeat guidance, reporting that sales increased by double digits year over year in January. With that in mind, the company is guiding for a high-single-digit comps increase in the first quarter of 2023. That's in line with Chipotle's typical performance. However, it expects that to moderate in the second and third quarters.

Chipotle is managing costs effectively, and due to the price hikes and increase in total revenue, food, beverage, and packaging costs decreased 2.3% from last year as a percentage of revenue to 29.3%. Going forward, the benefits of price increases won't be felt as acutely in year-over-year comparisons, but that might be balanced out by increased traffic and volume if inflation winds down and the economy improves. In the event of a recession, Chipotle's customers, who as a group are more affluent than the average fast-food consumer, are generally more resilient. But if a recession hits and spending slows, Chipotle won't be immune to the impact.

The long-term story is intact

Chipotle has demonstrated growth throughout the pandemic and in the current inflationary atmosphere. There are many reasons to be confident about the future as it invests in new ventures such as more Chipotlanes, which contribute to higher profitability, improvements in the digital process, and new menu items.

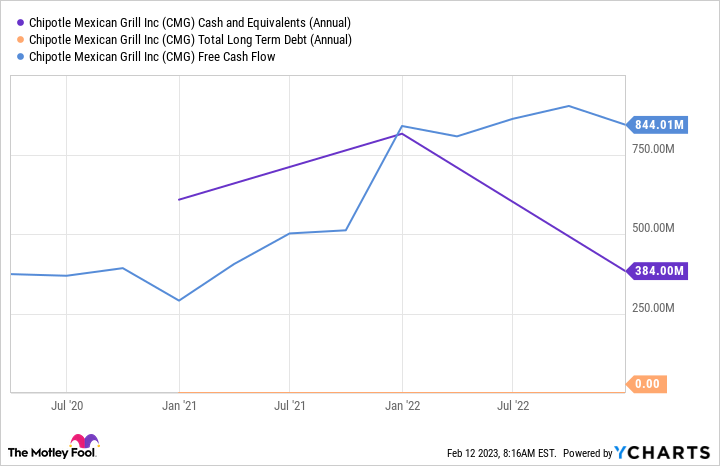

It ended the year with $384 million in cash with no debt, and generated $844 million in free cash flow in 2022.

CMG Cash and Equivalents (Annual) data by YCharts

It's also opening stores at a rate that should generate growth for at least the next decade.

How much weight should you put on valuation?

Chipotle stock isn't cheap. Shares trade at 49 times trailing 12-month earnings, which is a lot higher than other restaurant stocks. However, it's close to the cheapest Chipotle has traded at in about five years. With the fourth-quarter performance, though, investors may wonder if Chipotle deserves the rich valuation it typically sports.

I'm not convinced -- after years of solid growth and resilience through challenging circumstances -- that it's time to bail out because of one quarter that didn't measure up for some investors. I see Chipotle as having incredible future prospects, and I recommend it as a long-term pick.