What happened

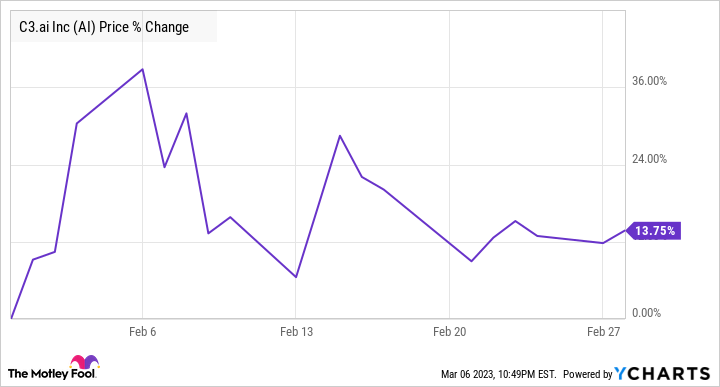

Shares of C3.ai (AI 3.02%) finished February up 14% in volatile trading, according to data from S&P Global Market Intelligence.

The software-as-a-service stock that focuses on artificial intelligence (AI) benefited from the increasing attention around AI after Microsoft announced its own ChatGPT-powered Bing search engine and Alphabet revealed its own ChatGPT competitor, Bard AI.

As one of the few pure-play AI stocks, C3.ai got a boost from the hype around AI, though investors also seemed to question the stock's valuation as shares pulled back after the spike on the Microsoft news.

As the chart shows, the stock was all over the map over the course of February.

So what

C3.ai jumped on Feb. 2 as D.A. Davidson initiated coverage on the stock with a buy rating, and analyst Gil Luria said the company is "a truly scarce asset in a critical software arena." He also called generative AI a "killer app" for artificial intelligence and gave the stock a price target of $30.

The artificial intelligence stock continued to gain over the next few days in anticipation of the Microsoft and Alphabet announcements, peaking on Feb. 6 at $30.92 a share before some of the air seemed to get let out of the hype bubble.

Later in the month, C3.ai announced it was expanding its strategic partnership with Amazon Web Services, with the C3.ai platform being co-sold with AWS. Additionally, C3.ai's application suite is now available on AWS marketplace.

Now what

C3.ai got another boost early in March after it reported better-than-expected results in its third-quarter earnings report.

Revenue actually fell 4.4% to $66.7 million, but that beat analyst estimates at $64.3 million. Its bottom-line result improved from an adjusted per-share loss of $0.07 to $0.06, which was well ahead of the consensus at a per-share loss of $0.22.

CEO Thomas Siebel also said the company was seeing increased interest in C3.ai solutions and that overall business sentiment is improving.

On March 6, short-seller Kerrisdale Capital said it was short C3.ai, saying that it's a misconception that the company benefits from the excitement around ChatGPT. It also noted C3.ai's poor customer traction, cash burn, customer concentration, and weak revenue growth.

Indeed, the stock is expensive, but it's too early to write off C3.ai. The stock has a lot to prove with a price-to-sales ratio around 15, and some of the recent gains are due to ChatGPT-related hype. However, the company may be able to use that to its advantage, especially since it's launched its new generative AI product suite, which includes search functionality across an enterprise's data.

Investors will want to pay attention to how that new product does.