Warren Buffet's stock picks get lots of attention, but they can't all be zingers. Berkshire Hathaway made a large investment in Brazillian e-commerce pioneer, StoneCo (STNE 5.01%), when it made its stock market debut in 2018. It bolted out of the gate, but the good times didn't last.

StoneCo stock peaked during the lockdown phase of the pandemic and has fallen around 91% from the high water mark it set in 2021.

Despite the disappointing drop from its peak, StoneCo looks like an unbeatable bargain at its depressed price. Here's why.

StoneCo's gaining market share

Brazil's a big country with more than 200 million people who increasingly shop online. Brazil's e-commerce industry grew sales by 24.6% in 2022, according to StoneCo.

StoneCo's recent earnings report suggests its share of Brazil's rapidly growing e-commerce industry is growing too. In 2022, the total volume of payments processed (TPV) grew 33.4%, which was significantly faster than its average competitor.

Small and midsize businesses (SMBs) and micro small and midsize businesses (MSMBs) are driving growth for StoneCo. In 2022, TPV from MSMBs soared 52.3% year over year.

Improving profit margins

StoneCo markets financial services such as payments and banking. The company also offers a suite of software solutions similar to Shopify but geared toward Brazillian merchants.

StoneCo works with companies of all sizes, but it generally squeezes wider profit margins from smaller businesses. At 2.15% last year, StoneCo's take rate for payments sent by MSMBs was more than double its take rate for established e-commerce companies.

Increased focus on clients willing to absorb higher fees is working wonders for the company's bottom line. Adjusted earnings before taxes worked out to 12.4% of revenue in the fourth quarter compared to a loss of 2% in the previous year's period.

Why the nice price?

At the moment, you can scoop up shares of StoneCo for just 15.1 times trailing free cash flow. At this very reasonable multiple, investors will come out ahead even if the business creeps forward at half the pace of Brazil's overall e-commerce industry.

StoneCo's past misfires are the reason its stock currently trades at a somewhat depressed valuation. Before the pandemic, it let a lot of smaller merchants borrow money they couldn't pay back when COVID-19 lockdowns threw out unprecedented obstacles.

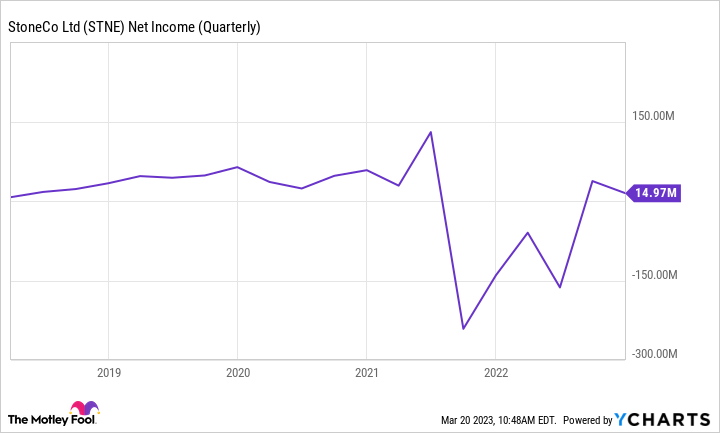

STNE Net Income (Quarterly) data by YCharts.

As a result, the previously profitable company began posting heavy losses in 2021. Luckily, an expanded client base and improved take rates have already pushed its bottom line back into positive territory. Continuing along this trajectory could return StoneCo's bottom line to growth before the end of 2024.

Follow Buffett

Warren Buffett will be the first to tell you that blindly following Berkshire Hathaway's stock purchases isn't recommended. In this case, though, following the Oracle of Omaha into this particular investment looks like a smart move.

Everyday investors would do well to follow Buffett's lead with this stock in more ways than one. First of all, Berkshire has held this stock for about three and a half years already with no sign of letting go.

While the stock has what it needs to produce market-beating gains, there are no guarantees. Perhaps the most valuable lesson individual investors can learn from Berkshire's investment in StoneCo is diversification. Berkshire Hathaway owns around 4% of StoneCo's outstanding shares, but this position makes up just a sliver of the holding company's total equity portfolio. Investors should only take a chance on this fintech stock if they too can make it a relatively small part of a diversified portfolio.