When you think of growth stocks, insurance companies aren't generally the first thing that comes to mind. Insurance tends to be a steady industry with modest growth and good cash flows. However, Kinsale Capital (KNSL -15.80%) has bucked the trend and achieved impressive growth since its initial public offering (IPO) in 2016.

The specialty insurance company has leveraged its expertise and technology to ride favorable trends in the industry, achieving industry-beating profitability in the process. Investors who got in on the ground floor have seen the value of their shares explode. Read on to discover how much $1,000 invested in the specialty insurer is worth today.

Specializing in specialty insurance

Kinsale Capital writes insurance policies covering things that traditional insurers won't cover. It is known as a specialty insurer and operates in a segment of the insurance market called excess & surplus (E&S). E&S insurance is a niche market within the larger property & casualty insurance space. What makes this business appealing is it doesn't face the same stringent regulations as traditional insurers.

Tradition policies, like automotive or homeowners, are highly regulated regarding what they can charge and must cover. Because traditional insurance products are highly uniform, companies compete based on price. Specialty insurers don't face these same limitations.

Instead, companies like Kinsale can write unique policies on things they have expertise in, and they have more flexibility in the premiums they can charge. Because of the specialized knowledge and flexible pricing, specialty insurance companies can have very healthy profit margins.

If you invested $1,000 in Kinsale in 2016, you'd have this much

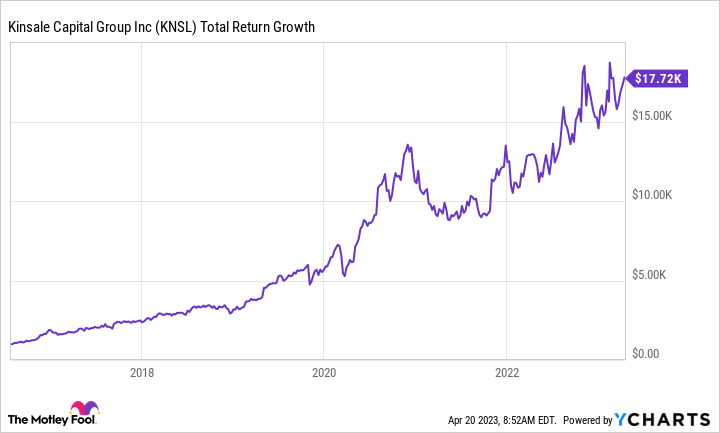

Kinsale has done an excellent job of writing highly profitable insurance, and the stock has delivered returns to investors who bought it on day one. If you invested $1,000 in Kinsale during its IPO on July 28, 2016 and reinvested dividends, you would have over $17,720 today -- a return of over 1,670%.

KNSL Total Return Level data by YCharts.

Here's why it has thrived

Kinsale has a few things that have worked in its favor since its IPO. For one, the insurance market has been in a "hard market" since 2019, according to the insurance broker Risk Strategies.

The insurance industry is cyclical and goes through periods of growth or contraction. When many insurers compete on price and coverage, this is known as a "soft" market. During times like this, insurers' margins face pressure because of the increased competition.

However, when insurers face higher claims due to increased catastrophes or higher regulations, it creates conditions for a hard market where insurers are more selective about what they will cover. A hard insurance market benefits E&S insurers like Kinsale by allowing them to cover policies others are unwilling to touch.

Kinsale has benefited from these tailwinds but has also leveraged other factors to outpace its peers. The company credits its years of experience among senior leaders and data and technology as crucial competitive advantages. It practices disciplined underwriting, strictly limiting geographic concentration while leveraging reinsurance to protect it from catastrophic losses.

It also leverages its data and expertise to write policies quickly and accurately, making it a leader in the industry in terms of profitability. It has automated much of the process of responding to brokers and handling claims, allowing it to quickly and efficiently respond to customers and achieve impressive growth.

KNSL Revenue (TTM) data by YCharts.

Why it can keep winning

Kinsale Capital has done a stellar job of taking advantage of favorable market conditions while leveraging expertise and technology to achieve industry-beating results. The company trades at a more expensive valuation than its peers, with a price-to-earnings (P/E) ratio of 46, which is justified given its impressive growth since going public.

Its management team sees favorable conditions for insurers going forward. Insurers have faced rising claims costs in recent years due to the increased frequency and severity of events, which can partially be attributed to inflation. It continues to have a strong inflow of new business, and can raise rates and increase exposure across coverage types.

Kinsale Capital has done a stellar job in the specialty insurance space and should be able to continue this going forward -- making it a solid stock for investors to consider buying today.